- The currency pair turned to the upside only because the Dollar Index rebounded.

- The Canadian and US economic data could bring more action.

- As long as it stays within the ascending pitchfork’s body, the median line could attract the price.

The USD/CAD price is trading at 1.3318 at the time of writing. After yesterday’s rally, the price turned to the downside as the US dollar slipped lower.

–Are you interested in learning more about STP brokers? Check our detailed guide-

In the short term, the currency pair remains rangebound. That’s why we’ll have to wait for a clear direction. Fundamentally, the USD failed to resume its appreciation as the US reported mixed data yesterday. The Philly Fed Manufacturing Index came in worse than expected, while Unemployment Claims, Housing Starts, and Building Permits came in better than expected.

Today, economic data could have an impact as well. The US Existing Home Sales could drop from 4.71M to 4.41M, while the CB Leading Index is expected to report a 0.4% drop. On the other hand, Canada is to release its Foreign Securities Purchases, IPPI, and RMPI data.

As you already know, the CAD/USD pair turned upside after the Canadian inflation figures. The CPI reported a 0.7% growth versus the 0.8% expected but far above the 0.1% growth in the previous reporting period, while Core CPI registered a 0.4% growth.

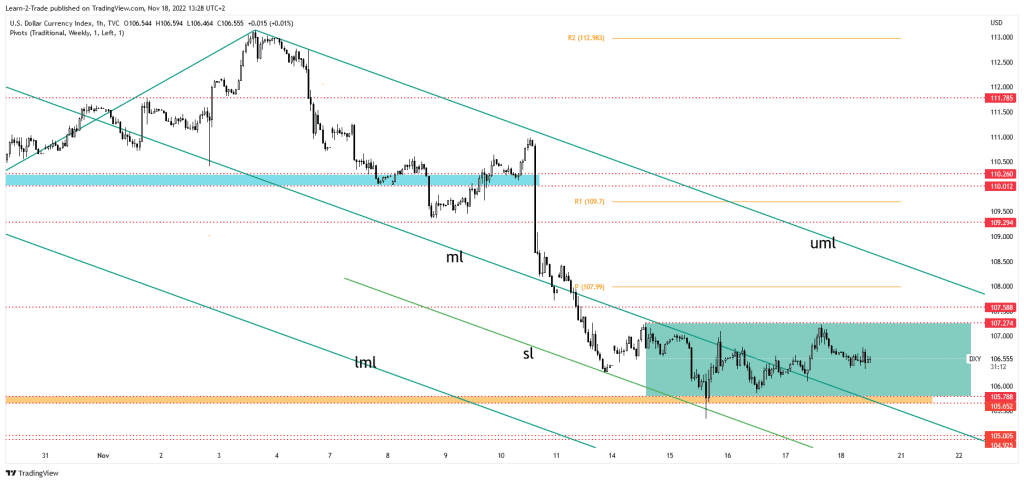

Dollar Index price technical analysis: Downside seems over

The Dollar Index continues to move sideways in the short term. It has rebounded after registering only a false breakdown below the 105.65 – 105.78. It rallied after retesting the median line (ML). However, it has failed to take out the 107.27 resistance. A new higher high activates further growth. A new leg higher, new leg higher could force the greenback to dominate the currency market.

USD/CAD price technical analysis: Temporary retreat

The USD/CAD pair found resistance at 1.3401. Now the pair has turned to the downside to test and retest the broken downtrend line. Coming back and stabilizing above 1.3326 and the weekly pivot point of 1.3350 may signal further growth.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

After testing the lower median line (LML), the rate signaled a potential upside movement, at least towards the median line (LML). The median line acts as a magnet and could attract the price. A larger growth could be activated only after a valid breakout through the median line.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.