- USD/CAD saw significant selling pressure in the immediate aftermath of Wednesday’s Bank of Canada meeting.

- The pair dropped from close to 1.2700 to nearly as low as the 1.2600 mark, before paring back to 1.2650.

- Soft inflation numbers have done little to hurt demand for the loonie.

USD/CAD saw significant selling pressure in the immediate aftermath of Wednesday’s more hawkish/optimistic Bank of Canada Monetary Policy decision at 15:00GMT. The pair dropped from pre-release levels close to 1.2700 to nearly as low as the 1.2600 mark, before paring losses to settle closer to 1.2650. In doing so, the loonie hit its highest levels in nearly three years versus the US dollar.

On the day, the pair trades 0.7% or just over 90 pips lower, unaffected by a broad decline in Consumer Price Inflation in December, which is being seen as temporary as a result of the short-term impact of new virus concerns/lockdowns. Indeed, Capital Economics expects core inflation to rise above 2% in the summer.

Bank of Canada Meeting Recap

Despite some analysts calling for and money markets pricing in some probability that the Bank of Canada would opt for a “mini” rate cut and take interest rates down to 0.1% (as the BoE and RBA did back in 2020), the bank opted to hold fire and stand pat with rates at 0.25%. The bank reiterated its interest rate guidance; “the Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In our projection, this does not happen until into 2023.”

Meanwhile, the pace of monthly asset purchases was left unchanged at CAD 4B per week. However, the bank signalled that it would reduce the pace of rate of purchases as Governing Council members gain confidence in the strength of the economic recovery.

On the economic outlook, the bank was relatively upbeat; the bank acknowledged the deterioration in the near-term economic outlook as a result of rising Covid-19 cases but noted that “outlook is now stronger and more secure…thanks to earlier-than-expected availability of vaccines and significant ongoing policy stimulus”.

In the press conference, Governor Tiff Macklem noted that if the economy does turn out to be substantially weaker than the bank is currently projecting, leading to greater disinflationary pressures, there would be the option to add more stimulus. Asked if the bank had considered the micro-cut that some analysts had expected, Macklem said that the Governing Council had determined that the current “considerable” amount of stimulus currently in place was sufficient, but that a micro-cut could be an option moving forward.

When pressed to speak about the recent appreciation of the loonie, Macklem noted that it was a risk to the outlook but did not go any further (i.e. by implying that the bank might seek to take action to actively weaken CAD). US Treasury Secretary Janet Yellen’s testimony before Congress on Tuesday, in which she issued a thinly veiled warning to the US’ major trading partners not to actively seek to weaken their currencies, was likely fresh in the minds of BoC policymakers.

A new Monetary Policy Report full of new economic forecasts was also released; the bank expected the YoY rate of GDP growth in Q1 2021 to be -2.5% and the bank’s forecast for full-year 2021 growth was lowered to 4.0% from 4.2% to reflect this early weakness. However, the bank’s 2022 forecast received an upgrade to 4.8% from 3.7% and 2023 GDO growth was forecast at 2.5%. The 2022 inflation forecast was left unchanged at just 1.7%, still below the bank’s 2.0% target.

Market reaction

The fact that the bank didn’t cut rates to 0.1% (and some portion of the market was betting they would), the more upbeat tone on the longer-term economic outlook, the lack of any notable CAD jawboning and the fact that the bank signalled that it could soon move towards a tapering of its asset purchase programme all worked in favour of the loonie, helping power USD/CAD to fresh multi-year lows just above the 1.2600 level.

USD/CAD bearish bias intact

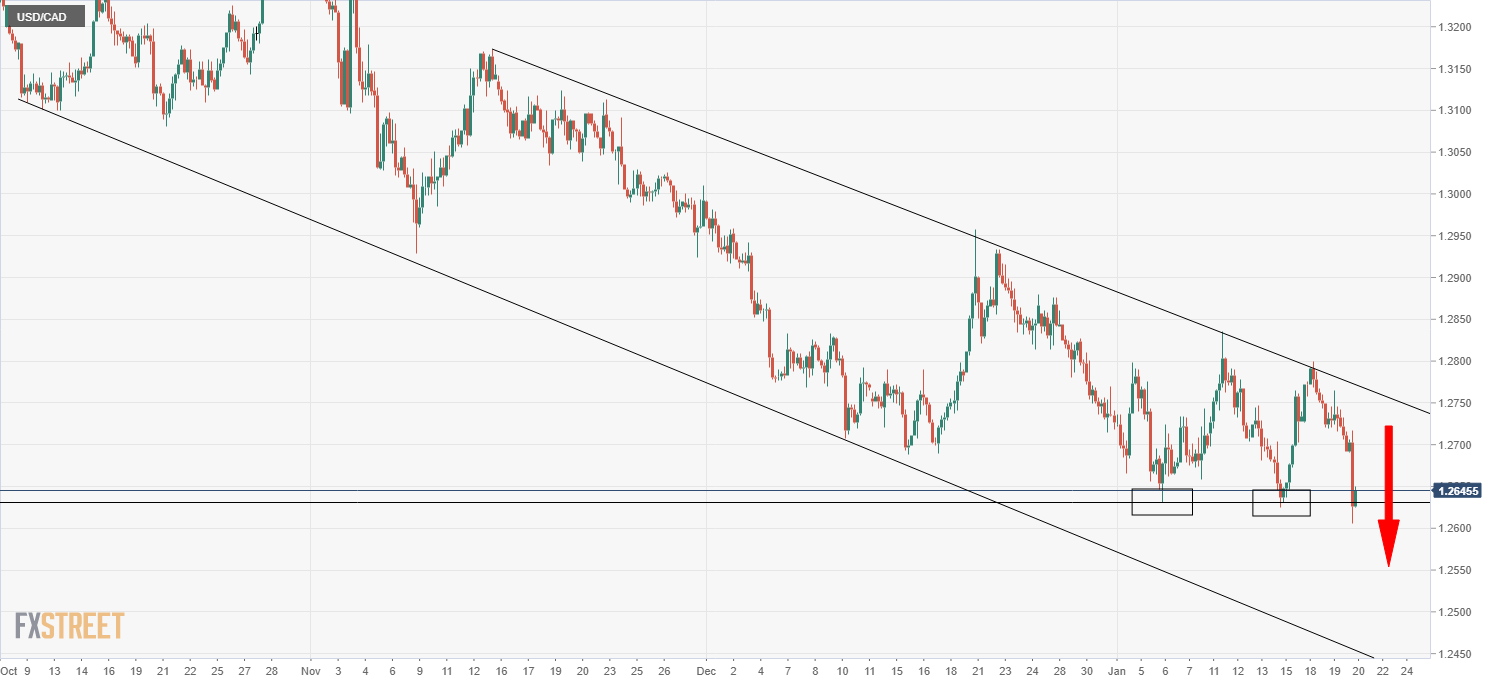

USD/CAD’s bearish bias remains intact; the pair continues to move to the south within the confines of a long-term downwards trend channel. To the upside, price action is being constrained by a trendline linking the 13 and 23 November, 21 December and 11, 17 January highs, while to the downside, the price action is being supported by a downtrend linking the early October, 10 November and mid-December lows. Technically speaking then, a continued move to the south towards the 1.2500 level seems the most likely outcome.

USD/CAD four-hour chart