- Canada’s inflation data set to come out later in the day has investors on the edges of their seats.

- Canada’s inflation expectations have been rising, further fueling price pressures.

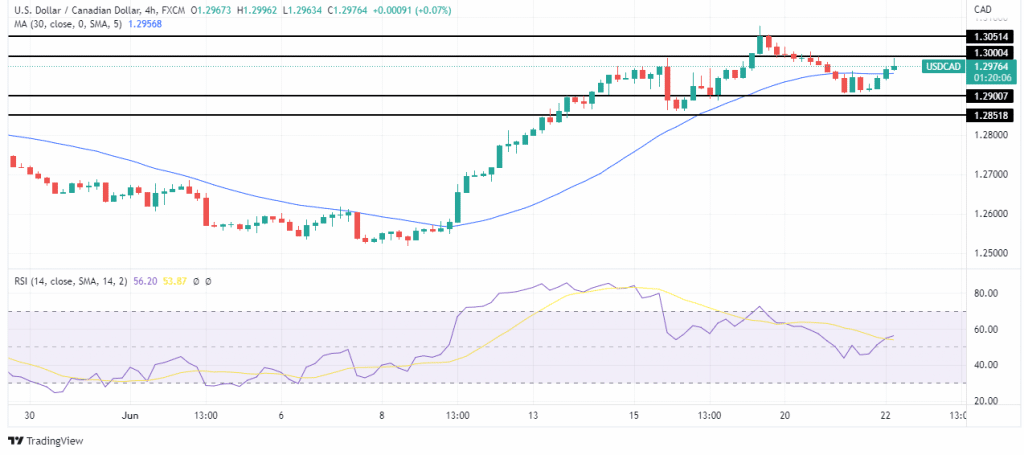

- The USD/CAD is approaching 1.3000 in the charts.

The USD/CAD price is pushing toward 1.3000 as investors wait for inflation data from Canada. This move can also be attributed to the stronger dollar, pushed by recession concerns. With every inflation data release comes the fear of collapsing economies as central banks try to tame price pressures.

-Are you interested in learning about forex live calendar? Click here for details-

Investors expect the Bank of Canada to match the Federal Reserve by raising rates by 75-bps at its July 13 meeting.

“Central bankers can’t be too happy with what’s happening at the gas pumps since it’s one of the prices that households most closely track, along with some other staples like milk and bread. These prices have more influence over perceptions of inflation than their actual weight in the consumer basket,” said Avery Shenfeld, chief economist at CIBC Capital Markets.

USD/CAD key events today

The testimony by Fed Chair Jerome Powell later in the day will likely cause volatility in the US dollar index and subsequently USD/CAD as there might be clues on the next rate hike in July.

Investors are also keen on inflation data from Canada, with core CPI (YoY) expected to go up to 5.9% from 5.7% in May. May’s Core CPI (MoM) is expected to drop to 0.4% from 0.7%. This inflation data has a lot of weight as it will inform the Bank of Canada on the next steps regarding interest rates.

USD/CAD price technical analysis: Eying regain of 1.3000

Looking at the 4-hour chart, we see the price pushing higher after pushing below the 30-SMA. The price has gone above the SMA, showing that bulls have returned. RSI is trading above 50, which also favors bullish momentum. If bulls can maintain this momentum, we could see the price retesting at 1.3050. A break above this level would lead to a higher high, further confirming the bullish trend.

-Are you interested in learning about forex signals? Click here for details-

However, there is a significant obstacle on the way: the 1.3000 level, a critical psychological level. If bulls cannot break above this, we could see bears coming in to push the price below 1.2900.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money