- USD/CAD pair continued upside momentum on Monday.

- US Treasury yields are rising amid upbeat US NFP data on Friday.

- Crude oil sees a 2% fall amid growing coronavirus concerns and potentially falling demand.

As the European session begins, the USD/CAD price is still rising from the prior session. The pair is in a very narrow trading band with a neutral position.

As of writing, USD/CAD trades at 1.2550, up 0.04% from yesterday.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

The yields on US Treasury bonds rose after the Labor Department’s employment report exceeded expectations. According to the Bureau of Labor Statistics (BLS), the number of non-farm jobs increased by 943k in July, far surpassing the market’s forecast of 870k.

In July, the number of employees increased, reflecting improved labor market conditions, allaying concerns about the spread of the COVID-19 Delta variant.

However, the currency weakened after the Ivey Purchasing Managers Index (PMI) dropped from 71.9 to 56.4 in July from a month ago.

On Monday, a rally in the dollar and concerns over demand prospects, combined with renewed fears about the Coronavirus, sent oil prices down about 2%.

The new incentive to trade is awaiting the start date for housing construction in Canada and opening jobs in the United States.

–Are you interested to learn more about forex signals? Check our detailed guide-

USD/CAD technical analysis: Bulls hold but inactive

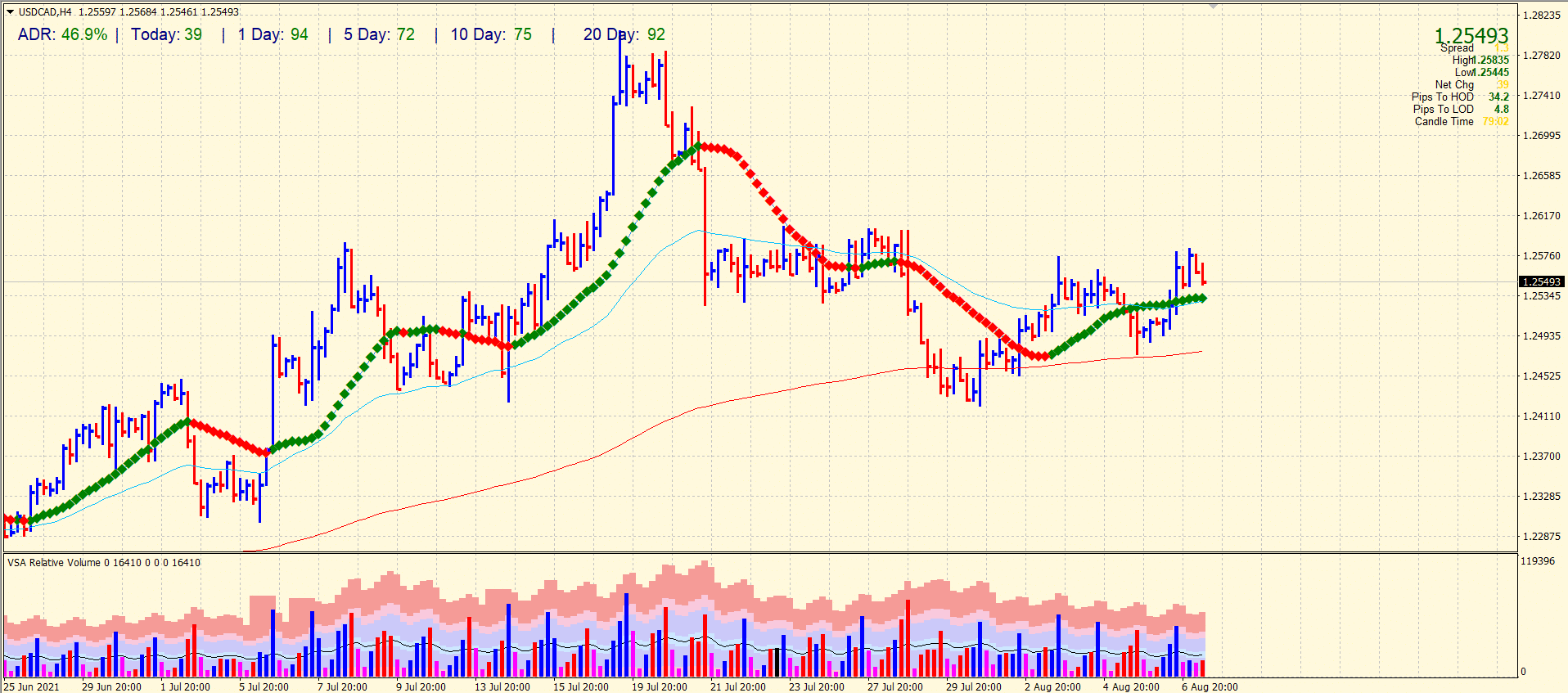

The USD/CAD pair is consolidating the gains after rising briefly beyond the mid-1.2500 area. The price is still above the 20-period and 50-period SMAs on the 4-hour chart. However, the price seems to lack traction to continue the bullish momentum. The price has done 46% average daily range so far, which shows more room to gain is still there. But the market needs a catalyst to activate the bulls. The key is to remain above the 20-period SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.