- USD/CAD risk reversals have shed CAD bearish bias.

- A break below 1.30 in USD/CAD may revive the demand for CAD calls.

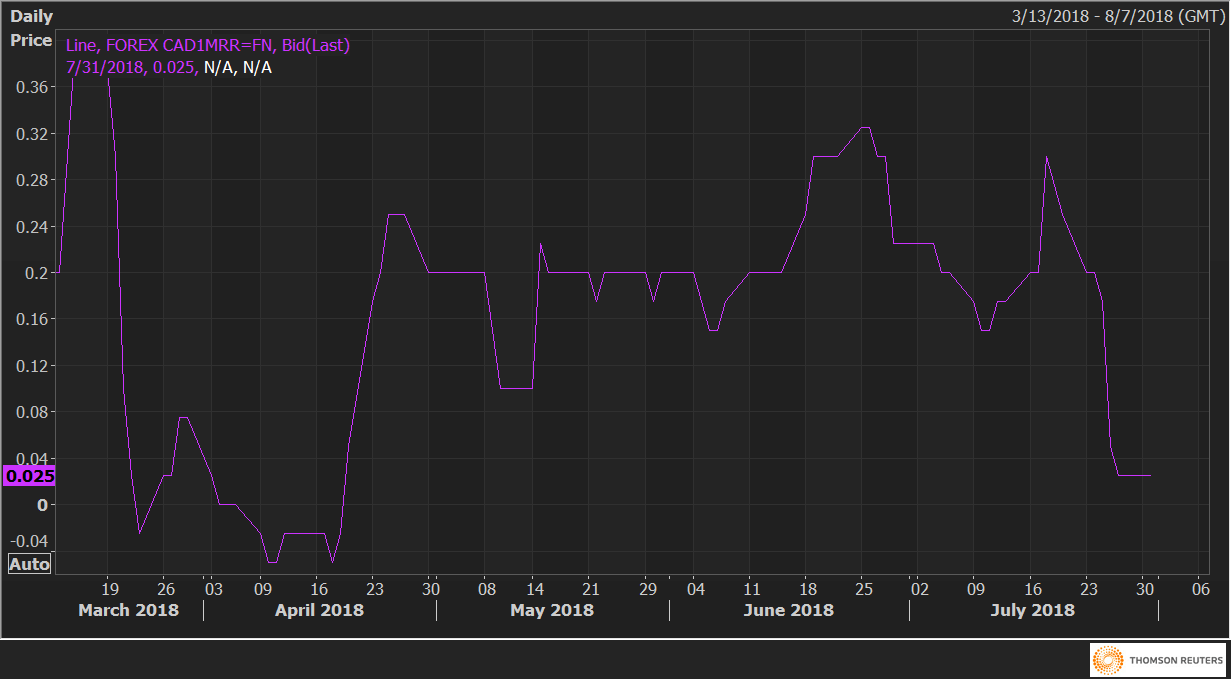

The USD/CAD one-month 25 delta risk reversals (CAD1MRR) is sidelined at 0.025 since Friday – the lowest level since April 19, having hit a high of 0.30 two weeks ago.

The decline from 0.30 to 0.025 indicates a falling implied volatility premium or falling demand for CAD puts (bearish bets). The data add credence to USD/CAD’s recent drop from 1.3386 to 1.30.

The risk reversals risk turning negative (higher implied volatility premium for CAD calls) if the USD/CAD pair finds acceptance below the psychological mark of 1.30.

CAD1MRR