- The RBA’s move to raise interest rates by 50bps has spooked investors, pushing the dollar higher.

- Oil prices are pulling back after a big bullish move.

- The rise in demand for oil could see crude oil resume its bullish move.

- In the charts, USD/CAD bears are showing some weakness.

The USD/CAD price edged higher on Tuesday as the dollar rose on concerns over inflation in the global economy. The RBA fueled these concerns when they raised interest rates by 50-bps this morning, surprising everyone. This hike was a move to control soaring inflation. If inflation in Australia is high, then there is a chance that inflation in other countries could also keep going up.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

Most central banks use interest rate hikes as the best weapon against inflation. However, it is a double-edged sword as it could lead a country’s economy to a recession. This risk of a recession concerns most investors, leading them to seek safety in the US dollar.

On the other hand, oil prices pushed lower on Tuesday after going above $120.00 a barrel as the commodity retraced its earlier gains. However, this move down may be short-lived as there are doubts that a higher output target by OPEC+ producers would ease tight supply.

As China reopens, the rise in demand could also see crude oil trading above $120.00, meaning a stronger Canadian dollar and a bearish USD/CAD.

USD/CAD key events today

USD/CAD investors will be looking out for trade balance reports for May from the United States and Canada. They will also be paying attention to the Ivey PMI for May from Canada and the EIA’s short-term energy outlook from the US.

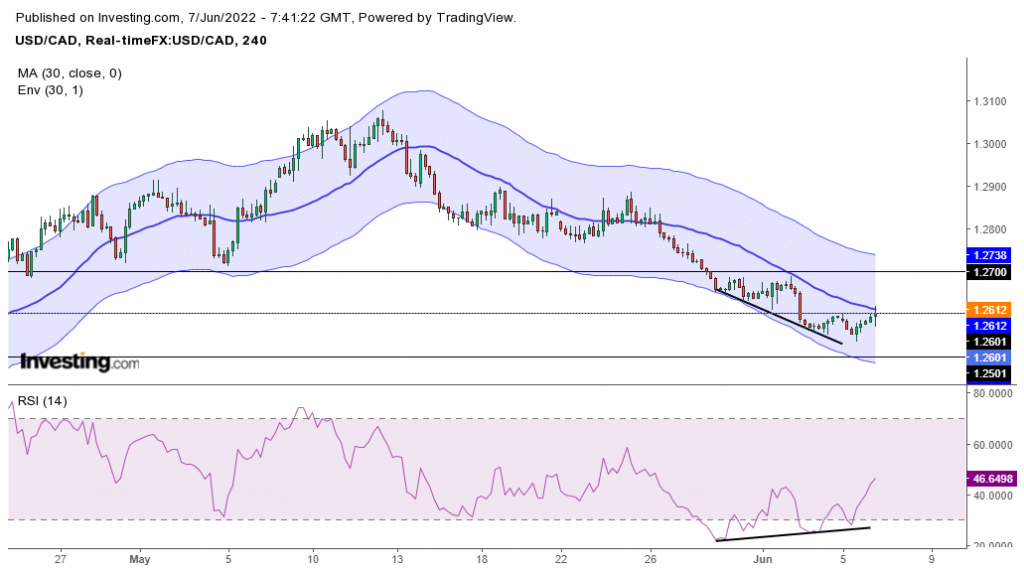

USD/CAD price technical analysis: Bullish divergence

The 4-hour chart shows a bullish RSI divergence, which shows weakness in the bearish trend. The price has traded below the 30-SMA for some time and is experiencing resistance from the 30-SMA and the 1.2600 level.

-Are you interested in learning about the forex indicators? Click here for details-

The bulls would have to break above the 30-SMA and push RSI above the 50 levels to start a new bullish trend. The bearish trend might continue if bulls are not strong enough to push the pair above 1.2600. If bulls win, we might see the price at 1.2700, while a bearish win could push the price to 1.2500.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money