- USD/CAD bulls maintain the momentum beyond 1.2600.

- BOC has started tapering, but the economic outlook and estimates are downgraded.

- US economic outlook seems better performing.

- Crude oil prices can decline, giving more room to USD/CAD bulls.

The weekly outlook for the USD/CAD pair remains bullish as the price managed to break above the key level of 1.2600. The pair has seen the longest bullish trend in the past four months and is gaining for three straight weeks. The divergence between BOC and Fed is obvious, and it can support bulls around the USD/CAD.

-If you are interested in forex day trading then have a read of our guide to getting started-

Provided there is no major data release next week from the US or Canada, the USD/CAD pair is expected to maintain the uptrend. However, risk sentiment and oil prices will still act as catalysts for the pair.

The Bank of Canada kept the base rates unchanged at 0.25% this week. BOC decided to taper the bond-buying program from C$3 billion per week to C$2 billion per week. The economic growth estimates have been downgraded from 6.5% to 6% as inflation targets are still beyond reach at the moment. Slow economic recovery in Canada has eased inflationary pressure. As a result, the estimate for the GDP growth of 2022 was highly offset from 4.6% to 3.7%.

On the other hand, Fed Chair Powell faced several heated comments in Capitol Hill during his biennial testimony. The Core CPI for the US rose to a 30-year high in June. In addition, US retail sales in June came up with quite strong figures. Powell said that the Fed is actively considering economic progress and will act accordingly.

The crude oil prices are expected to ease off as UAE, and other OPEC+ members agree to enhance the production output as per their requirements. Moreover, the price has already peaked at several months top, and a corrective action looks due at the moment. This can provide further buying impulse to the USD/CAD.

-Are you looking for automated trading? Check our detailed guide-

What’s next for the USD/CAD?

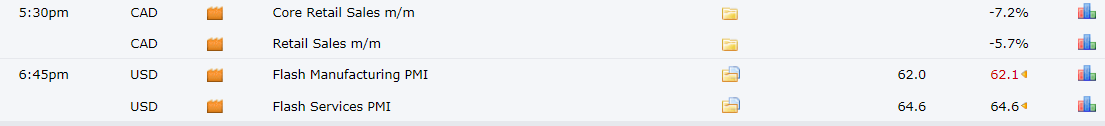

The next week comes up with mostly low-tiered USD data that has potentially no impact on the pair’s pricing. However, the Canadian retail sales and core retail sales data are due on Friday, leaving a mild impact on the pair.

USD/CAD Weekly Outlook:

The USD/CAD pair has maintained its momentum above the 20-day moving average since the first week of June. The price remains well supported by the 20-day and 50-day moving averages. However, the price found resistance at 200-day moving average on Thursday, and it could not break even on Friday. Therefore, the level can be considered a key point for the buyers to overcome. If the level is broken, bulls can head to May’s highs of 1.2734.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.