“¢ A modest USD retracement fails to provide any fresh bullish impetus.

“¢ Positive oil prices underpin Loonie and further kept a lid on any up-move.

“¢ Investors look forward to Canadian CPI for fresh directional impetus.

The USD/CAD pair traded with a mild negative bias through the early European session and eroded a major part of the overnight uptick to 3-1/2 week tops.

On Thursday, the pair reversed an early dip and turned higher for the second straight session in reaction to some renewed US Dollar buying after the US Treasury Secretary Steven Mnuchin’s comments to impose new sanctions against Turkey.

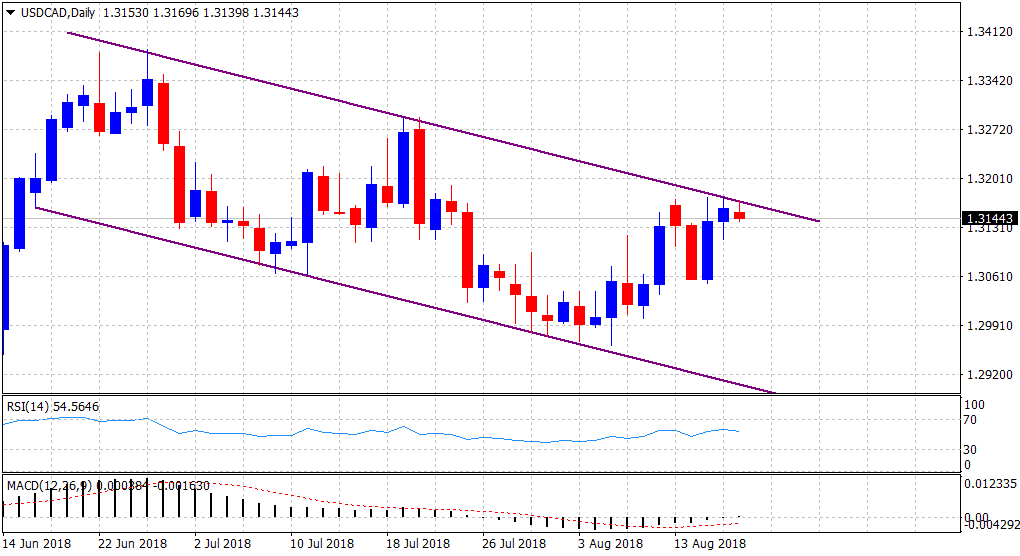

Meanwhile, a combination of factors failed to provide any fresh bullish impetus, with the pair continuing with its struggle to make it through a short-term descending trend-channel formation on the daily chart.

A modest USD retracement and a mildly positive tone around crude oil prices, which tend to underpin demand for the commodity-linked currency – Loonie, kept a lid on any meaningful up-move for the major.

Meanwhile, the downside remained cushioned, at least for the time being, as traders seemed reluctant to place any aggressive bets ahead of today’s important release of the latest Canadian consumer inflation figures.

Technical Analysis

The short-term descending trend-channel remains a key hurdle to conquer, above which a bout of short-covering could lift the pair, even beyond the 1.3200 handle, towards testing its next major hurdle near the 1.3270-75 supply zone.

Alternatively, rejection slide from the mentioned barrier, leading to a subsequent break below the 1.3115-10 immediate support is likely to drag the pair back towards retesting the 1.3055-50 strong horizontal support.