- The Canadian dollar declined 1.4% for the week as oil plummeted.

- The annual inflation rate in Canada slowed in March to 4.3%.

- Data on corporate activity in the US revealed a robust economy.

The USD/CAD weekly forecast is bullish as investors price another Fed rate hike in May.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Ups and downs of USD/CAD

The Canadian dollar declined 1.4% for the week as oil, one of Canada’s main exports, plummeted. At the same time, investors increased their bets on the Federal Reserve, raising interest rates next month.

The Canadian currency dropped to a three-week low on Friday versus the US dollar. Poor Canadian retail sales data revealed that the economy suffers from rising borrowing rates.

The annual inflation rate in Canada slowed in March to 4.3%, although it is still more than the Bank of Canada’s goal rate of 2%.

Initial claims in the United States increased slightly to 245,000 in the most recent week. This pointed to a slowing labor market.

Weak data confirmed predictions that the greatest economy in the world is headed for recession.

However, data on corporate activity revealed a robust economy, which supported predictions that the Fed will raise interest rates at its policy meeting next month.

Still, the long-term outlook for the dollar remained bearish as investors prepared for the Fed’s tightening cycle to end.

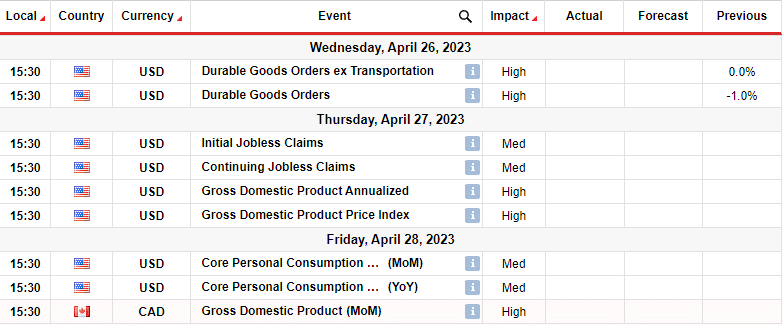

Next week’s key events for USD/CAD

Next week, investors will pay close attention to US and Canadian data. The GDP statistics and the core PCE index will receive more focus.

The GDP figures will reveal the state of both economies. The US core PCE, preferred by the Fed as a measure of inflation, could influence the next policy meeting outcome.

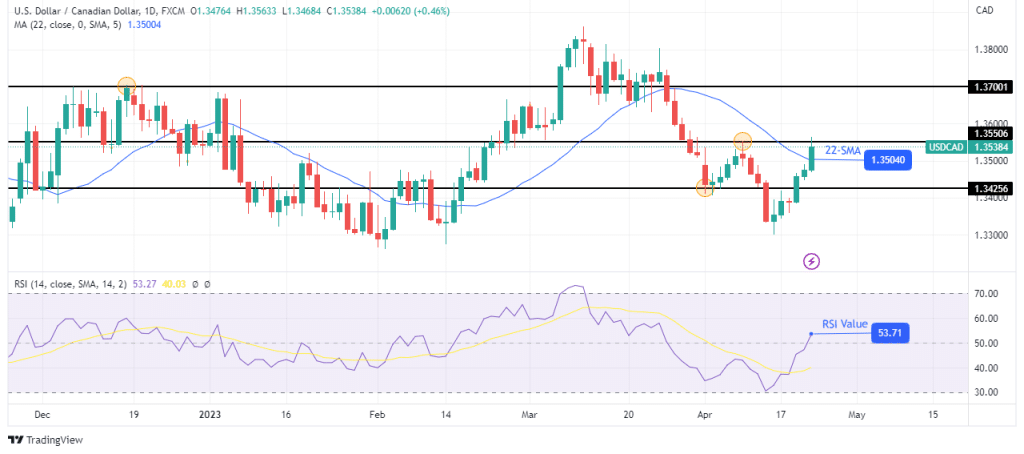

USD/CAD weekly technical outlook: Bulls attempt a reversal

There has been a shift in sentiment in the daily chart from bearish to bullish. The RSI has crossed above the 50 mark, while the price has broken above the 22-SMA resistance. However, the price must break above the 1.3550 resistance level to confirm a bullish takeover and start making higher highs and lows.

–Are you interested in learning more about forex robots? Check our detailed guide-

A break above 1.3550 would allow the price to climb to the next resistance at 1.3700. However, if bears are not ready to give up control, we might see the 1.3550 resistance holding firm. This would see the price bounce lower to retest the 1.3425 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money