- On Tuesday, several factors led to USDCAD falling below 1.2500.

- Increased oil prices supported the Canadian dollar and put pressure on a backdrop of modest US dollar weakness.

- Fed’s hawkish expectations should limit losses in the dollar.

During the first half of the European session, the USD/CAD price continued its steady intraday decline, reaching a fresh daily low, falling below the psychological 1.2500 level in the last hour.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

A combination of factors led to fresh selling in USDCAD on Tuesday, after an overnight bounce on short exits and a subsequent pullback from 1.2600. First, increased investor confidence has been attributed to the prospect of progress in the Russia-Ukraine peace talks. This is evident from the positive mood in the stock markets, which put pressure on the safe-haven dollar. Additionally, rising crude oil prices supported the commodity-pegged Canadian dollar, putting downward pressure on the major currency.

Peace talks related to optimism

Optimism about a diplomatic resolution to the Ukrainian conflict and concerns about the impact of new COVID-19 restrictions in China on fuel have created headwinds for oil prices. However, further dollar losses should be limited by the growing expectation that the Federal Reserve will tighten policy quickly to combat stubbornly high inflation. The markets expect the Fed to hike by 50 basis points in its next two meetings, which favors US dollar bulls.

The recent surge in yields

The recent rise in US bond yields, which pushed the benchmark 10-year bond above 2.5% to a near 3-year high, helped underscore expectations for a more aggressive Fed policy. As a result, fundamentals point to bearish buying near the USD/CAD pair, and bearish traders should exercise caution. However, if the pair drops below 1.2465, it should find decent support above a yearly low around mid-1.2400. This is likely to provide a solid foundation for spot rates.

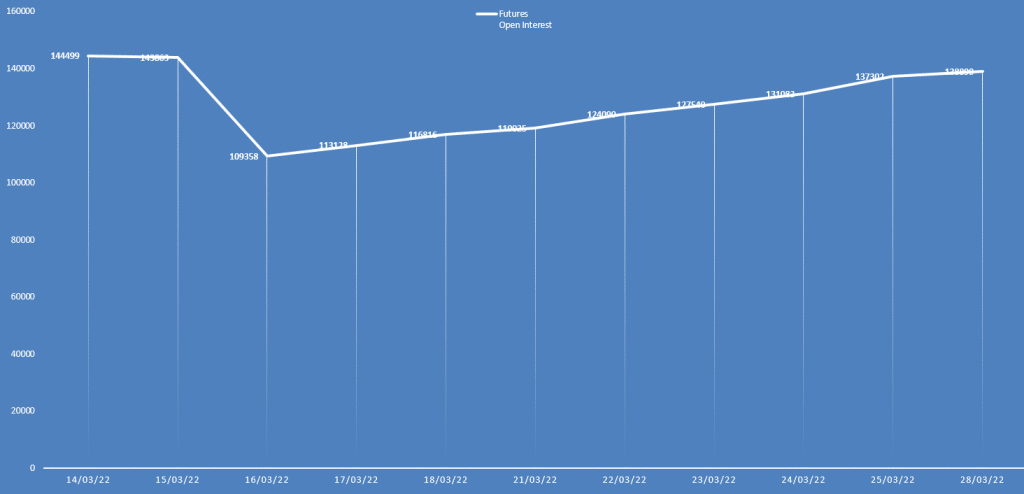

USD/CAD price and daily open interest analysis

On Monday, the USD/CAD price rose while the open interest also gained. It shows a bullish bias. However, the open interest gain is not quite significant.

What’s next to watch for USD/CAD price?

Market participants are now focused on releasing the US economic report, which includes JOLTS Job Openings and the Consumer Confidence Index from the Conference Board. The market risk sentiment should continue to be influenced by incoming geopolitical headlines. Bond yields and incoming geopolitical headlines will support dollar strength. Furthermore, changes in the oil price can also offer trading opportunities around USD/CAD.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

USD/CAD price technical analysis: Bears taking back control

The USD/CAD price remained capped by the 50-period SMA on the 4-hour chart. The pair is now wobbling below the 1.2500 area. Yesterday’s price action gained a bit by the end of the day, but the inability to hold on to highs shows that the pair has further potential to the downside.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money