- USD/CAD’s sell-off from the 1.41 recovery highs has put crucial support back in view.

- The Commodity complex has been enjoying a respite but is now testing critical resistance in the indexes.

USD/CAD is currently trading on the bid, having travelled from a low of 1.3891 to a high of 1.3970 rising 0.41% to 1.3956 at the time of writing. The US dollar is broadly positive on the day following a resurgence overnight. DXY is 0.2% up so far and proving resilient in the 99 handle.

Commodity currencies are struggling to hold onto gains towards the end of the week as US-Sino tensions continue to heat up, sapping some appetite from risk assets. China has warned that US measures and sanctions would result in counter-measures. The Global Times wrote

China never starts trouble and never flinches when trouble comes its way. China will firmly defend its interests if the US does things that undermine China’s core interest: NPC spokesperson.

However, in the balance, we have firming demand which continues to buoy the commodity complex just as global economies reopen. Ahead of China’s National Party Congress, analysts at TD Securities explained that “expectations are rising that demand will increase further, should China announce further measures of economic support.”

Meanwhile, with CAD correlated to the global energy markets which continue to trade strong amid rebalancing, tumbling supply and reports that demand is recovering, some stability along these daily lows vs the greenback (1.3850) might be expected for some time still to come. Like with all commodity currencies at the moment, there has also been a strong correlation to equities throughout this crisis:

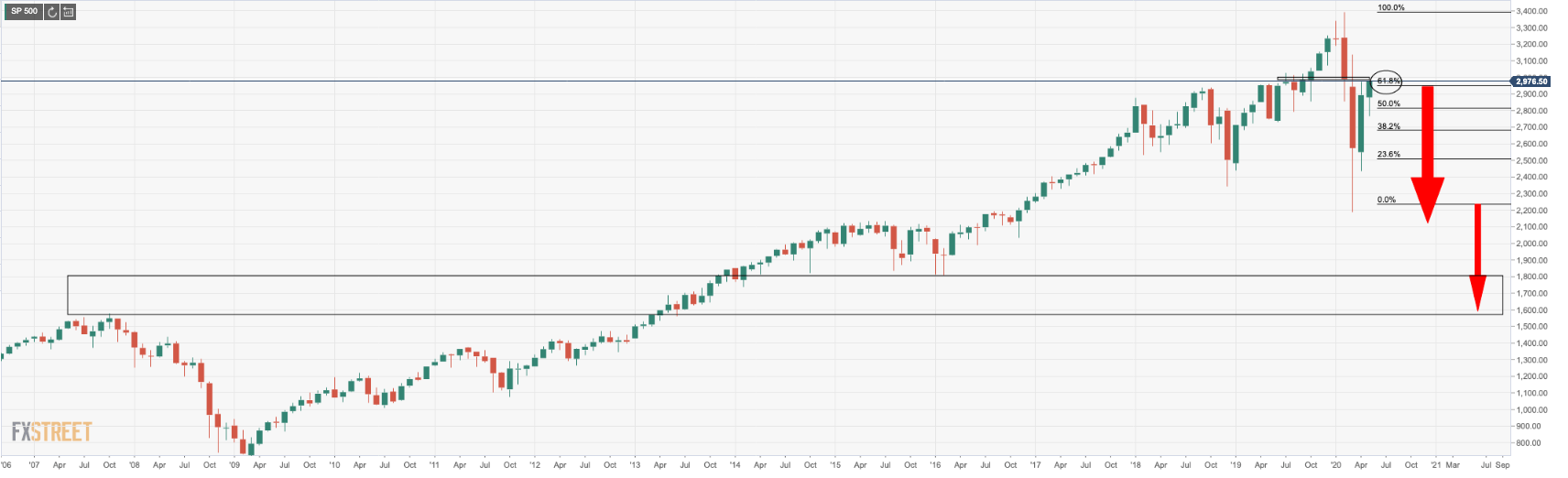

S&P 500 Index meets 61.8% Fibo (the Golden Ratio)

The S&P 500 has met a 61.8% Fibonacci retracement around the 2950s which is garnering a great deal of the market’s attention. There are little signs that the market is about to turn south however with positive volumes on the bullish and positive closes. However, it is either make or break time on both the equities and CRB index daily charts. Doubts about the sustainability of the recent rallies are emerging, particularly in commodities. Copper is higher for all of the wrong reasons and tightness in the copper market shows no sign of easing. Gold is underpinned by pure uncertainty, the compelling arguments which support the case for a global depression and a subsequent financial market’s crash (US dollar, yen and CHF supportive as well). Economists are predicting currency debasements which will be highly unfavourable to commodity-FX.

- Global COVID-19 update: Global cases surpass 5 million, financial markets taking it in their stride

“We rather think that a lot of good news is already in CAD’s price,” analysts at TD Securities argued. “Positioning is skewed short, but we think these are strategic in nature. Meanwhile, a broad USD pullback appears well advanced on our measure.”

USD/CAD levels

Noting the 1.3850/70 area, the analysts at TD Securities explained that this is the third time it has been tested as part of a broader descending triangle since the March highs. “Thus, a break below this support would be bearish the pair, particularly if confirmed with DMA crossovers that would expose 1.3766. Meanwhile, a move through 1.4050/80 daily downtrend resistance will open topside extension.”