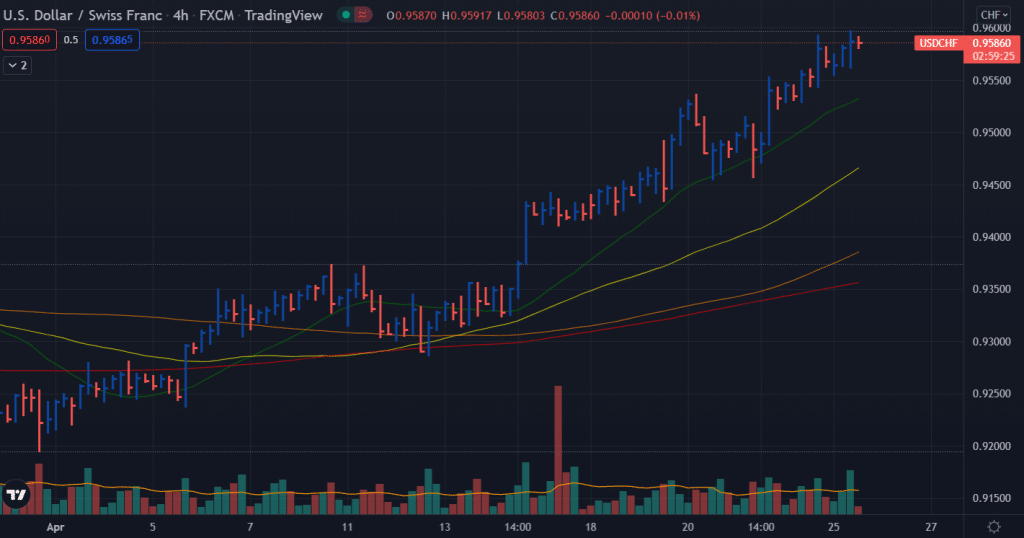

- On Monday, the USD/CHF pair hit its highest level since June 2020 due to continued buying of the US dollar.

- Dollars have been supported by bets on more aggressive Fed tightening.

- The Swiss franc acted as a safe haven and limited gains in an anti-risk environment.

The USD/CHF forecast is strongly positive as the US dollar gains amid the Fed’s aggressive rate hike plan and broader risk-off sentiment.

During the first half of the European session, the USD/CHF price maintained modest gains, trading near its highest level since June 2020, just below 0.9602.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

The pair continued its recent strong bullish trend, picking up some follow-on momentum for the third consecutive day on Monday. Dollar strength was a major driver of the USD/CHF tailwind, which was boosted by a higher US dollar. As a safe haven, the Swiss franc has been supported by the current risk-averse environment, which has held back any further gains.

As the Fed tightens monetary policy at an accelerated pace to combat stubbornly high inflation, the US dollar receives support. Federal Reserve Chair Jerome Powell confirmed Thursday that a 50-basis point rate hike will be discussed at the upcoming FOMC meeting in May. Powell also suggested that the Fed may hike rates several times this year. During the following four sessions, markets recognized the massive rate hikes and continued to support the dollar.

Global growth fears are fueled by the prospect of more aggressive rate hikes by the Fed and ongoing COVID-19 lockdowns in China. This has reduced the investors’ appetite for riskier assets, resulting in a generally weaker mood in stock markets. In addition, the anti-risk flow has supported traditional safe-haven assets such as the Swiss franc, which will discourage aggressive betting and limit the USD/CHF pair is slightly overbought conditions.

Fundamentals, however, suggest that any pullback can be viewed as an opportunity for further short-term gains. The price action of the US Dollar will continue to play a significant role in influencing the USD/CHF pair in the absence of significant economic news. Traders will continue to watch for broader market risk sentiment for short-term opportunities.

USD/CHF price technical forecast: Bulls ready for more gains

The USD/CHF price is just shy of the 0.9600 key resistance level. The pair seems strongly bullish and gives no clue of reversal here. Moreover, the volume data also supports further upside. Hence, the pair will likely break the 0.9600 level and test the 0.9650 ahead of 0.9700.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

On the flip side, any strong selling around current levels may push the price towards the 0.9500 handle ahead of 0.9450. However, the probability of such a scenario is very thin.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money