- Oil consolidates intraday losses as USD/CAD struggles to extend four-day bounce from late November lows.

- The market’s concern ahead of key central bank meetings fuels risk aversion as Omicron fears spread.

- Inflation may not return to the BOC’s target of 2%, according to Maclem.

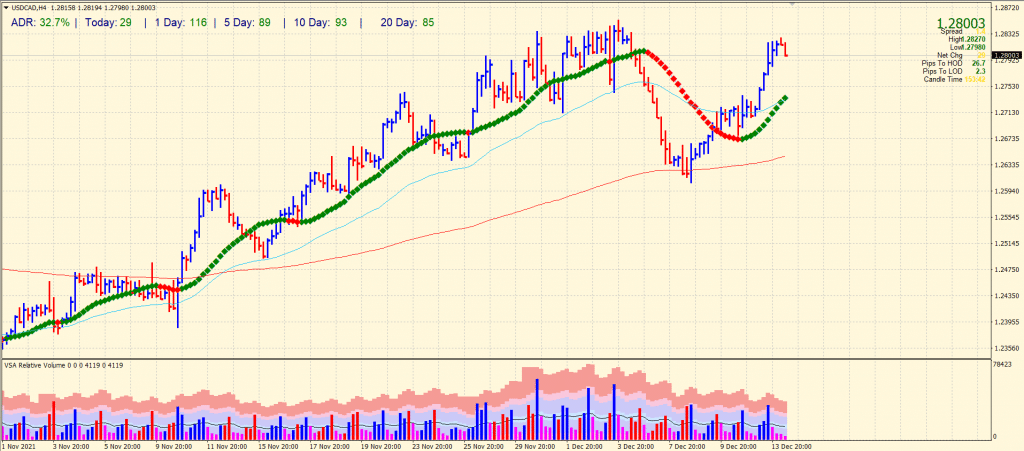

In advance of Tuesday’s European session, the USD/CAD price rebounded near a weekly high, sliding from an intraday high to 1.2820. The Loonie pair has been consolidating from its lowest levels since November 19th after a four-day advance.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

Risk appetite may support the bulls, but the recent spike in the price of Canada’s top export, WTI crude oil, may indicate a decline in the USD/CAD pair. Currently, the WTI crude price rebounded from an intraday low at $ 71.

Due to reduced capital spending, Abdulaziz bin Salman, Saudi Arabia’s oil minister, recently warned that oil production will decline by 30% by the end of this decade. They also discussed geopolitical concerns about US-Iran diplomatic relations and Sino-US relations.

However, the market sentiment remains adverse, supporting the demand for the US dollar as a safe haven. The yield on 10-year US Treasury bonds is hovering around 1.42%, while S&P 500 futures are up 0.15% at the moment. Moreover, stocks in Japan, Australia, New Zealand, and China are trading in different directions.

New South Wales (NSW) reports the highest daily viral infection rates in more than two months after the first Omicron-related death in the UK and the return of the mask mandate in California. The pandemic has led G7 finance ministers and central bank governors to pledge to do more to combat the virus. In addition, Reuters reported that the Asian Development Bank (ADB) has also lowered its growth forecast, citing the same reason.

Following a framework review with Canada’s Finance Minister Christia Freeland, Bank of Canada Governor Tiff Maclem said the bank focuses on bringing inflation to target levels without hurting the Canadian economy. As a result, the Canadian central bank left the five-year inflation rate unchanged at 2.0%.

The November US producer price index, forecast at 9.2% YoY versus 8.6% earlier, may indicate an intraday direction for USD/CAD prices, but risk catalysts will be more important.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

USD/CAD price technical analysis: Undecided at 1.28

The USD/CAD price is wobbling around the 1.2800 mark, well above the 20-period SMA on the 4-hour chart. The 20-period and 50-period SMAs are making a bullish crossover, indicating the probability of further gains. However, it won’t be an easy hurdle to break at 1.2850 area. On the flip side, 1.2750 and 1.2700 will provide support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.