The USD/CAD price rallied in yesterday’s New York session, and now it stands at 1.2578 level far above 1.2501 yesterday’s low. It posted fresh highs near 1.2613, where it has found resistance again. The USD has taken back the dominance as the Dollar Index has edged higher.

-If you are interested in forex day trading then have a read of our guide to getting started-

The outlook is bullish, so the USD/CAD pair could resume its rally despite a temporary correction. However, we cannot exclude a retracement after its last rally. So, it is still left to see how the market will react around the US retail sales data.

The Retail Sales is expected to drop by 0.4% in June versus a 1.3% drop in May. On the other hand, the Core Retail Sales is expected to increase by 0.4% after a 0.7% drop in the previous reporting period. Moreover, the Prelim UoM Consumer Sentiment and the Business Inventories figures will be released as well.

USD/CAD price technical analysis: More gains on cards

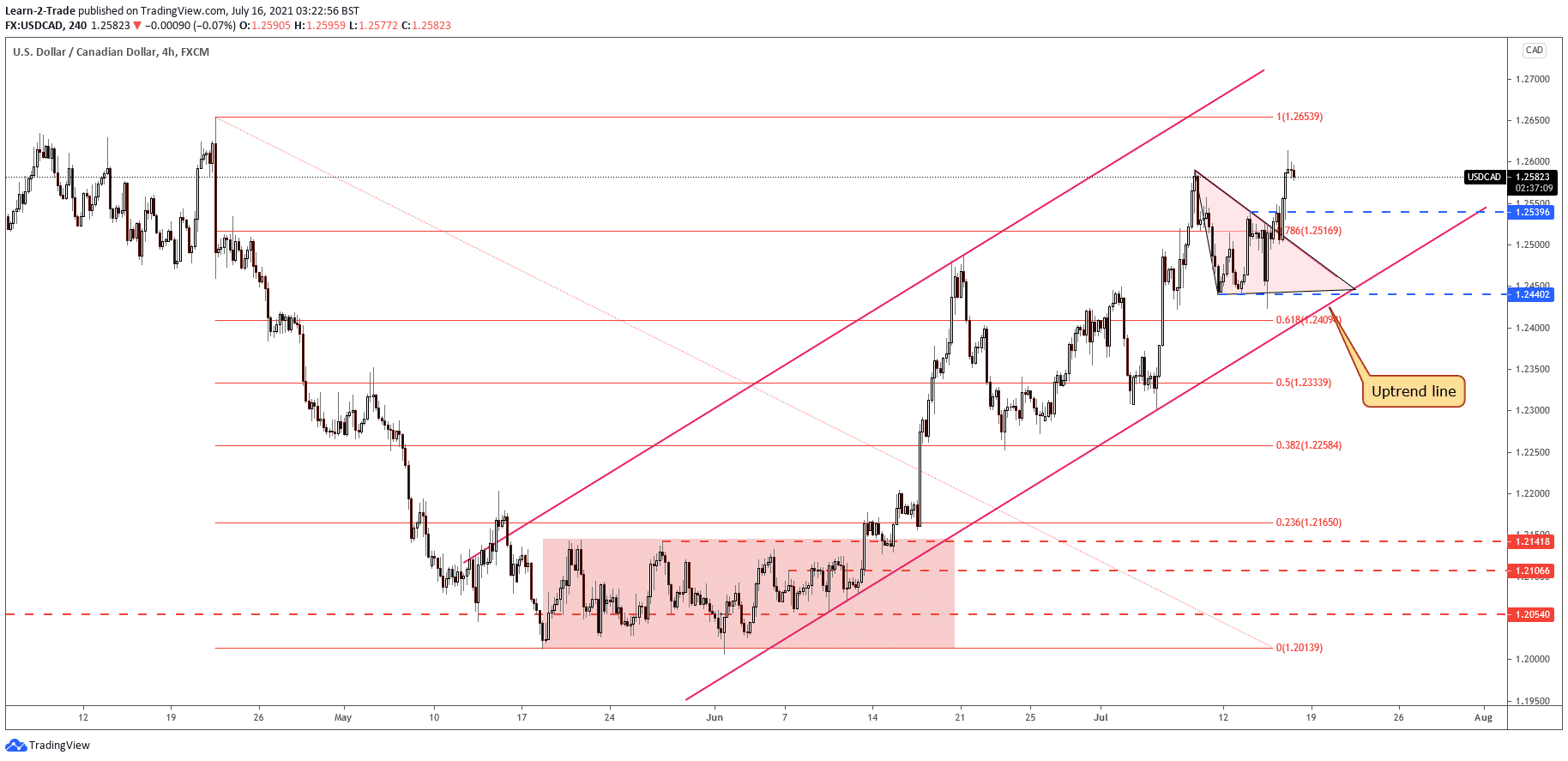

As you can see on the 4-hour chart, the USD/CAD price is located within an ascending channel pattern, so the bias is bullish. Moreover, it has escaped from a triangle pattern, so yesterday’s rally was somehow expected.

It could drop a little trying to accumulate more bullish energy before resuming its upwards movement. Better than expected US data due today could boost the Greenback.

-Are you looking for automated trading? Check our detailed guide-

Technically, the next major upside target is seen at the 100% (1.2653) level. The USD/CAD pair needs to make a valid breakout above the 1.2590 to approach this potential upside target.

The pair has registered only a false breakout above this static resistance, formerly high, so it could slip lower. The 1.2539 is seen as a potential downside target if the price continues to drop. However, a temporary decline could help us to catch a new swing higher.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.