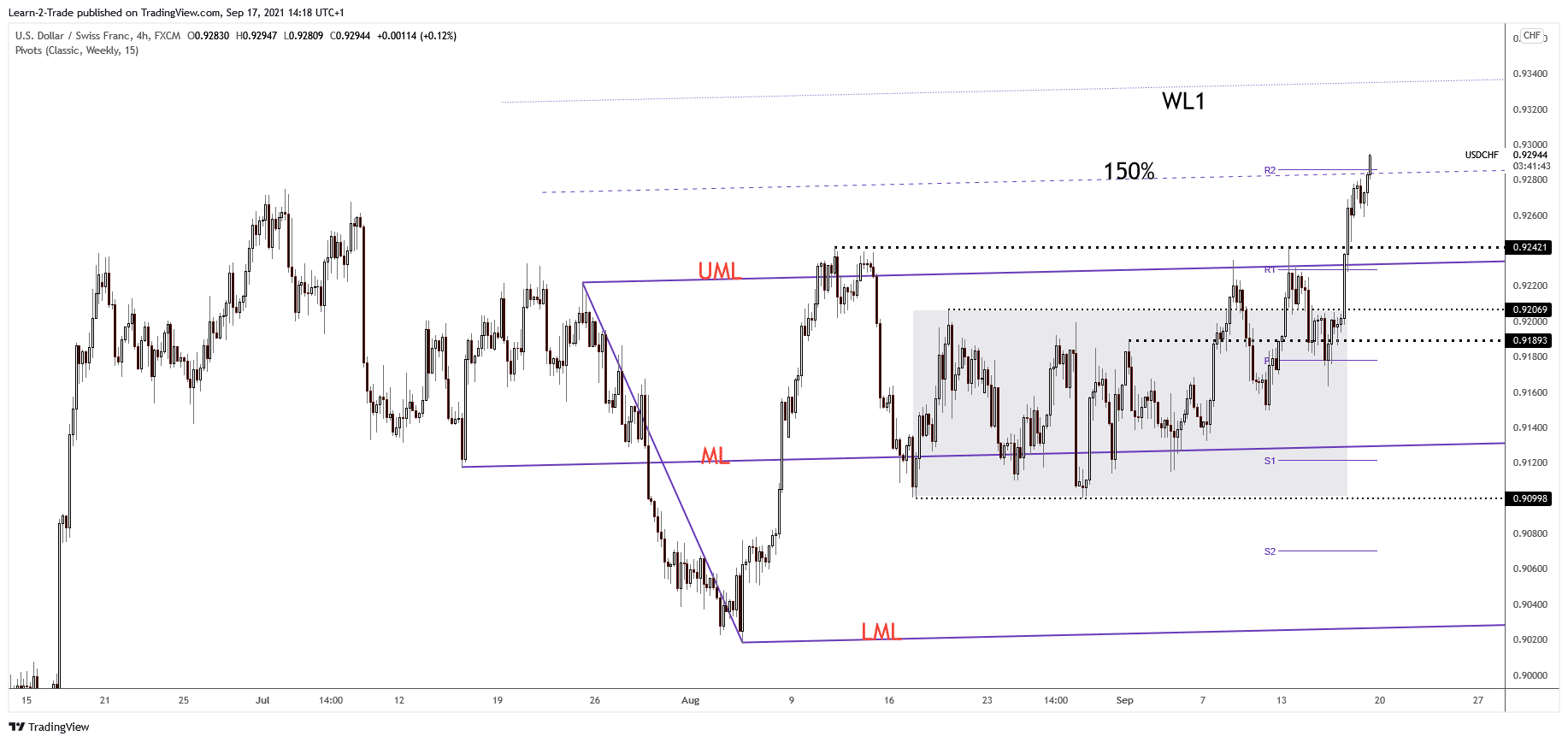

- The USD/CHF could approach and reach fresh new highs if the Dollar Index resumes its growth.

- Making a valid breakout through the 0.93 psychological level signals a potential growth towards the WL1.

- Better than expected US data could boost the USD/CHF pair.

The USD/CHF price rose as high as 0.9294 level today, and it may attempt to acquire the 0.93 psychological level. Technically, the price is strongly bullish as the Dollar Index is bullish.

-Are you looking for the best CFD broker? Check our detailed guide-

DXY’s further growth may force the pair to approach fresh highs. We have a strong correlation between the US Dollar Index and the USD/CHF.

In the early morning, the price fell a little because the Dollar Index retreated after reaching dynamic resistance. Still, the bias is bullish after better than expected US retail sales data. Furthermore, the USD could accelerate its rally if the Prelim UoM Consumer Sentiment comes in better than expected today. Also, the Prelim UoM Inflation Expectations indicator will be released as well.

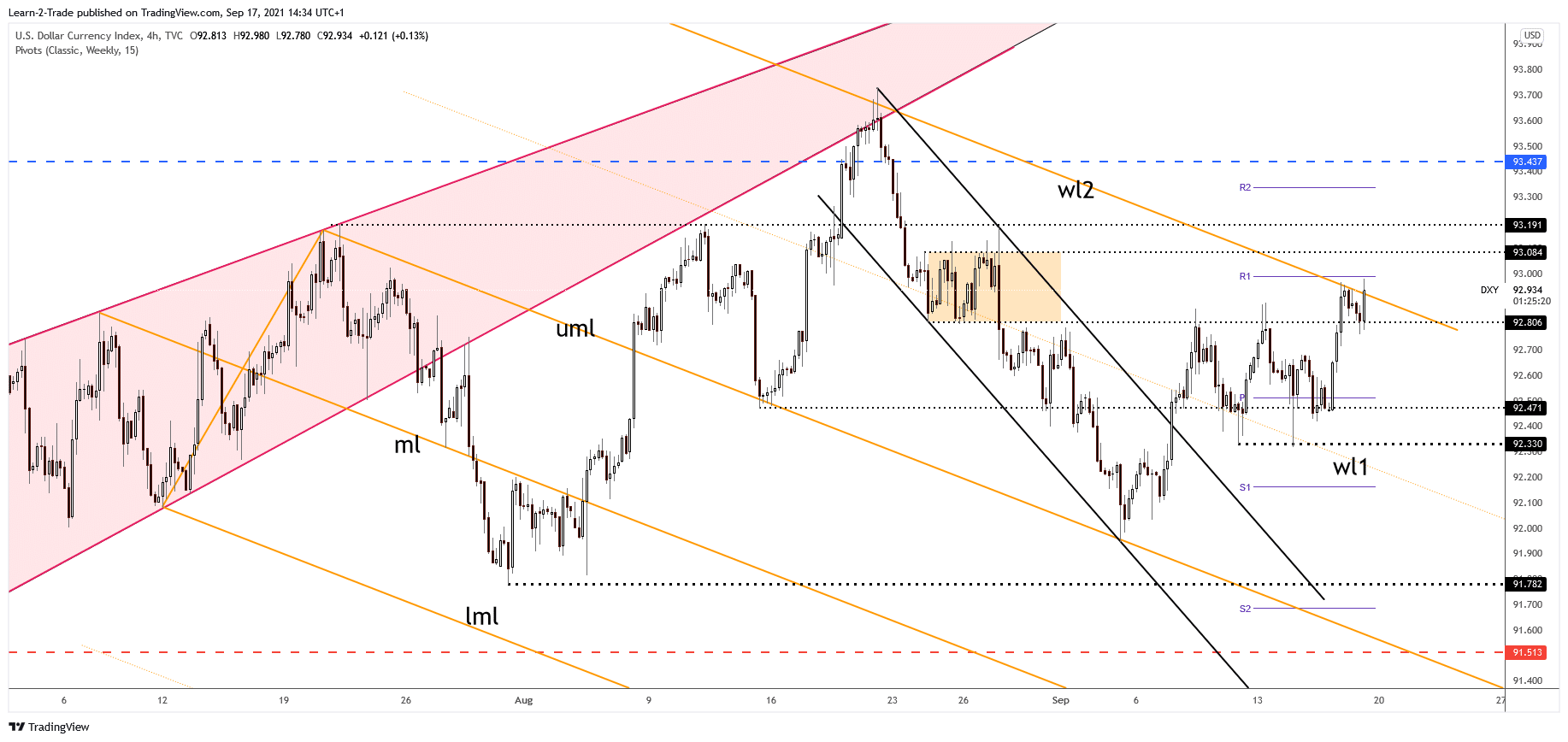

Dollar Index price technical analysis: Bulls gaining ahead

The Dollar Index is trading in the green at 92.94 level, and it’s pressuring the second warning line (wl2), which represents strong dynamic resistance. Making a valid breakout through it could activate further growth.

This scenario indicates that the USD should appreciate versus its rivals. Only a false breakout through the second warning line (wl2) followed by a new lower low 92.76 may invalidate an upside continuation.

USD/CHF price technical analysis: Bullish trend intact

The USD/CHF price rallies at the moment of writing, located above the 150% Fibonacci line of the ascending pitchfork and above the weekly R2 (0.9286) level. In my previous analyses, explained that the price should extend its growth if it makes a valid breakout through these upside obstacles.

-Are you looking for forex robots? Check our detailed guide-

In the short term, we cannot exclude a temporary decline. The price may come back down to test the broken levels before jumping higher. The 0.9300 psychological level is seen as an immediate resistance, upside target. Closing above it may signal further rise towards the first warning line (WL1). Only invalidating the breakout through the 150% line could indicate that the upside movement is over.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.