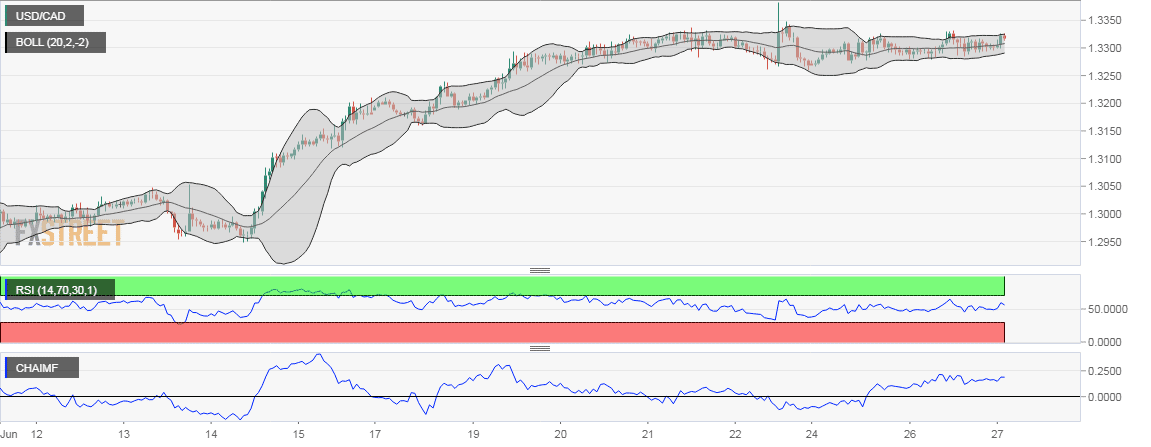

- USD/CAD hourly chart shows Bollinger Bands (+2/-2 standard deviation on 20-hour moving average) have narrowed (popularly known as squeeze), indicating low volatility.

- An extended period of low volatility is often followed by a big move (high volatility).

- The RSI is biased to the bulls (above 50.00), having built a base around 45.00 over the last two days. Also, Chaikin Money Flow is positive.

- So, Bollinger Band squeeze may end up with a bull breakout.

Hourly chart

Spot Rate: 1.3316

Daily High: 1.3324

Daily Low: 1.3294

Trend: Teasing a bull breakout

R1: 1.3229 (previous day’s high)

R2: 1.3385 (76.4% Fib R of Apr 2017 high – Sep 2017 low)

R3: 1.34 (psychological level)

Support

S1: 1.33 (round figure)

S2: 1.3260 (weekly low + 200-hour moving average)

S3: 1.3120 (4H 100-candle moving average)