- The Canadian Consumer Price Index could be decisive today.

- A new higher high may activate further growth.

- The median line stands as an upside obstacle.

The USD/CAD price rallied in the short term. The pair is trading at 1.2910 at the time of writing. After its strong rally, the price may accumulate more bullish energy or buyers before resuming its uptrend.

-Are you looking for automated trading? Check our detailed guide-

The price turned to the upside as the Dollar Index rebounded. DXY ended its corrective phase. It seems determined to surge back higher. Still, the fundamentals could be the key price driver today. So, you’ll have to be careful as anything could happen.

Yesterday, the Canadian economic data came in worse than expected. The Wholesale Sales rose by 0.1% versus 0.6% expected, while the Manufacturing Sales dropped by 0.8% more versus the 0.7% estimated.

Today, the Canadian Consumer Price Index stands as a high-impact event. The indicator is expected to report a 0.1% growth versus 0.7% growth in the previous reporting period. In addition, the Core CPI, Common CPI, Median CPI, and Trimmed CPI will also be released.

The volatility could be high, and the currency pair could register sharp movements. The US Industrial Production may report a 0.3% growth. The Capacity Utilization Rate is expected to be at 80.2%, while Housing Starts and Building Permits could register a significant drop.

USD/CAD price technical analysis: Resistance zone capping gains

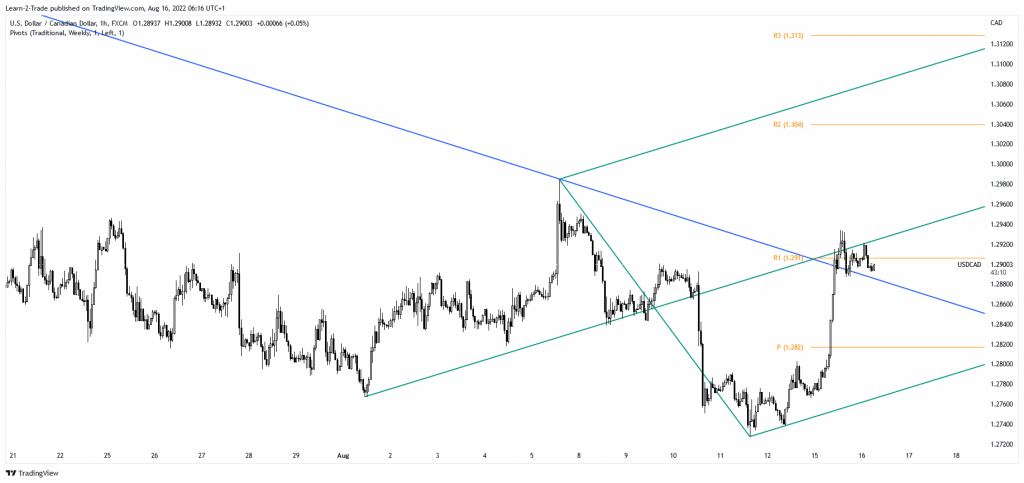

From the technical point of view, the USD/CAD passed above the downtrend line, but it has found resistance at the ascending pitchfork’s median line. After registering only false breakouts through this dynamic resistance and above the R1 (1.2910), the price could come back to test the broken descending trendline.

-Are you looking for forex robots? Check our detailed guide-

Retesting this line may validate the breakout. The USD/CAD pair can resume its upside movement if it stays above the descending trendline. However, only a new higher high, a valid breakout above the 1.2933 and through the median line, could trigger further uptrend continuation. Most likely, the price could register sharp movements in both directions. Dropping and stabilizing below the downtrend line may invalidate the breakout and signal a new sell-off.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.