- US inflation showed more easing in November.

- Powell emphasized the need for higher rates to tame inflation.

- Investors are expecting Canada’s inflation to fall to 6.6% in November.

The USD/CAD weekly forecast is bullish as investors are expecting further easing of Canada’s inflation rate. This would weaken the Canadian dollar.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Ups and downs of USD/CAD

The US issued inflation figures last week, and the Federal Reserve boosted interest rates, which caused significant volatility for USD/CAD.

The fact that the November increase in the US consumer price index was less than expected raised hopes that the Federal Reserve would slow the pace of rate hikes after its two-day meeting on Wednesday. However, these hopes were dashed by Powell’s remarks after the meeting.

The Fed’s policy-making body raised its benchmark overnight interest rate by 0.5 percentage points and forecasted that it would continue to rise until it reached above 5% in 2023. Powell told reporters there is still no reason to believe that the war has been won despite recent evidence of declining inflation.

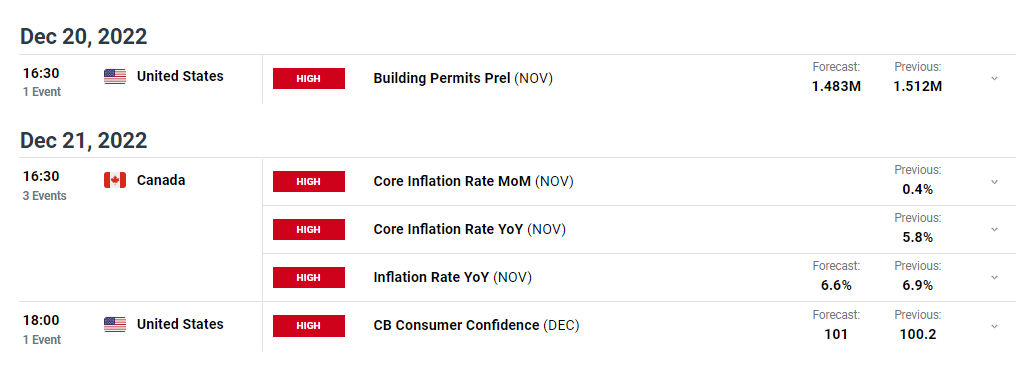

Next week’s key events for USD/CAD

Canada will be releasing important inflation data next week. Inflation eased to 6.9% in October after peaking at 8.1% in June but is likely to be more persistent than previously thought after spreading from goods prices to services and wages, where higher costs can become more entrenched.

For November, investors expect the inflation rate to drop to 6.6%. Anything higher or lower might cause some volatility for USD/CAD.

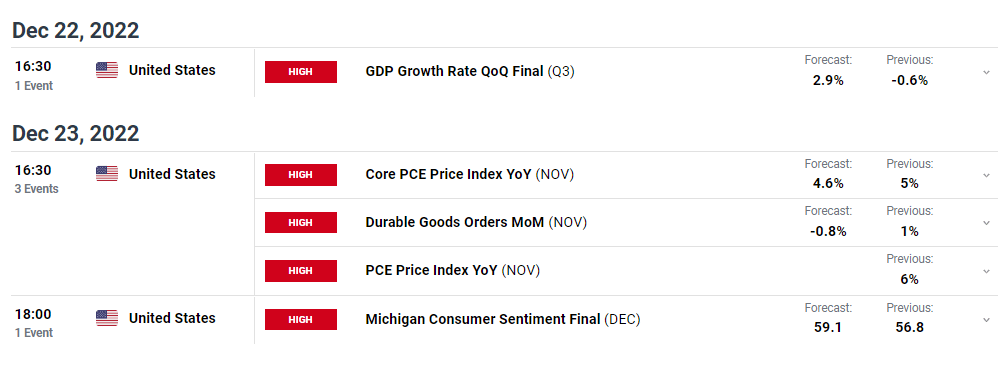

From the US, investors will pay attention to the CB consumer confidence figure, GDP data, and more inflation data, among others. All these will give insight into the state of the US economy.

USD/CAD weekly technical forecast: Next target at 1.3901

The daily chart above shows the price trading above the 22-SMA while the RSI is above 50. This shows the current trend is bullish. The price is pushing off the 1.3537 support level and might be headed for 1.3901 resistance in the coming week. The bulls might be able to break above this level if they gather enough momentum.

–Are you interested to learn more about forex options trading? Check our detailed guide-

However, if bulls fail to break above this resistance level, bears might return as the price will bounce lower. This could mean a break below the 22-SMA and a possible reversal in trend. The bullish trend will continue if the price trades above the 22-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.