- Canada’s politicians criticize the Bank of Canada for failing to control inflation.

- A lot of domestic data from the US could cause volatility for USD/CAD in the coming week.

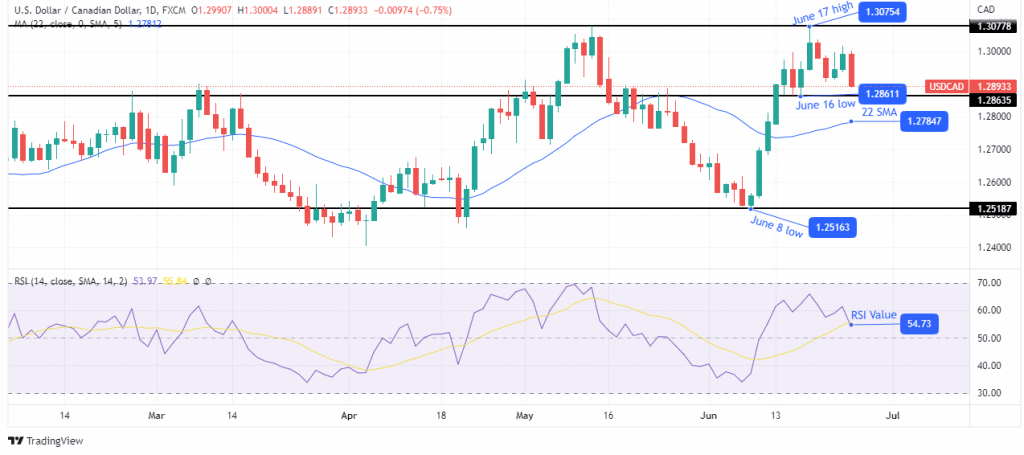

- Bears are pushing the price toward the 22-SMA on the charts.

The weekly forecast for the USD/CAD pair is bearish as the BoC attempts to curtail the hot inflation. The Bank of Canada will have to adopt a tighter monetary policy to rein in rising inflation, possibly pushing the USD/CAD lower.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Ups and downs of USD/CAD

The USD/CAD closed the week lower after the long-awaited inflation data came in higher than expected. As Canada’s economy overheats, the Bank of Canada has been criticized this past week for underestimating inflation. The bank has admitted missteps and has promised more transparency in the future.

“Is there always room for more transparency? Probably. That’s something we’re reflecting on right now,” Senior Deputy Governor Carolyn Rogers told Reuters in an interview this month. “It’s something we think about a lot.”

The last time the Bank of Canada faced as much political heat as it currently was in the early 1990s when opposition leader Jean Chretien criticized the high-interest rate policy.

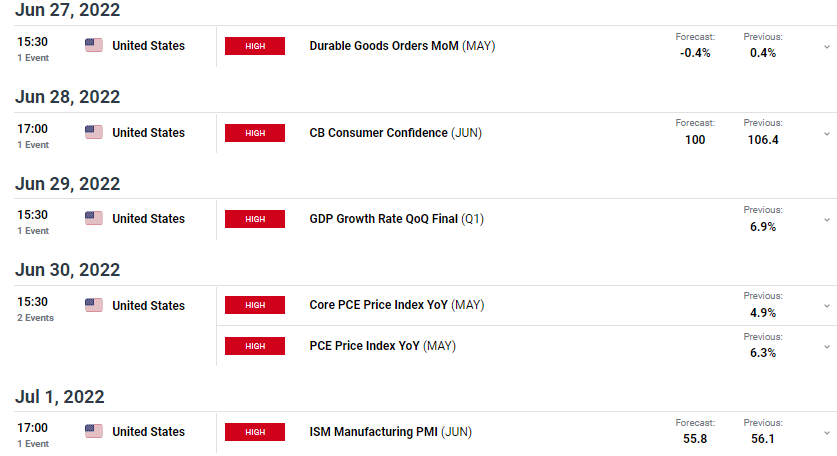

Next week’s key events for USD/CAD:

Investors will not be receiving any significant news releases from Canada. The US, on the other hand, will have several news releases. Durable goods orders in the US are expected to drop from 0.4% to -0.4% in May. CB consumer confidence is expected to drop in June. This data will show confidence in the economic activity, which also points to consumer spending habits. The manufacturing PMI is expected to show a drop in the activity level in the manufacturing sector.

USD/CAD weekly technical forecast: Short-term bears retesting the June 16 lows

Looking at the daily chart, we see the price pushing toward the June 16 low. The price is trading above the 22-SMA, showing bulls are in control. RSI is trading above 50, also favoring bullish momentum. The June 17 high at 1.30754 has acted as resistance before and has stopped the recent rally.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

If the June 16 low acts as support, we could see the bullish trend resuming. If this support fails, there is the 22-SMA, which could act as support. A break below the 22-SMA could see the price retesting the May 8 lows at 1.25163.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money