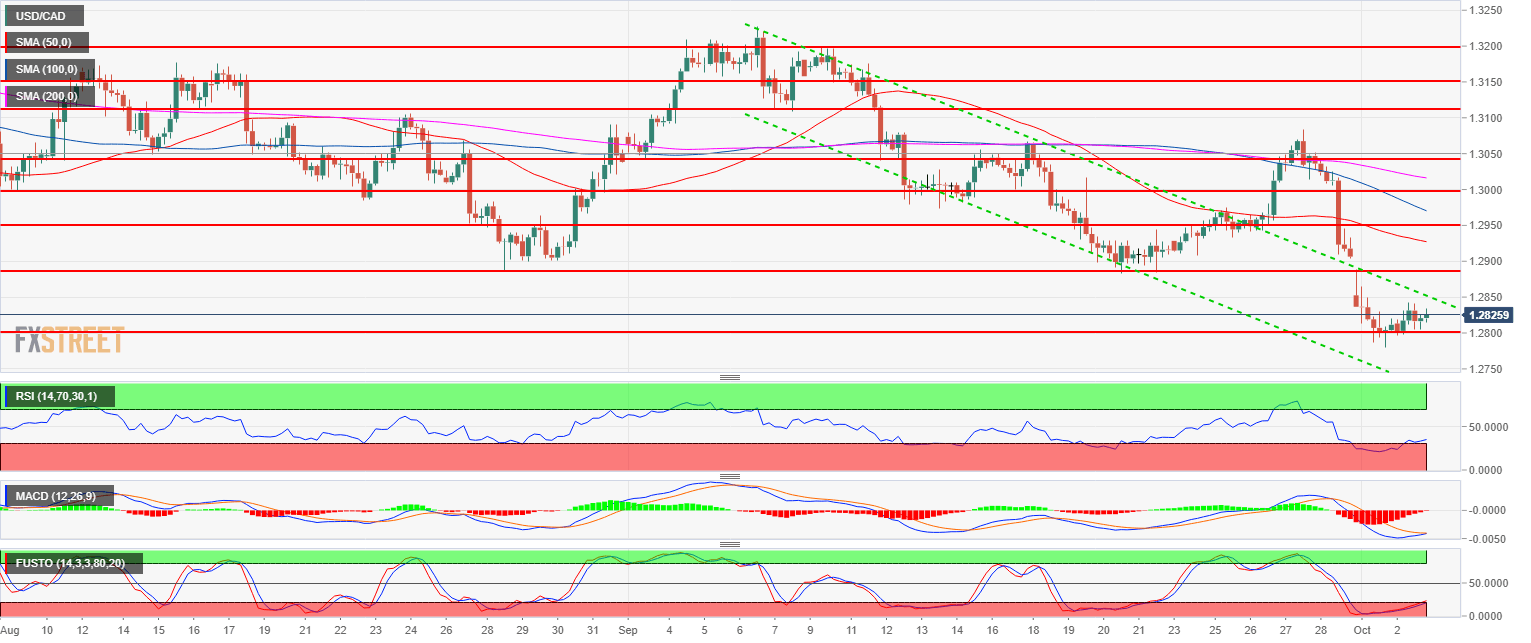

- USD/CAD main bull trend has switched to neutral as the market broke below the 200-day simple moving average (SMA).

- The 1.2800 figure has been holding since Monday while USD/CAD is trading far away from its simple moving averages, suggesting a potential return to the mean. The RSI and Stochastics indicators have left the oversold condition while the MACD is slowly turning bullish. All-in-all a potential rebound to 1.2882-1.2900 (September 20 low and figure) can be on the cards for bulls.

- A bear breakout below 1.2800 would invalidate the short-term bullish bias.

Spot rate: 1.2826

Relative change: -0.01%

High: 1.2843

Low: 1.2796

Main trend: Bullish to neutral

Resistance 1: 1.2855-65 June 6 low – 200-day SMA

Resistance 2: 1.2882 September 20 low

Resistance 3: 1.2959 August 7 low

Resistance 4: 1.3000 figure

Resistance 5: 1.3048 August 14 low

Resistance 6: 1.3108, September 7 low

Resistance 7: 13200 figure

Support 1: 1.2800 figure

Support 2: 1.2727 May 11 low

Support 3: 1.2600 figure