- USD/CAD price remains on the backfoot below the 1.2800 handle.

- The PBOC’s headline about cash injection and rising WTI prices provide support to the Canadian dollar.

- USD demand may rise as the R&F (another real estate giant) comes under restrictions.

As European traders prepare for an important event, the USD/CAD price retreated to 1.2780, down 0.21% on the day.

-Are you looking for the best CFD broker? Check our detailed guide-

As risk appetite for Chinese yields improves, the loonie pair has been bearish for four straight days and has pulled back from its monthly high. However, US Treasury bond yields are increasing, supporting a rise in the US Dollar Index (DXY), which rose to 93.23 in a period of concern over the Federal Reserve.

Positive headlines from China were largely based on the People’s Bank of China’s (PBOC) liquidity injection and Evergrande’s announcement of coupon payments at the September 23 expiration date. The International Monetary Fund had previously expressed cautious optimism. However, regarding China’s potential to contain a real estate company’s fear, IMF Chief Economist Geeta Gopinath has chosen to take a risk. In addition, with the House of Representatives voting 217-207 for temporary government funding and a debate on raising the debt ceiling, there were also hopes of extending the US debt ceiling’s expiration date.

Another Chinese real estate company, Guangzhou R&F, is rumored to be suspending bond trading, fueling demand for the US dollar as a safe haven. Additionally, Bloomberg reports that the EU and US are attempting to limit China’s risks, and the Australian government has joined the Anglo-American relationship to sway Beijing’s policies.

The rising price of WTI crude oil, which rose by 0.82% at the latest to USD 71.35, is putting additional pressure on the USD/CAD. However, since oil is Canada’s largest export commodity, recent positive news from China and a weaker stock market, according to the American Petroleum Institute (API), is favoring bulls.

Despite the lack of a majority, Justin Trudeau’s victory in the Canadian federal election strengthens the Canadian dollar (CAD).

The weakness of the Fed and the West’s relationship with Beijing may preoccupy the USD/CAD traders shortly.

-Are you looking for forex robots? Check our detailed guide-

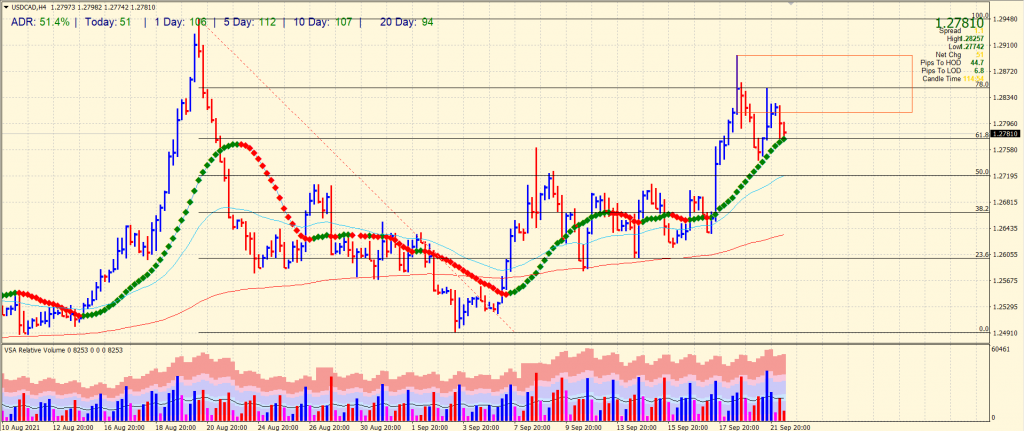

USD/CAD price technical analysis: Stays under clouds

The USD/CAD pair is technically struggling as the price formed a top reversal pattern on Monday, followed by a huge dip. The pair fell from multi-month highs around 1.2900. The price is still under 1.2800 after testing the lower band of the top reversal bar. The volume for the price fall is high. If the fall persists, the pair may test 1.2750 ahead of the 1.2700 handle. On the upside, the price may test 1.2850 ahead of recent swing highs at 1.2900.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.