- The chairman of SNB hinted the central bank would be raising rates again.

- The SNB is working on taming inflation at 3.0% in October.

- Investors are awaiting the outcomes of the US midterm elections.

Today’s USD/CHF forecast is bearish. Thomas Jordan, the chairman of the Swiss National Bank, indicated on Tuesday that the central bank would be raising interest rates again, saying “determined action” is needed to rein in inflation. This gave strength to the Swiss franc.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

Jordan said there were justifications for a wait-and-see strategy and more active initiatives to combat inflation in Switzerland. According to data released last week, inflation was at 3.0% in October. Despite being low relative to other nations, the figure represents the ninth month that inflation has exceeded the SNB’s 0-2% target. It is close to reaching its highest level in almost three decades.

“In an environment such as the one we face today, mixed signals on the persistence of inflation might tempt policymakers to postpone further reaction to inflationary pressures until the uncertainty about future inflation has receded,” Jordan said in a speech at the start of a meeting of central bankers in Zurich.

“Yet uncertainty must not mean indecision. A risk management approach to policy-making sometimes calls for decisive action,” he added.

The SNB has increased interest rates twice this year, bringing its policy rate to 0.5%. Economists anticipate the SNB will hike interest rates again at its next monetary policy meeting in December.

USD/CHF key events today

There won’t be any significant news releases from the US or Switzerland today so the pair might consolidate.

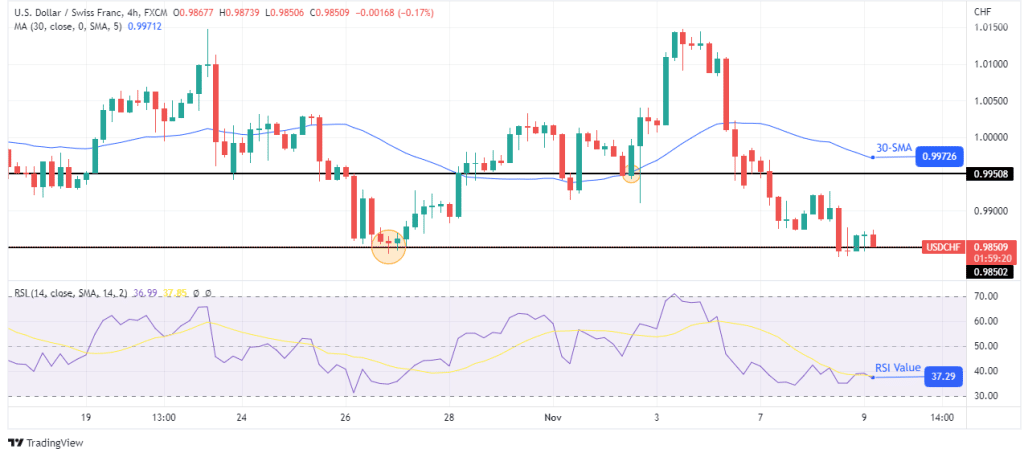

USD/CHF technical forecast: Strong bearish momentum

Looking at the 4-hour chart, we see the price trading well below the 30-SMA and the RSI below 50, showing bears are in control. The price has made a steep bearish move since it broke below the SMA and has paused at the 0.9850 key support level. This level stopped bears back on October 27.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

At this point, bulls might return to retrace the recent move. If this happens, the price will likely push up to retest the 0.9950 resistance. However, if bears can gather enough momentum, they might be able to break below the 0.9850 support level and seek new lows. The bearish bias will remain if the price stays below the 30-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.