- USD/CAD has been on an uptrend in the past two trading days.

- After police cracked down on protests over the Coronavirus restrictions, US and Canadian trade ties have been restored.

- Although Kyiv recently asked Moscow to meet, oil prices remain steady amid war fears between Russia and Ukraine.

The USD/CAD price is trading near 1.2730 ahead of Monday’s European session. The pair is consolidating gains around key levels.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

As geopolitical tensions ease in Canada and abroad and optimistic oil prices favor the Canadian dollar (CAD), the Canadian dollar falls for the first time in three days. However, the Fed’s cautious mood and the easy schedule and indecision regarding the Russia-Ukrain situation limit the immediate movement of the quote.

As a result of Canadian police dispersing protesters opposing the lifting of COVID-19 restrictions on Sunday, North America’s busiest trade route was reopened to traffic late Sunday night after a six-day blockade, Canada’s Border Services Agency said.

However, Ukraine recently requested a meeting with Russia, which, in turn, soothed geopolitical fears of an imminent war that Western leaders signaled yesterday.

Moreover, the Fed’s bearish stance is putting downward pressure on USD/CAD prices, as is the rise in WTI crude oil prices resulting from uncertainty about the Fed’s next move. The price of WTI Crude Oil is near its highest level since late 2014, having risen to $93.00 in recent weeks.

The Fed raised interest rates by 50 basis points (bps) in March, despite market expectations for a 0.25% hike last week. The CME FedWatch tool estimates a nearly 50-50 likelihood of such a move and lowers US Treasury yields based on Michigan’s Consumer Sentiment Index for February, which fell from 61.7 to 67.2 previously.

Further, the Fed’s latest report is also reluctant to support a sharp change in interest rates, exerting downward pressure on USD/CAD rates.

The USD/CAD market awaits clear news from Russia and comments from St. Louis Fed Chairman James Bullard on the intraday direction. Nevertheless, the focus will be on Wednesday’s FOMC meeting minutes.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

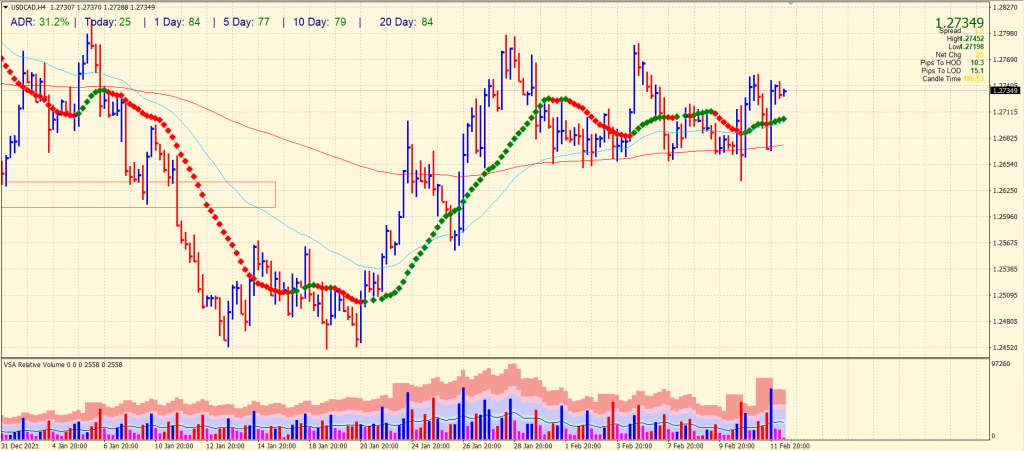

USD/CAD price technical analysis: Bulls resilient above 20-SMA

The USD/CAD price consolidates above 20-period SMA on the 4-hour chart. However, the widespread bar closing near the highs remains a key technical reason for the bulls to continue. We may see some correction before further upside. The average daily range is 31% so far, which is normal. The volume data is supportive of the bullish action.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money