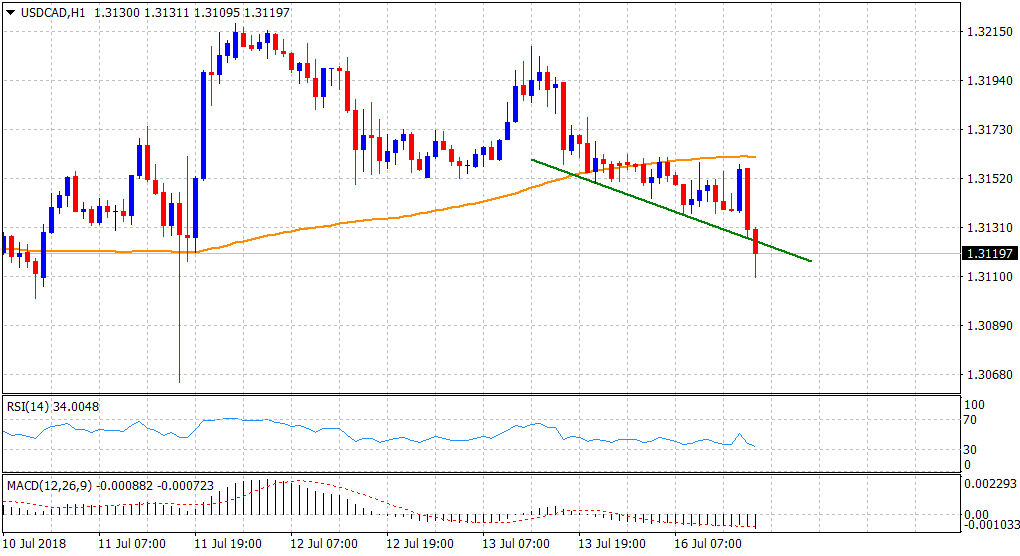

“¢ The US retail sales data-led uptick failed ahead of the 100-hour SMA, with bears dragging the pair below a short-term descending trend-line support on the 1-hourly chart.

“¢ Short-term technical indicators maintain bearish bias and hence, a follow-through weakness, back towards the post-BoC swing low, now looks a distinct possibility.

“¢ The ongoing slump in crude oil prices, which tends to undermine demand for the commodity-linked currency – Loonie, might turn out to be the only factor extending some support.

Spot rate: 1.3120

Daily High: 1.3163

Daily Low: 1.3110

Trend: Bearish

Support

S1: 1.3100 (round figure mark)

S2: 1.3072 (S3 daily pivot-point)

S3: 1.3032 (50-day SMA)

Resistance

R1: 1.3161 (100-period SMA H1)

R2: 13209 (Friday’s swing high)

R3: 1.3270 (horizontal zone)