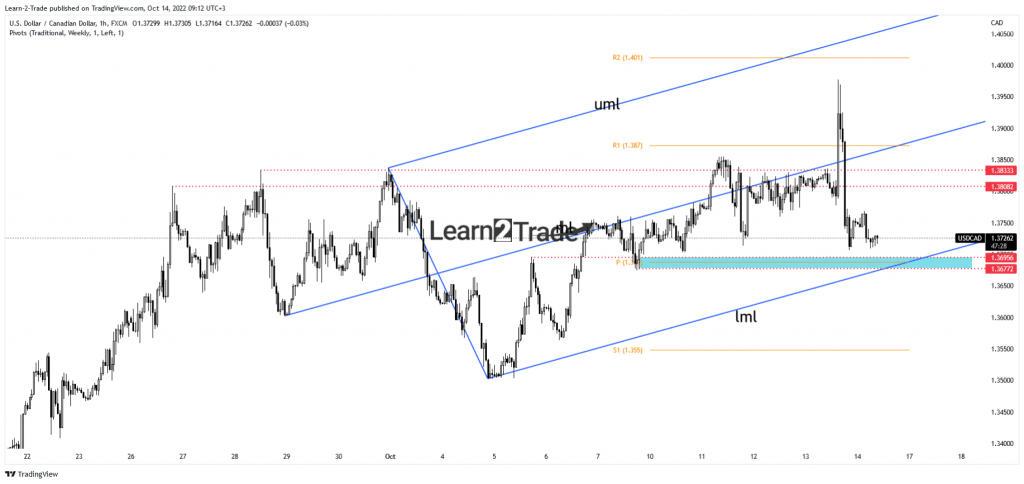

- The USD/CAD pair maintains a bullish bias as long as it stays above the lower median line (LML).

- The US data could bring sharp movements later today.

- DXY’s deeper drop should force the pair to approach and reach new lows.

The USD/CAD price climbed as high as 1.3977 yesterday, where it found resistance. The pair is trading at 1.3706 at the time of writing.

-If you are interested in forex day trading then have a read of our guide to getting started-

The Canadian dollar tumbled as the US dollar made an upside correction in the short term. DXY’s deeper drop should force the pair to drop towards new lows. Fundamentally, the US reported higher inflation in September.

The Consumer Price Index m/m rose by 0.4% versus the 0.2% growth expected and compared to 0.1% growth in August, while Core CPI surged by 0.6% exceeding the 0.4% growth forecasted. In addition, the CPI y/y came in at 8.2% versus the 8.1% expected.

The currency pair rallied after the inflation data release because the FED is expected to continue hiking rates in the next monetary policy meetings. Higher inflation is not good for the US economy. That’s why the greenback lost significant ground in the short term.

Today, the US Retail Sales indicator is expected to report a 0.2% growth in September, while Core Retail Sales could register a 0.1% drop.

In addition, the Prelim UoM Consumer Sentiment also represents a high-impact indicator and is expected at 58.7 points above 58.6 points in the previous reporting period.

The Business Inventories and the Import Prices will be released as well. On the other hand, Canada is to release the Wholesale Sales and the manufacturing Sales data.

USD/CAD price technical analysis: Sell-off

The USD/CAD pair registered only a false breakout through the R1 (1.3870) and above the median line (ml). It reached the 1.3695 – 1.3677 area and the lower median line (LML). From the technical point of view, as long as it stays within the ascending pitchfork’s body, the rate could resume its uptrend. A valid breakdown below this dynamic support activates a larger drop in the short term.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The US economic data could be decisive today. Better-than-expected figures could lift the currency pair. Strong consolidation and false breakdowns below the near-term downside obstacles may signal a new leg higher.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.