- A new higher high activates further growth.

- The SNB Press Conference could really shake the markets.

- The bias remains bullish as long as the DXY resumes its growth.

The USD/CHF price continues to move sideways in the short term as the traders wait for the SNB. Today, the fundamentals could drive the price.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

As you already know, the Swiss National Bank is expected to increase the SNB Policy Rate from -0.25% to 0.50%. The SNB Monetary Policy Assessment and the SNB Press Conference could really shake the markets. Personally, I’m expecting sharp movements. That’s why it’s risky to trade the USD/CHF pair.

The price remained undecided after the FOMC. As expected, the FED increased the Federal Funds Rate from 2.50% to 3.25%. The Federal Reserve will continue hiking rates in the next monetary policy meetings. That’s why the USD remains bullish.

Later today, the US is to release the Unemployment Claims, expected at 220K in the last week versus 213K in the previous reporting period. The current account could be reported at -261B, while the CB Leading Index may report a 0.1% drop.

Tomorrow, the US Flash Services PMI, Flash Manufacturing PMI, and the FED Chair Powell Speaks could also bring action.

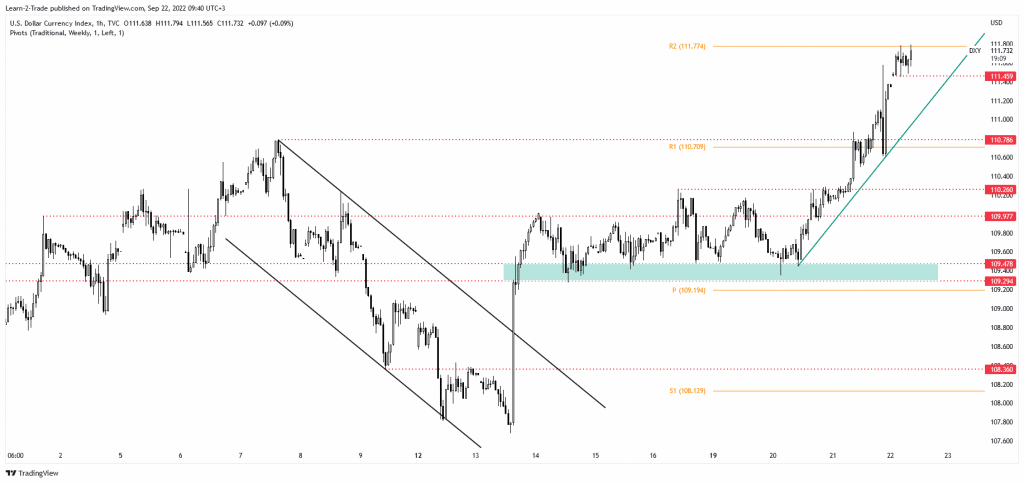

Dollar Index price technical analysis: Strongly bullish

The Dollar Index extended its growth after failing to stay below the R1 (110.70) and under the 110.78 key level. Now, it has found temporary resistance at the R2 (111.77). In the short term, the bias remains bullish as long as it stays above the 111.45 level. Taking out the R2 may signal upside continuation.

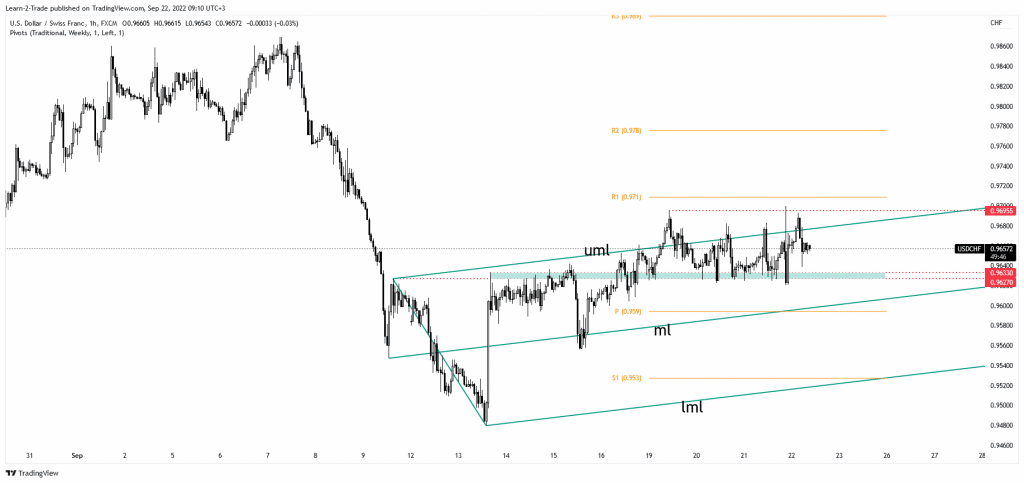

USD/CHF price technical analysis: Ranging in a channel

The USD/CHF pair is trapped between 0.9627 and 0.9695 levels in the short term. It has failed to stay above the upper median line (UML) of the ascending pitchfork, but an upside continuation is still possible.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

A new higher high, registering a valid breakout above 0.9695, could activate further growth. As you can see on the hourly chart, the rate registered sharp movements after the FOMC. I’m also expecting sharp movements in either direction after the SNB.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.