- USD/CAD is spiking to new monthly highs above the 1.3300 handle ahead of the FOMC minutes.

- The level to beat for bulls is the 1.3310/1.3331 resistance zone .

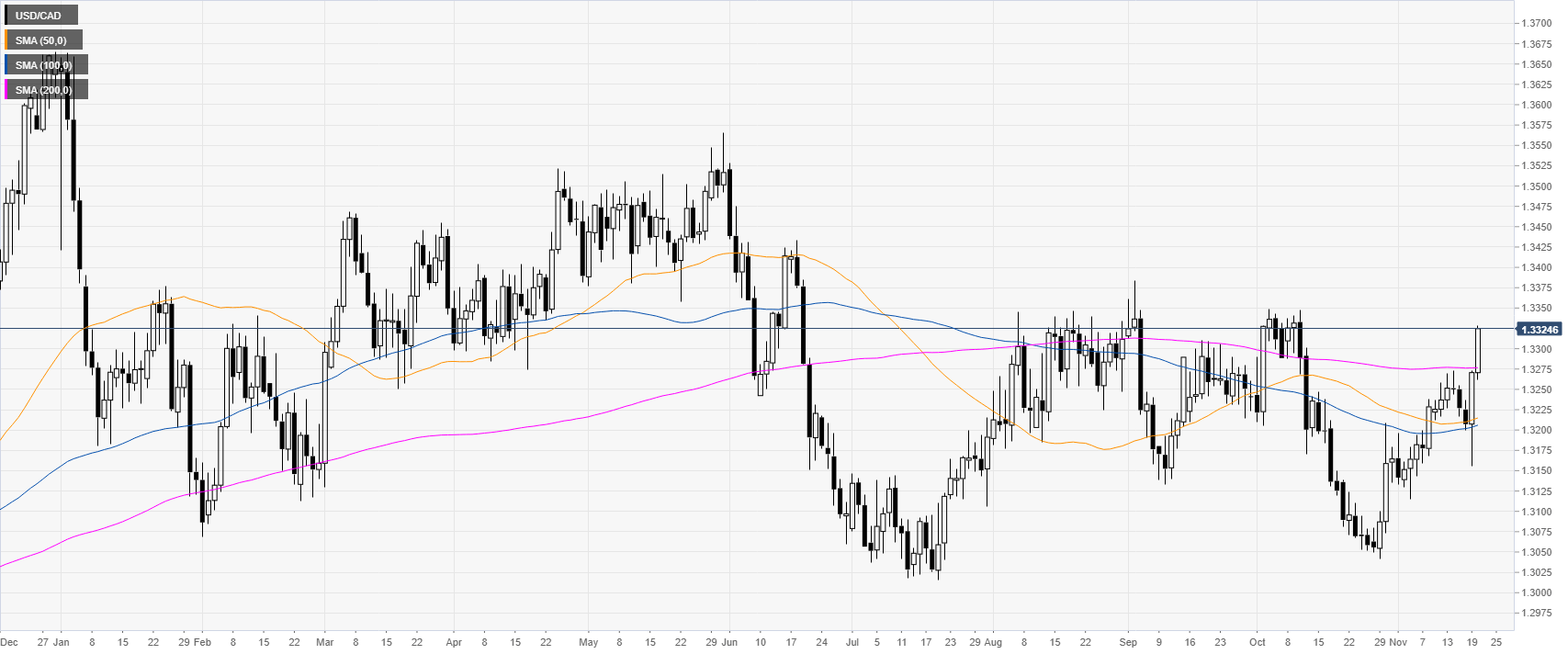

USD/CAD daily chart

The loonie on the daily chart is spiking up above the 1.3300 handle above the main daily simple moving averages (DMAs). The FOMC minutes will be released at 19:00 GMT this Wednesday.

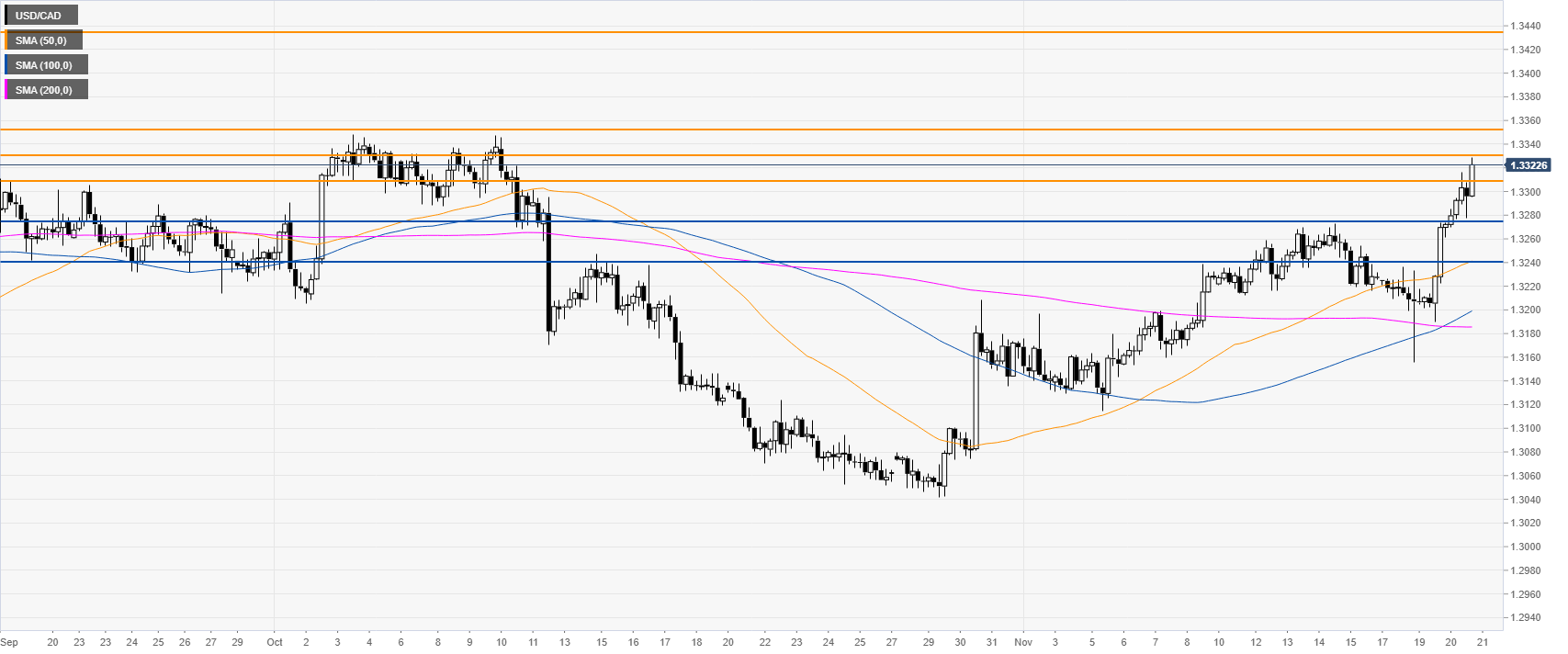

USD/CAD four-hour chart

USD/CAD is challenging the 1.3310/1.3331 resistance zone (near the October high) while trading above the main SMAs. A break above the October highs can lead to further strength towards the 1.3352 and 1.3435 levels, according to the Technical Confluences Indicator.

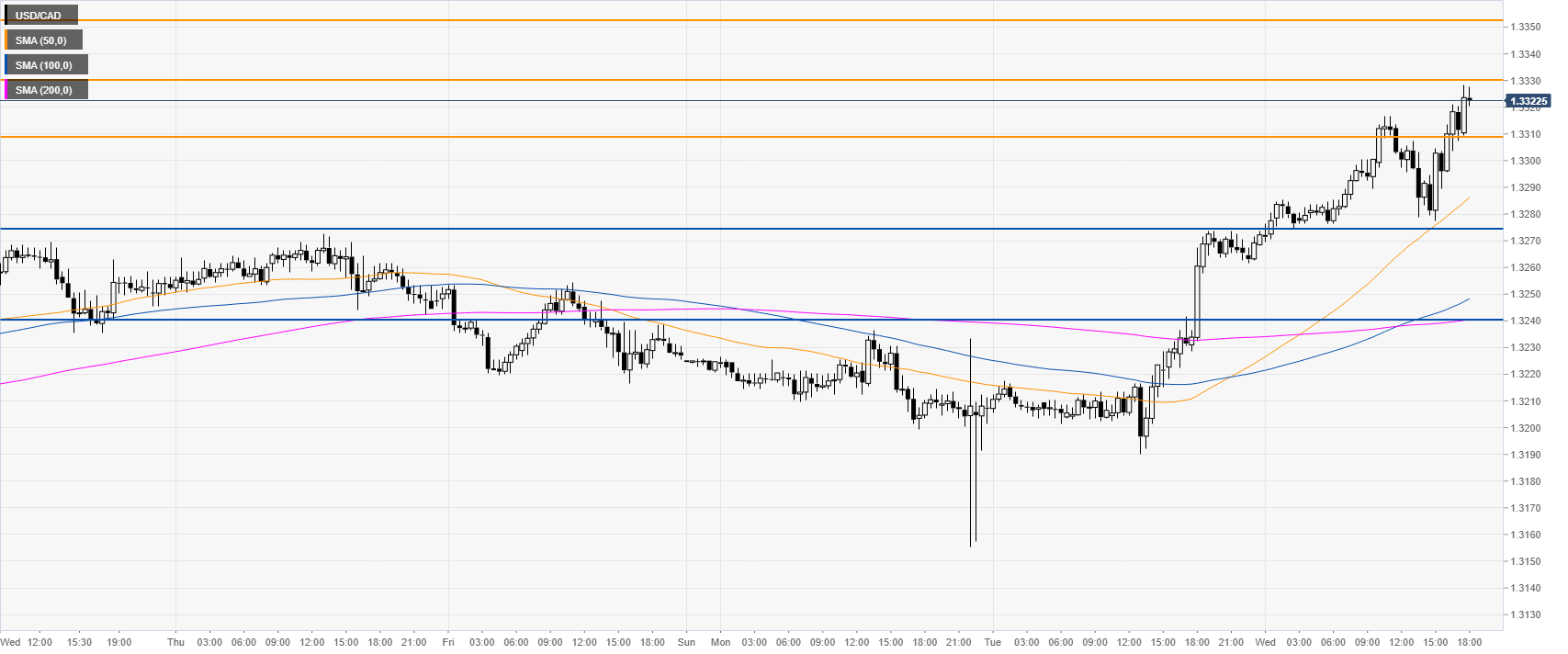

USD/CAD 30-minute chart

USD/CAD is trading above its main SMAs, suggesting a bullish momentum in the near term. Support is seen at the 1.3276 and 1.3240 price zone, according to the Technical Confluences Indicator.

Additional key levels