- USD/CAD couldn’t gather traction from rising oil prices.

- Dollar Index remains positive on the day, keeping the pair supported.

- Fed’s hawkish stance is lending support.

The rise in oil prices did not help the USD/CAD price very much in its confrontation. The US Dollar lost some ground yesterday after the data released that showed an increase in the number of initial jobless claims in the US last week by 51,000 to 419,000 (according to the forecast, the number of applications was expected to decrease 350,000).

–Are you interested to learn more about forex options trading? Check our detailed guide-

However, many economists believe that any short-term weakness in the US Dollar will be limited as concerns about the spread of the coronavirus globally will support demand for it as a safe haven asset. At the same time, consumer and business confidence in the US remains high.

The DXY dollar index remains positive, with DXY futures trading close to 92.93 as of this writing, which is in line with early April levels.

Meanwhile, market participants turn their attention to the Fed meeting, which will end on Wednesday (at 18:00 GMT) with the publication of the decision on the interest rate.

The Fed now buys 80 billion in Treasury bonds and $ 40 billion in mortgage-backed bonds every month and keeps interest rates in the 0.00% -0.25% range.

Earlier, Fed officials have repeatedly stated that they will not slow down the rate of bond purchases until they see “significant further progress” in achieving the inflation target of 2% and the labor market reaching pre-crisis (before the pandemic) levels. Inflation is now well above the target, but Fed officials still expect inflation to slow after closing the deficit amid the opening of the economy after the lockdowns.

Since the Fed officials have signaled their intention to warn the markets in advance of the cuts in stimulus, they are likely unlikely to start such cuts at the July meeting.

Nevertheless, the intrigue around the intentions and actions of the FRS remains since, after the meeting on June, 13 out of 18 Fed leaders predicted a rate hike until the end of 2023 and 7 until the end of 2022.

Still, the further spread of the coronavirus remains a serious risk to the global economy, which supports the dollar, offsetting the impact of US labor market data indicating that the likelihood of Fed tightening is less likely.

–Are you interested to learn about forex robots? Check our detailed guide-

Returning to the Canadian dollar and the USD/CAD pair, which at the time of the publication of this article is trading in the zone below the important resistance levels 1.2580, 1.2605, market participants will pay attention today to the publication at 12:30 (GMT) of data on retail sales in Canada (they are expected a drop of -3.0% in May after a decline in retail sales of -5.7% in April, which is negative for CAD) and the publication at 13:45 (GMT) of PMI indexes from Markit of business activity in the USA (PMI values are above the level of 60.0 and their next growth is expected, which is generally positive for the USD).

Thus, from a fundamental point of view, we should expect further USD/CAD pair rises or preserves its positive dynamics, which resumed in early June.

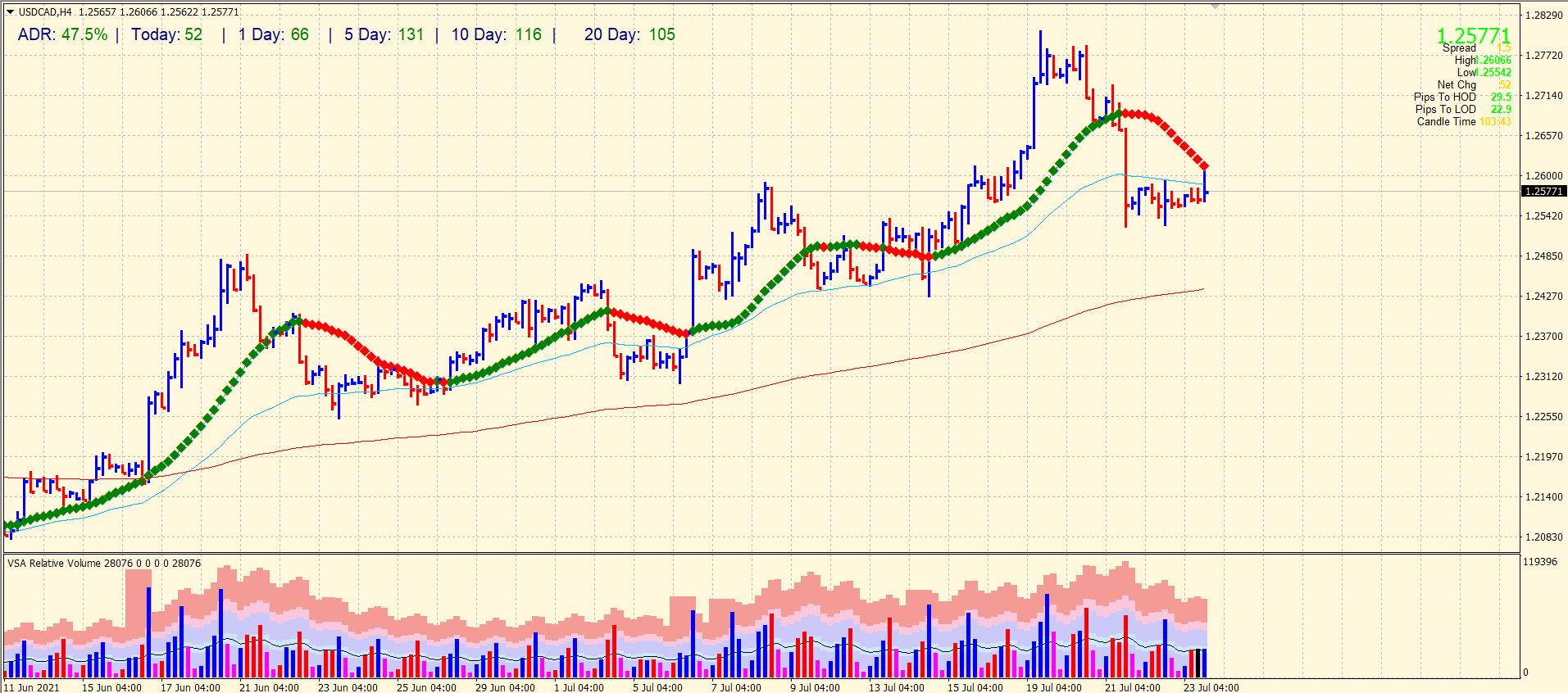

USD/CAD price technical analysis: Bears look stronger

The price is ranging under the 20 and 50 SMAs on the 4-hour chart. The volume is below the average. The upsurge attempt earlier today was capped by the 20-period SMA. The price may target a 200-period SMA and 14 July swing low of 1.2430. The upside trend remains questionable at the moment. Buyers need to crack above the 20-period SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.