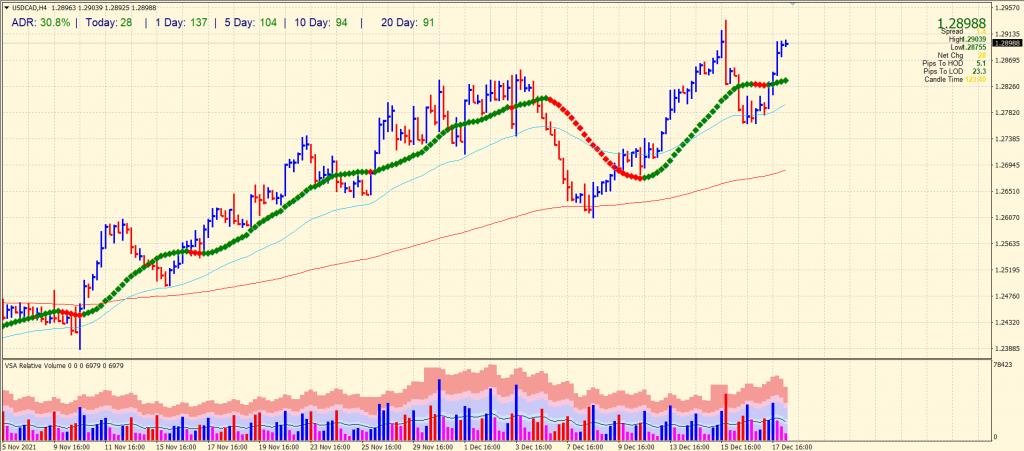

- USD/CAD continues to rise after reaching its highest close in 2021.

- The risk appetite has weakened due to concerns from Omicron, fears of a Fed rate hike, and problems stimulating the US economy.

- WTI crude oil fell more than 1.5% to a new two-week low.

- The short-term market will move based on qualitative factors in a simple calendar environment.

The USD/CAD price is hovering around 1.2900 during Monday’s Asian session after hitting its highest daily close in 2021 after a sharp daily rise in recent weeks.

–Are you interested to learn more about Forex apps? Check our detailed guide-

Low prices of WTI crude, Canada’s main export commodity, appear to be appealing to buyers of the Canadian pair. Despite a bright calendar and risk aversion, bulls seem to be facing challenges around the key resistance level lately.

After updating a two-week low of $ 68.79, WTI fell 1.55% to $ 69.20 at the time of writing. Moreover, black gold suffers from a strong US dollar index (DXY) and negative sentiment.

However, the DXY rose to its highest level in just six weeks the day before after comments from Fed Governor Christopher Waller rekindled concerns about a Fed rate hike. The Fed’s decision to accelerate the reduction of quantitative easing was all about getting the March Fed meeting ready for the first rate hike, a politician told Reuters.

Covid’s recent increase to 4,177 cases in Canada is reminiscent of Ontario’s capacity and collection limits. However, concerns about Omicron, the South African variant of Covid, are also growing in other developed countries. For example, the UK saw the largest increase in daily COVID-19 infections yesterday, with the weekly number also increasing 52%. In addition, Anthony Fauci, a senior physician from the United States, fears that additional measures will be necessary to contain COVID-19 cases.

A key senator’s refusal to support stimulus measures also weighs on market sentiment following the disappointment with US President Joe Biden’s Build Back Better (BBB) proposal. Reuters reported that a bill signed by President Joe Biden, “Build Back Better,” aimed at expanding the safety net and combating climate change, might be doomed by Senator Joe Manchin of West Virginia.

Kaisa International, a troubled Chinese firm, is asking for a resumption of its shares trading while at the same time declaring. According to Reuters, “It has not yet received any notice from bondholders to expedite payment as a marginalized Chinese developer raised the $ 400 million US dollar has not paid off the bond or the interest on promissory notes due in 2023 and 2025.”

As a result of these trends, S&P 500 futures fell 0.40%, while 10-year US Treasury yields dropped 1.3 basis points (bps) to 1.38% for the third straight day.

With the latest risk-averse sentiment and a light calendar, sentiment headlines are key to new momentum.

–Are you interested to learn more about STP brokers? Check our detailed guide-

USD/CAD price technical analysis: Bulls taking a pause

The USD/CAD price gained to 1.2900 area after falling to the 1.2760 support. However, the recent price wave has lost traction as the volume declines and may find a pause around 1.2900. The average daily range is 30% so far, which is normal. Also, the recent swing high is 1.2940 may further halt the gains. On the flip side, 1.2850 and 1.2800 will be the key support areas.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.