- On Monday, USD/CAD saw fresh selling, ending a streak of two straight days of gains.

- Against a backdrop of muted US dollar price momentum, rising oil prices supported the Canadian dollar.

- The dollar’s decline should be limited by the Fed’s hawkish expectations.

The USD/CAD price fell to a new daily low below the psychological 1.2500 resistance level in the last hour.

Following an early rise into the 1.2525-1.2530 range, USD/CAD met a fresh offer on Monday and appears to have broken its two-day winning streak. In addition, crude oil prices have modestly recovered, supporting the commodity-linked Canadian dollar while putting downward pressure on the major currency amid weak dollar demand. The combination of factors should limit deeper losses and act as a tailwind for spot prices.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

US officials announced last week that they would sell up to 1 million barrels of oil a day from the Strategic Petroleum Reserve (SPR) starting in May 2022. As part of the agreement, the International Energy Agency will release more oil on Friday. Oil supply concerns were eased by a two-month truce between the Saudi-led coalition and the Houthi group linked to Iran. Additionally, COVID-19 outbreaks in China may limit oil price increases.

Fed’s aggressive rate hike

On the other hand, the dollar should benefit from increasing recognition that the Fed will adopt more aggressive policies to combat stubbornly high inflation. The US jobs report on Friday confirmed the market’s expectations that the Fed would hike rates by 100 basis points in the next two meetings. Consequently, US Treasury yields have risen, which has favored the bulls of the US dollar and bolstered the prospects of bear buying in the USD/CAD pair.

What’s next to watch for USD/CAD?

On Wednesday, the minutes of the FOMC meeting will be published. At the same time, events surrounding the Russian-Ukrainian conflict and the yield on US bonds could affect the US dollar. Meanwhile, traders will closely monitor the price of oil. However, USD/CAD’s recovery from its YTD low of 1.2425-1.2315 – touched last week – appears to have stalled.

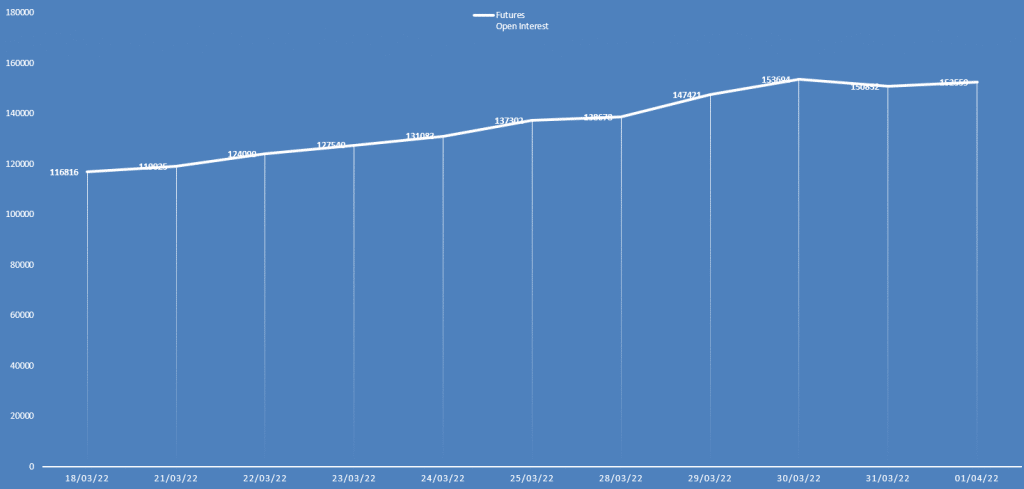

USD/CAD price analysis via daily open interest

The USD/CAD price fell on Friday while the daily open interest slightly rose. Nevertheless, it shows that the bearish bias remains intact.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

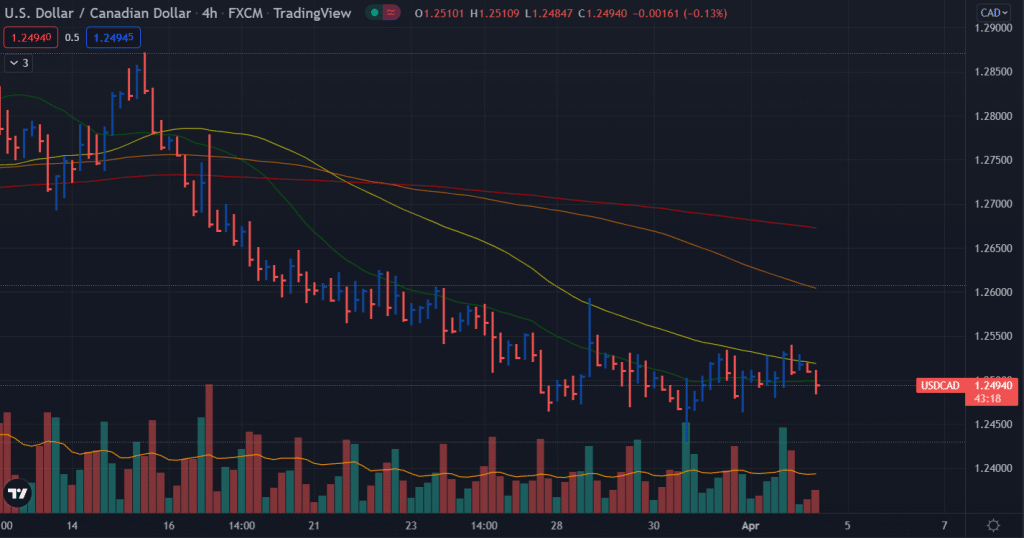

USD/CAD price technical analysis: Rangebound behavior

The USD/CAD price has been wobbling above and below the key figure of 1.2500. Technically, the bias is bearish as the price lies below the key moving averages. However, the price remains ranging within the 100-pip range. Therefore, traders should remain cautious and find opportunities when a valid range breakout occurs on either side.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money