- The USD/CAD pair bounced off the late January low, ending a nine-day decline.

- On the lockdown in Shanghai, oil prices tumbled as hopes of a deal with Iran collided with Saudi Arabia’s geopolitical concerns.

- Risk catalysts amplify bullish bias as high yields support the US dollar.

- US trade data and US NFP will keep traders entertained amid dovish Fed rhetoric.

A week after hitting a two-month low, the USD/CAD price attempts to rise intraday in Europe early Monday, up 0.10%.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

The Canadian dollar gained for the first time in 10 days while oil prices fell, leading to the Canadian dollar’s first daily gain in a week. Also, higher yields and risk aversion are driving the USD/CAD rate, supporting the US dollar’s strength.

Crude oil declines

The price of WTI Crude Oil is down 1.90% on the day to $109.70 at press time. The recent weakness in black gold could result from the COVID-19 lockdowns imposed in China and the expectation that Iran will soon be able to help global energy markets weather the supply crisis. Despite these difficulties, the Houthi attacks on oil facilities in Saudi Arabia and the Ukraine-Russia crisis give oil buyers hope.

US yields keep soaring

Additionally, US 10-year Treasury yields rose 5.4 basis points (bps) to their highest level since May 2019, around 2.54% at press time, which pushed the US Dollar Index down from a two-week high. In addition to escalating tensions between China and Russia and indecision in the Kyiv-Moscow negotiations, the Coronavirus issue has also helped USD/CAD bulls.

At press time, S&P 500 futures are trading at 4530, 0.35% lower on the day than their seven-week high.

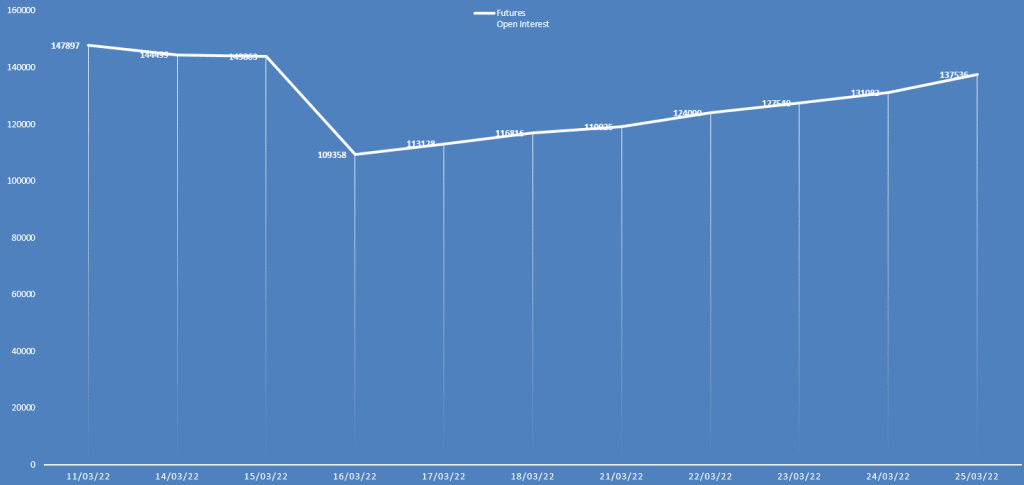

USD/CAD daily open interest and price analysis

The bias remains strongly bearish as the open interest is constantly rising while the price is falling. The same happened in the last trading session as well.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

What’s next to watch?

The US goods trade balance and wholesale inventories for February may indicate intraday moves shortly. First, however, we will concentrate our attention on risk catalysts, including headlines about the Ukraine-Russian crisis and the Coronavirus.

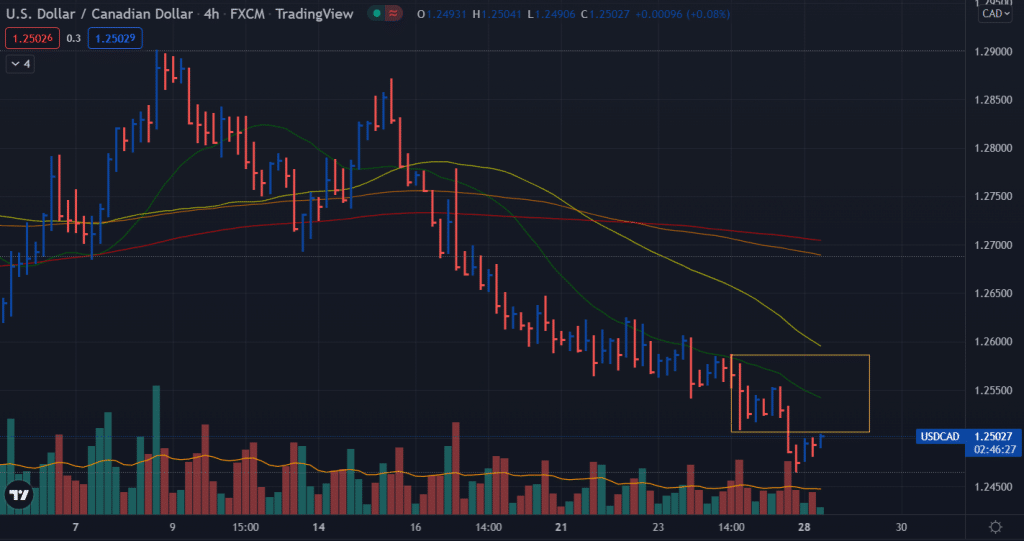

USD/CAD price technical analysis: Bears keep control

The USD/CAD price broke below the 1.2500 level and tested the fresh daily lows around 1.2465. The pair managed to correct higher towards 1.2500. However, this is a key level as it is the low of the high volume down bar. The downtrend remains intact as there is a hidden upthrust bar in the immediate background. Meanwhile, all the key SMAs on the 4-hour chart are pointing to the downside.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money