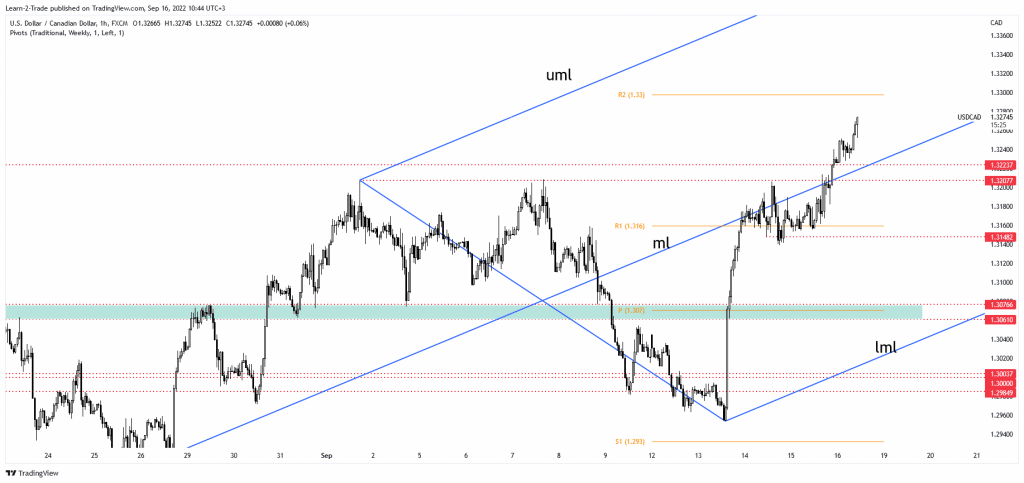

- The USD/CAD pair is bullish after taking out the resistance levels.

- The R2 stands as the next upside obstacle.

- The upper median line (UML) is seen as a major target.

The USD/CAD price rallied and seemed determined to extend its uptrend. The price is trading at 1.3277 at the time of writing and could hit new highs soon.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

As you already know, the US reported mixed data yesterday. Still, the USD remains strong as the Dollar Index maintains a bullish bias despite temporary retreats or sideways movements. The DXY moved sideways in the short term. Now it looks to trade higher.

Retail Sales rose by 0.3% in August versus a 0.1% drop expected. Core Retail Sales registered a 0.3% drop versus 0.0% growth, while Empire State Manufacturing came in at -1.5 points versus -12.7 points expected.

Furthermore, the Unemployment Claims came in better than expected, at 213K in the last week compared to 225K estimated. Industrial Production dropped by 0.2% even if the traders expected a 0.0% growth. At the same time, the Capacity Utilization Rate was reported at 80.0%, compared to the 80.2% forecasted.

Today, the US Prelim UoM Consumer Sentiment is a high-impact event. The indicator could be reported at 60.0 points above the 58.0 points in the previous reporting period. On the other hand, Canada is to release the Housing Starts, Foreign Securities Purchases, and Wholesale Sales.

USD/CAD price technical analysis: Strong bullish trend

From the technical point of view, the USD/CAD pair extended its swing higher after ignoring the 1.3207 and 1.3223 levels. The price resumed its growth after accumulating more bullish energy above the weekly R1 (1.3160). It has now jumped far above the median line (ml), representing a dynamic resistance.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

The weekly R2 (1.3300) is the next upside target and obstacle. It remains to be seen how it will react around this critical level. A valid breakout may signal further growth. As long as it stays above the median line (ml), the rate could climb towards new highs despite temporary retreats. The upper median line (UML) represents a significant upside target.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.