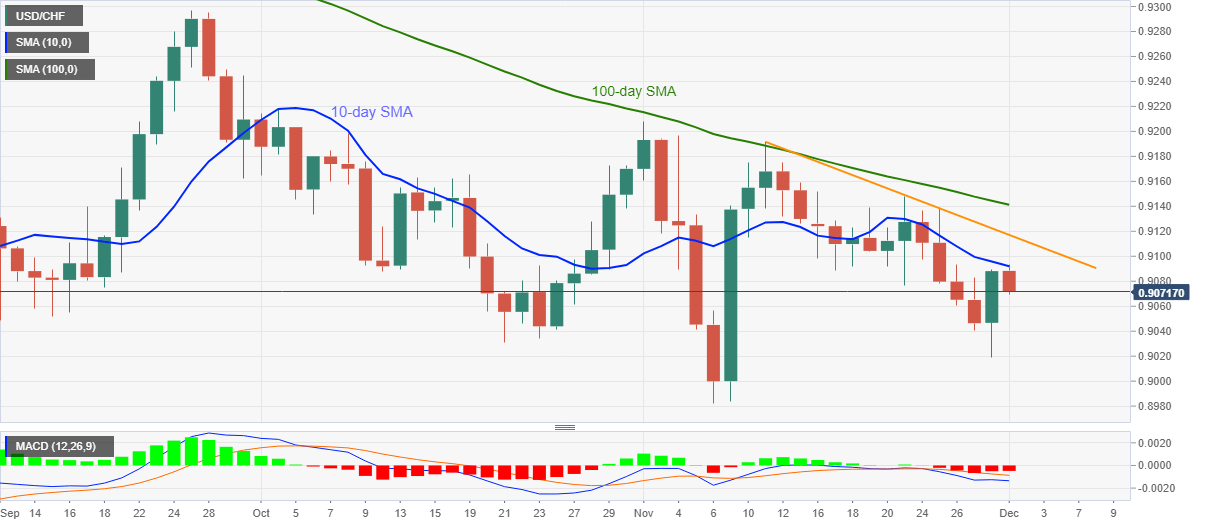

- USD/CHF stays below 10-day SMA for 11 days in a row, trims Monday’s gains.

- Bearish MACD, key upside hurdle challenge the bulls.

- Swiss Q3 GDP is expected to reverse -7.3% previous with +5.9% QoQ growth.

USD/CHF stays depressed near 0.9070, down 0.20% intraday, while heading into Tuesday’s European session. In doing so, the pair marked reversal from the 10-day SMA ahead of the key Q3 GDP data from Switzerland, up for publishing at .6:45 GMT.

Considering the pair’s inability to cross 10-day SMA, currently around 0.9090, coupled with upbeat expectations from the Swiss GDP, the USD/CHF prices are likely to remain pressured.

During the downward trajectory, 0.9040 and Monday’s low near 0.9020 can offer intermediate halts before directing the USD/CHF bears to November’s bottom surrounding 0.8980.

Alternatively, a falling trend line from November 11, at 0.9117 now, will precede the 100-day SMA level of 0.9141, to add a few more hurdles to the north.

It should, however, be noted that the USD/CHF buyers’ ability to cross 0.9141 enables them to challenge the previous month’s peak close to 0.9210.

USD/CHF daily chart

Trend: Bearish