- USD/CAD rallies 0.45% on a one-and-done looking Fed cut.

- Fed cuts interest rate decision to cut 0.25% and not as dovish statement as market had been priced for.

The Federal Reserve has done pretty much hat the market had expected in terms of the rate cut, choosing to cut by 0.25%. However, the statement is pretty much the same as the previous and there are little signs of intentions from the Fed’ to cut again anytime soon. The market was priced in 76% for a cut in Sept and 87% priced in for October. Ahead of the decision and statement, markets were dubious of a deeper cut considering the strength of the economy.

The main reason that markets expected some form of action was considering that U.S. inflation has been running well below the Federal Reserve’s informal target of 2%, which would have given policymakers political and economic cover in choosing to cut interest rates today. Indeed, this rate cut can be considered as an insurance policy guarding against weakness abroad as well as domestic inflation softness and so long as the economy continues to expand at its longest expansion on record, the next 3 x 25bp cuts that were priced in for the next 18 months will likely be dialled down now. Given the positive backdrop and the contrasts to the rest of the world, the dollar can hold onto the gains its been making his year.

Federal Reserve outcome

- The interest rate on excess reserves cut to 2.10% from 2.35%.

- FOMC cuts benchmark rate by 25 basis points (bps); target range stands at 2.00% – 2.25%.

- To conclude b/sheet reduction in august, 2-months earlier than previously indicated.

- To roll over at auction all principal payments from holdings of treasury securities, reinvest all principal payments from agency debt and agency MBS received each month.

- Principal payments from agency debt and agency mortgage-backed securities (MBS) up to $20 bln/month will be reinvested in treasury securities to roughly match maturity composition of outstanding Treasury securities.

- Principal payments from agency debt and agency mortgage-backed securities in excess of $20 bln will continue to be reinvested in mortgage-backed securities.

- Rate cut supports the committee’s view that sustained economic expansion, strong labour market and near-target inflation. are most likely outcomes but uncertainties remain.

- As it contemplates future path of fed funds rate it will continue to monitor incoming info, act as appropriate to sustain expansion.

- Household spending growth has picked up, but business fixed investment growth has been soft and inflation compensation measures remain low.

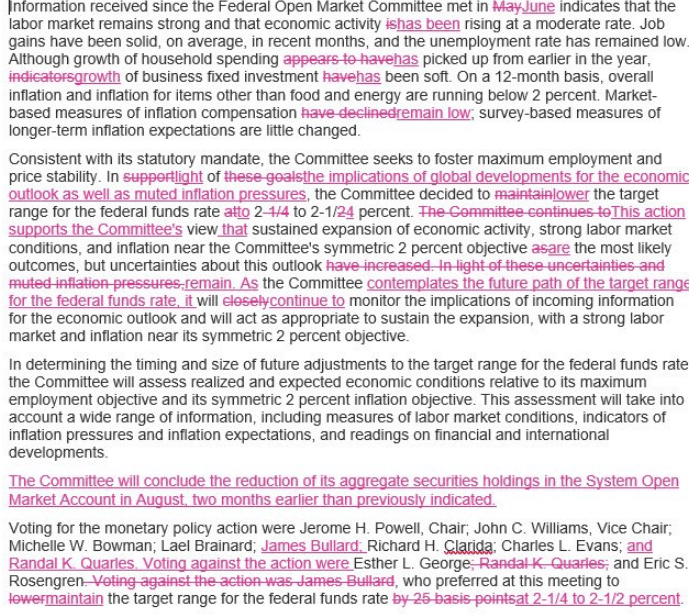

Statement comparison

What changed between the June 19 statement and the July 31 statement? This is pretty much identical to the last statement and there is no more dovishness that the market had been priced for, hence we can expect a stronger dollar for longer.

All looking good for the BoC

The Canadian dollar could be a market favourite considering the Canadian economy, second tot he US, is looking more robust and thus the Bank of Canada, (BoC) is unlikely to be in a hurry to join the race to the bottom. Strong growth in the last several months has underscored why the BoC has maintained a neutral policy bias.

Today’s data confirmed that with the Canadian GDP surprising to the upside for a third consecutive month in May. Growth was yet again broadly-based with most services industries recording gains while goods production was posting another solid increase.

“¢ GDP rose 0.2% in May, 0.1 ppt above consensus

“¢ Goods production saw another solid increase

“¢ Q2 growth tracking close to 3%

USD/CAD levels

More to come…