- The USDCAD is rising for the second straight day due to factors.

- In addition to the drop in crude oil prices, steady dollar buying supported the Canadian dollar.

- Markets are now anxiously awaiting the monthly US Jobs Report (NFP), which is expected to boost trading.

The USD/CAD price surged in the European session, returning closer to the overnight swing high in the last hour. However, the upside lacks follow-through momentum.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

Greenback bulls gain back

USDCAD recovered from a yearly low to gain momentum for a second straight day on Friday, and now bulls are looking to consolidate the gains made throughout the week. However, crude oil prices fell further in the first half of trading on the last day of the week because of overnight losses. A subsequent interest in buying the US dollar undermined the commodity-linked Canadian dollar, providing a tailwind to the major currency.

Increased supply weighs on WTI

In a move announced Thursday, the White House is releasing one million barrels of oil a day over the next six months from the US Strategic Petroleum Reserve (SPR). In addition, another emergency release of about 60 million barrels of oil will be discussed by the International Energy Agency (IEA) later this Friday. Combined with concerns that new COVID-19 restrictions could hurt fuel demand in China, this has hurt the Canadian dollar and oil prices.

Risk sentiment remains deteriorated

Meanwhile, the fading hope of a de-escalation in Ukraine has also caused some safe-haven asset flows to move to the US dollar and dovish Fed expectations. According to the markets, the Fed is expected to rise 100 basis points in two meetings to combat persistently high inflation. In addition, the US core PCE price index was released on Thursday, which rose 5.4% year over year in February.

What’s next to watch for USD/CAD

Fundamentals appear to be tilting in favor of bullish traders, supporting USD/CAD’s prospects for further gains in the near term. However, investors may opt to restrain themselves from aggressive interest rates ahead of closely watched monthly US jobs data. In addition, during the early North American session, the closely watched NFP report will be released and will likely influence the near-term USD price direction.

Further, traders will be guided by developments around the Russian-Ukrainian crisis, which may affect Crude Oil prices. On the last day of the week, USD/CAD is expected to gain significant momentum, allowing traders to seize short-term opportunities.

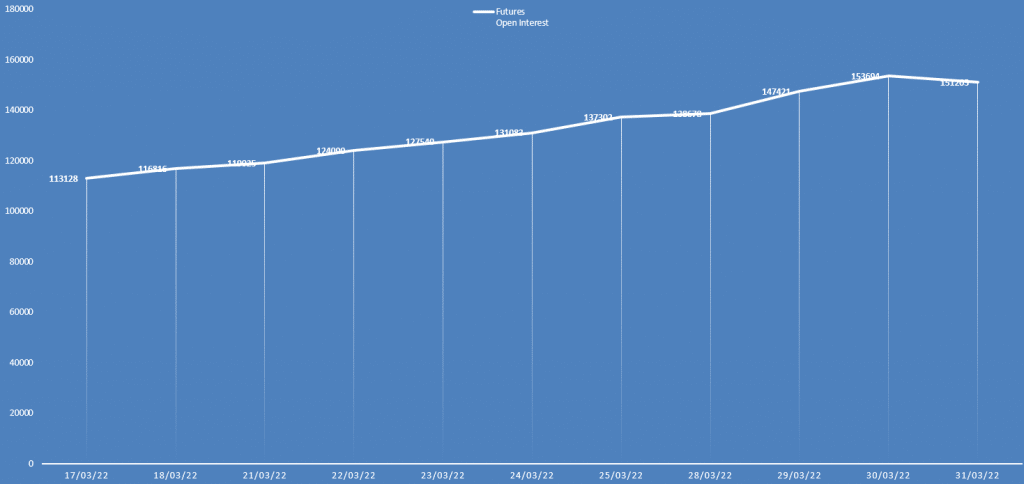

USD/CAD price analysis via daily open interest

The USD/CAD price rose on Thursday while the daily open interest fell slightly. This shows a consolidating behavior.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

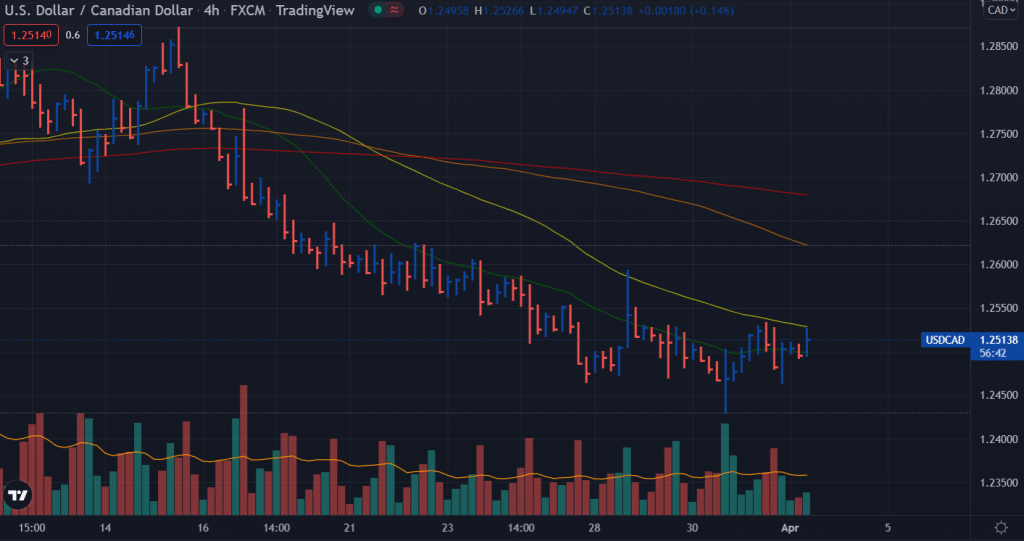

USD/CAD price technical analysis: Bulls lack strength

The USD/CAD price managed to stay above the 20-period SMA on the 4-hour chart. However, the pair found strong resistance by the 50-period SMA. Overall, the price remains in a broad range, and still, there are no clues of the confirmed uptrend. Therefore, breaking 1.2550 will be considered a bullish reversal.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money