- On Thursday, USD/CAD returned to its year-to-date highs, gaining positive momentum.

- The US dollar gained some support from the Fed’s aggressive rate hike statements.

- Oil prices dropped again, further strengthening the Canadian dollar.

The USD/CAD price gained steadily during the European session, moving closer to its yearly high in the last hour in the 1.3045 area.

–Are you interested in learning more about STP brokers? Check our detailed guide-

On Thursday, the USDCAD pair gained momentum after recovering from the 1.2920 area overnight. The dollar reached its highest level in almost two decades on more aggressive Fed tightening expectations. A decline in crude oil prices also undermined the commodity-linked Canadian dollar and served as a tailwind for the major currency.

Investors are confident the Fed will hike rates despite signs that inflation pressures have peaked in the world’s largest economy. Moreover, a 75 basis point rate hike to 81% in June is now being priced into the money market futures market on concerns that China’s Coronavirus policy and the war in Ukraine will drive consumer prices even higher. Together, these factors boosted the value of the safe-haven dollar.

Inflation fears are dampening investors’ appetite for riskier assets, as they fear interest rates will rise and shut down the global economy. Moreover, Chinese lockdown measures due to Covid-19 have stoked recession fears by slowing fuel demand. In addition, the delay in approving the phased embargo on Russian oil proposed by the European Union impacted crude oil prices.

The question remains whether bulls can build on this move or whether the USD/CAD pair will meet fresh supply at higher levels, requiring caution before positioning for further gains. In addition to US bond yields and broader risk appetite, market participants are now eagerly awaiting the US Producer Price Index (PPI). Short-term opportunities will continue to be watched by traders.

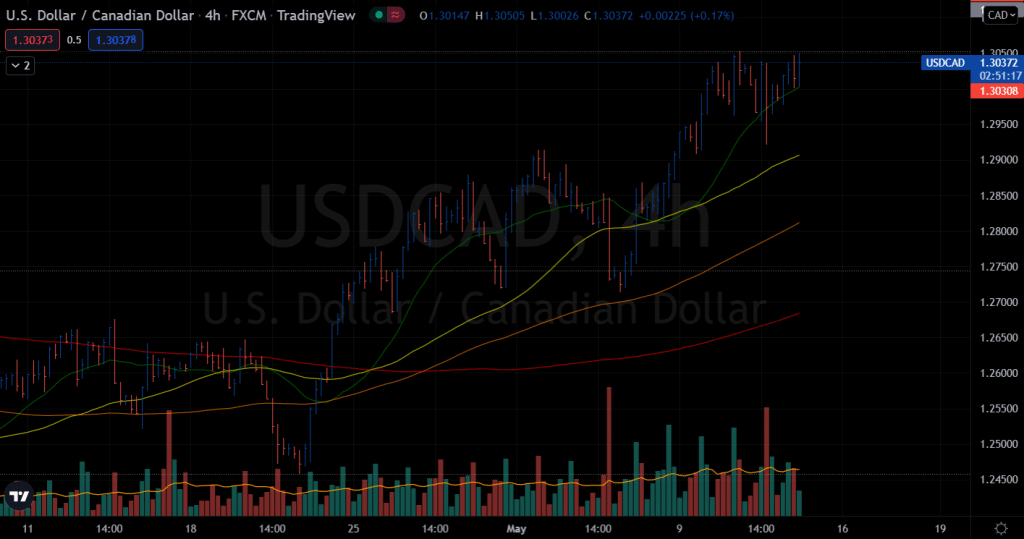

USD/CAD price technical analysis: Bulls to hit fresh highs

The USD/CAD price remains close to daily highs above 1.3000. The price has a tendency to break the swing highs of 1.3052 and post a fresh multi-month high. All the key SMAs on the 4-hour chart are well below the price, indicating a strong upside trend. However, the volume for the recent upside wave is declining. It indicates the probability of downside correction. The downside could be limited by the strong support of 1.2900.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money