- A two-day downtrend has left USD/CAD with no clear direction.

- Supply threats were eliminated, and concerns about demand grew as oil prices fluctuated.

- US inflation is still on the minds of Fed hawks, even with escalating virus problems.

As of early Monday morning, the USD/CAD price is hovering around 1.2650-45 after Friday’s US and Canadian employment reports greeted bears. On a busy calendar and in mixed moods, the loonie appears to be following the price of Canada’s most significant export commodity, WTI crude oil.

–Are you interested to learn more about AI trading brokers? Check our detailed guide-

The pair lost for the second day in a row a day earlier. This was also the strongest week, despite mixed December job reports from the US and Canada. However, disappointing nonfarm payrolls (NFP) data has dampened the US dollar index (DXY) ahead of its biggest daily drop in six weeks.

However, the US Nonfarm Employment Data (NFP) headline disappointed markets with 199,000 figures for December, compared with 400,000 forecasts and 249,000 earlier (revised from 210,000). The unemployment rate fell to 3.9%, versus a consensus estimate of 4.1%, and from a revised downward 7.7% in November, which equates to the level before the pandemic. In addition, the U6 youth underemployment rate fell to 7.3% from a revised downward of 7.7% in November. The disappointment reported in the NFP has largely been overshadowed by the unemployment rate and U6 underemployment rate. These two factors seem to have impacted market sentiment lately as well.

In contrast, employment in Canada increased by 54.7 k from 153.7k in November, exceeding the forecast of 27.5k, while unemployment fell to 5.9% from 6.0% in November, below expectations.

Although there is less concern about Kazakhstan and Libya’s supply shortages and virus-related energy demand, the price of WTI crude oil is around $78.60.

While these moves occur, S&P 500 futures are paring early Asian losses, though they remain sluggish. In addition, the movement of government bonds remains silent as everything is clear in the Japanese market on the day of the appointment.

On Wednesday, US Consumer Price Index (CPI) will gain fresh momentum despite the lack of key data/events. However, restrictive rates on the Fed’s rate hike will affect USD/CAD traders.

–Are you interested to learn more about Canada forex brokers? Check our detailed guide-

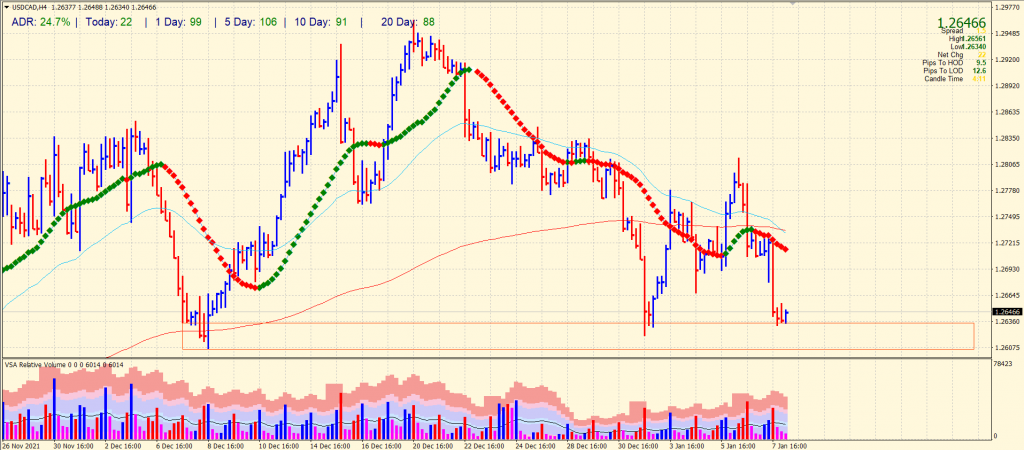

USD/CAD price technical analysis: Bears to pause at the demand zone

The USD/CAD price has dropped with a huge bearish volume. However, the pair has hit the strong demand zone that may provide solid support. Therefore, we can expect an upside correction from the current level of 1.2650 towards 1.2700. However, the probability of touching the lower end of the demand zone at 1.2600 also remains high.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.