- US retail sales jumped in August, showing increased consumer spending.

- Initial jobless claims in the US hit the lowest level over three months.

- Inflation in the US is expected to ease as commodities become cheaper.

Today’s USD/CHF outlook is bullish as the dollar soars on upbeat data. US retail sales unexpectedly increased in August as people bought more cars and dined out more with lower gas costs. Still, demand is dwindling due to the Federal Reserve’s relentless interest rate hikes to combat inflation.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

However, continued resilience in the labor market is anticipated to boost consumer spending. According to additional data released on Thursday, the number of people filing new unemployment benefit claims fell to its lowest last week in more than three months.

This data was one of the last reports to be public before the Fed’s policy meeting on Wednesday. The findings, along with an unexpected jump in consumer prices in August, will likely provide the US central bank the leeway it needs to implement a third straight 75-basis-point rate hike.

This positive data has seen USD/CHF surging as the dollar strengthens. This uptrend will probably continue as markets await the big rate hike from the FED.

Although inflation is still a problem in the US, it is not expected to become entrenched. Data released Thursday by the Labor Department showed that import prices fell in August for a second consecutive month due to reduced commodity prices and a strong dollar.

USD/CHF key events today

No significant news releases from the United States or Switzerland could mean a quiet trading day.

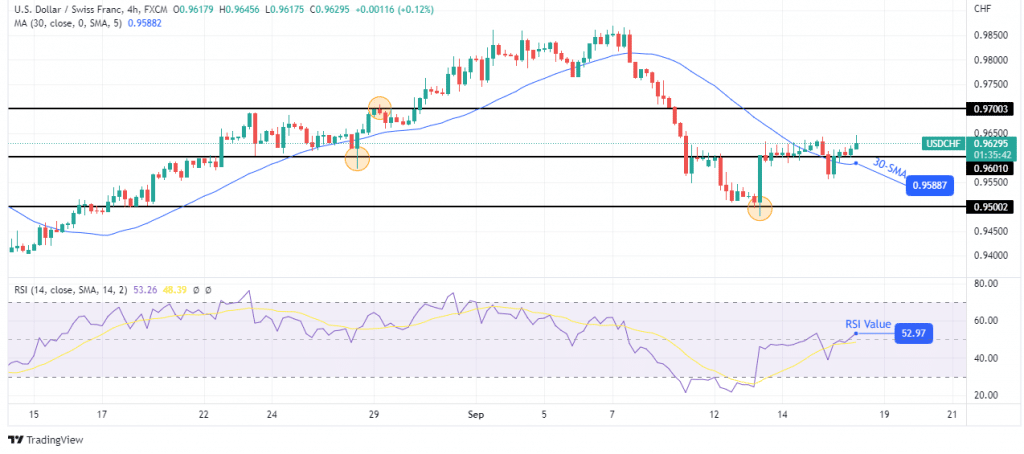

USD/CHF technical outlook: Bulls return above the 30-SMA

Looking at the 4-hour chart, we see the price trading above the 30-SMA after it broke above the 0.9601 resistance level. Bulls are taking control, and the RSI trading above 50 also supports bullish momentum. Buyers showed strength when they pushed the price from the 0.9500 support level to 0.9601.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

The price has now broken above the 30-SMA and the only thing left is for bulls to make higher highs and higher lows. If bulls maintain their strength, the price will retest resistance at 0.9700. This uptrend will continue if the price stays above 30-SMA and the RSI above 50.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.