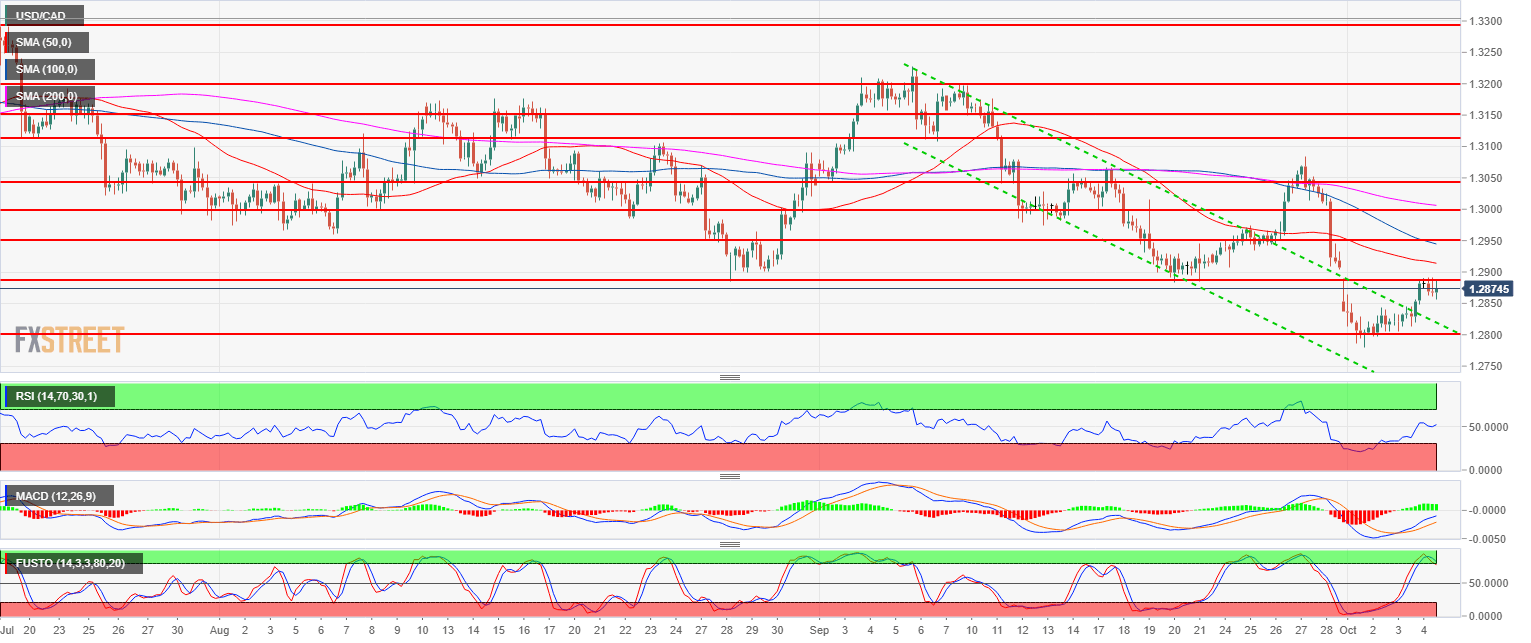

- USD/CAD is finding resistance just below the 1.2900 figure multi-week resistance.

- USD/CAD is trading below its 50, 100 and 200-period simple moving averages suggesting a bearish bias. However, the RSI, MACD and Stochastics indicators keep a bullish momentum for the time being.

- If capped below 1.2900 figure USD/CAD has room to potentially drop to 1.2800 figure.

USD/CAD

Overview:

Last Price: 1.2876

Daily change: 6.0 pips

Daily change: 0.0466%

Daily Open: 1.287

Trends:

Daily SMA20: 1.2988

Daily SMA50: 1.3022

Daily SMA100: 1.3051

Daily SMA200: 1.2867

Levels:

Daily High: 1.2886

Daily Low: 1.2806

Weekly High: 1.3083

Weekly Low: 1.2904

Monthly High: 1.3228

Monthly Low: 1.2882

Daily Fibonacci 38.2%: 1.2855

Daily Fibonacci 61.8%: 1.2836

Daily Pivot Point S1: 1.2822

Daily Pivot Point S2: 1.2774

Daily Pivot Point S3: 1.2742

Daily Pivot Point R1: 1.2902

Daily Pivot Point R2: 1.2934

Daily Pivot Point R3: 1.2982

Main trend: Neutral to bearish

Resistances and Supports:

Resistance 1: 1.2882-1.2900 September 20 low and figure

Resistance 2: 1.2959 August 7 low

Resistance 3: 1.3000 figure

Resistance 4: 1.3048 August 14 low

Resistance 5: 1.3108, September 7 low

Resistance 6: 13200 figure

Support 1: 1.2855-65 June 6 low – 200-day SMA

Support 2: 1.2800 figure

Support 3: 1.2727 May 11 low

Support 4: 1.2600 figure