“¢ Easing USD bearish pressure helps find decent support ahead of 1.3100 handle.

“¢ A goodish pickup in oil prices underpin Loonie and cap any meaningful up-move.

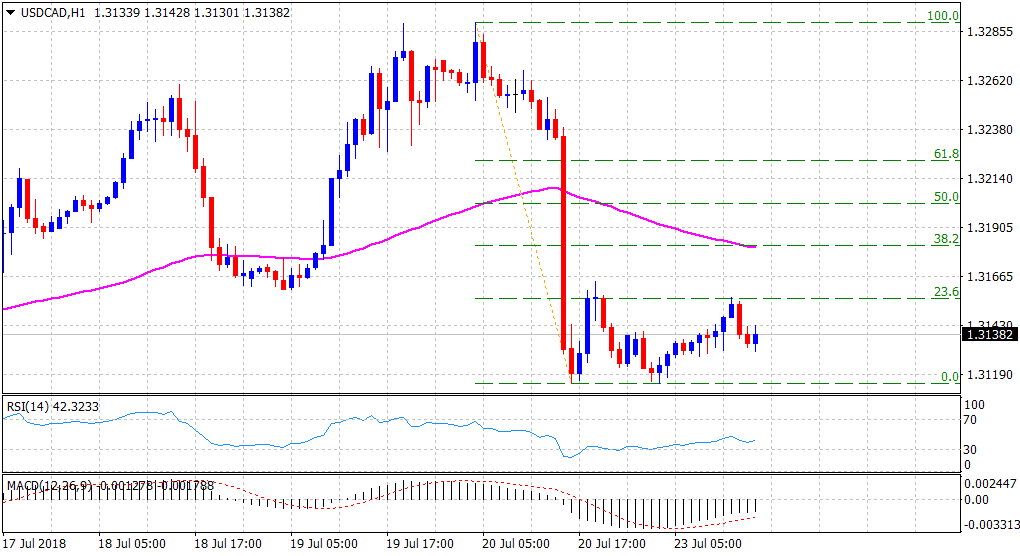

The USD/CAD pair continued with its range-bound price action and is currently placed at the mid-point of its daily trading range, just below 1.3150 level.

The pair was seen consolidating Friday’s sharp decline from three-week tops, with a combination of diverging forces failing to provide any meaningful impetus at the start of a new trading week.

The US Dollar selling bias, triggered by the US President Donald Trump’s comments on Thursday and Friday, now seems to have abated a bit and was seen as one of the key factors that helped the pair to find some support ahead of the 1.3100 handle.

The positive factor, to a larger extent, was negated by a sudden upsurge in crude oil prices, which underpinned the commodity-linked currency – Loonie and collaborated towards capping any meaningful up-move.

Today’s relatively thin US economic docket, featuring the release of existing home sales data, is unlikely to provide any meaningful impetus and hence, the USD/oil price dynamics might continue to play a key role in determining the pair’s momentum through the New-York trading session.

Technical Analysis:

The pair is now seen struggling to recover beyond 23.6% Fibonacci retracement level of Friday’s downfall and the price action clearly seems to suggest that the bearish pressure might still be far from being over.

The negative outlook is further reinforced by technical indicators, which have failed to gain any positive traction and hence, any attempted up-move seems more likely to meet with some fresh supply at higher levels.

Spot rate: 1.3138

Daily High: 1.3157

Daily Low: 1.3115

Trend: Bearish

Resistance

R1: 1.3157 (current day swing high)

R2: 1.3180 (100-period SMA H1)

R3: 1.3205 (50% Fibo. level of Friday’s move)

Support

S1: 1.3115 (horizontal level)

S2: 1.3083 (50-day SMA)

S3: 1.3064 (monthly low set on July 11)