- The USD/CAD pair signaled exhausted sellers.

- The Canadian retail sales data could have a significant impact.

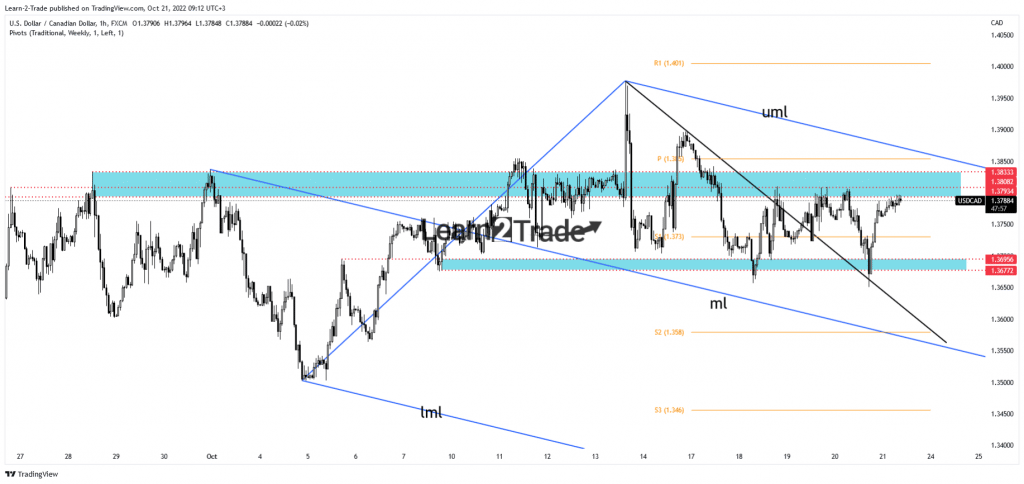

- Taking action, the upper median line (UML) activates further growth.

The USD/CAD price rallied in the last hours as the US dollar rebounded and erased the minor losses. Greenback’s upside continuation could force the pair to approach new highs.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

The US dollar remains strong even though the US reported mixed data yesterday. The Philly Fed Manufacturing Index came in at -8.7 points versus the -5.0 expected. Meanwhile, Unemployment Claims were reported at 214K in the previous week compared to 229K estimates. Existing Home Sales came in at 4.71M, above 4.69M forecasts, while the CB Leading Index reported a 0.4% drop more versus the 0.3% drop expected.

Today, the Canadian retail sales data could be decisive. The Retail Sales indicator could report a 0.2% growth compared to the 2.5% drop in the previous reporting period. In comparison, Core Retail Sales are expected to register a 0.3% growth in August after the 3.1% drop in July.

In addition, the US Federal Budget Balance and the FOMC Member Williams Speaks could have a minor impact.

The greenback remains strong as the Federal Reserve is expected to take action and increase the Federal Funds Rate again in the next monetary policy meeting.

USD/CAD price technical analysis: Sideways movement

The USD/CAD pair rebounded after failing to take out the 1.3677 – 1.3695 area. Now, it stands below the 1.3793 – 1.3833 resistance area. It could continue to move sideways in the short term. Only a valid breakout above 1.3833 may signal further growth.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

As you can see on the hourly chart, the price failed to reach the median line (ML), signaling exhausted sellers. It has passed above the minor downtrend line and retested it, signaling that the buyers could take control. The descending pitchfork’s upper median line (UML) stands as dynamic resistance as a critical upside obstacle.

So, only a valid breakout above it may signal an upside continuation. False breakouts through the near-term resistance levels may announce a new sell-off. This scenario could take shape only if the DXY drops again.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.