- Inflation is on the rise in Switzerland as well.

- USD/CHF bears are pushing the pair to 0.9600.

- SNB is expected to raise rates gradually.

The USD/CHF outlook is bearish as the price closed Tuesday on a bearish candle. The same way it did on Monday. Since last week, the pair has been going down a lot, and this could continue because the dollar is getting weaker and inflation in Switzerland is going up.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

In April, Swiss consumer prices rose by 2.5% annually, the highest since 2008. The Swiss National Bank has quite a negative benchmark interest rate. The rise in inflation gives the bank a chance to raise interest rates, strengthening the Swiss franc against the dollar and pushing USD/CHF lower.

The financial crisis in 2008 saw investors turning to Swiss francs for safety, and since then, the central bank has intervened in the currency markets to prevent its appreciation.

Recent demand for the US dollar and rising Treasury yields in the US have weakened the Swiss franc against the dollar through April and early May, but this trend seems to have stopped. Switzerland has a strong trade balance of 12% of GDP, the largest since 1950.

The SNB will avoid increasing pressure on the currency by raising interest rates. Last week, the bank’s chair, Thomas Jordan, said that SNB’s monetary policy depends on negative rates and limiting the franc’s strength.” We are not a hostage to other central bank monetary policies.” We have an independent policy with a focus on price stability.

Once the SNB begins to raise rates, it is expected to gradually increase. The hiking process is expected to begin as soon as September 2022.

USD/CHF key events today

A few things might make USD/CHF move later in the day. Most of which come from the US. Investors are expecting to see reduced manufacturing activity. The Core Durable Goods Orders are expected to be reduced from 1.2% to 0.6%. Crude oil inventories are expected to fall by -0.737M from -3.394M. Lastly, the FOMC Meeting Minutes might also move the pair a lot.

USD/CHF technical outlook: Bears ready to break below 0.9600

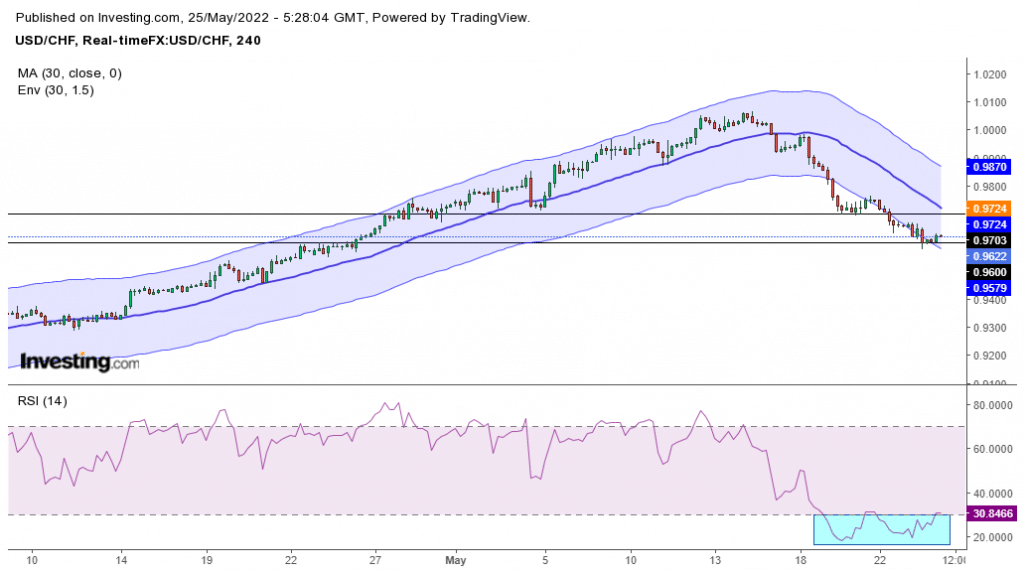

The 4-hour chart shows USD/CHF currently trading at 0.9600 after a sharp reversal and break of the 30-SMA to the downside. The price has broken out of its envelope and is in the oversold region, showing a lot of momentum.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

We could see prices falling below the 0.9600 level with downward momentum. A pullback to 0.9700 is also possible before we see lower prices. Bulls will only return to this market when we see a clean break of the 30-SMA to the upside, and the RSI gets overbought. Until then, the bias remains bearish.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money