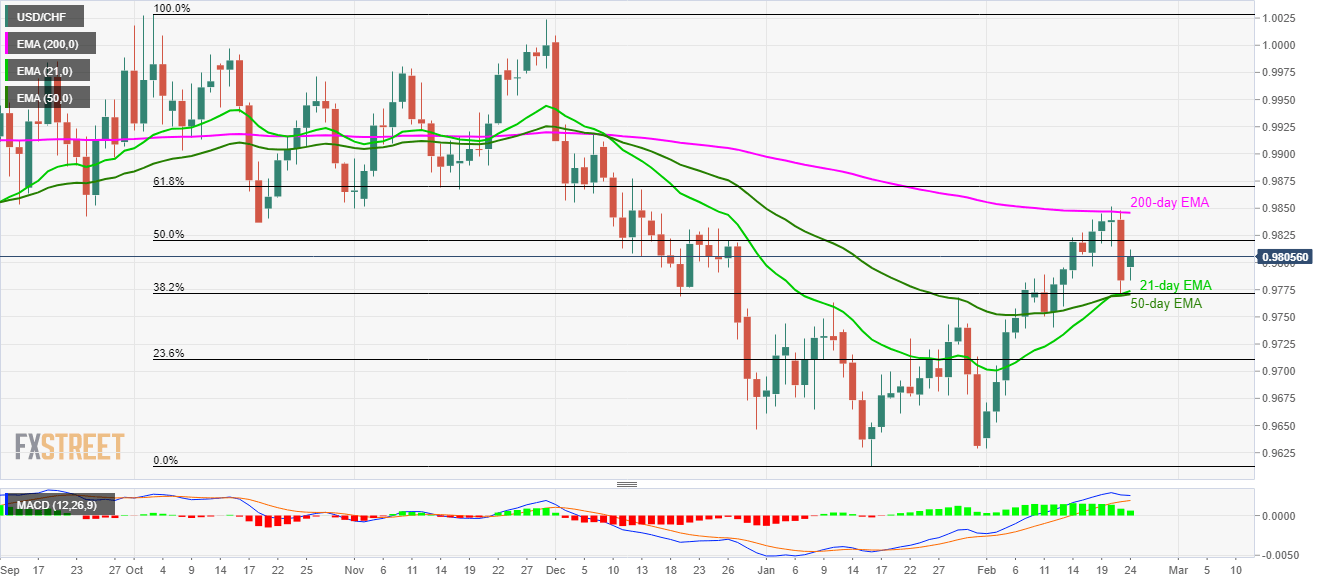

- USD/CHF bounces off the short-term key support confluence comprising 21 and 50-day EMA as well as 38.2% Fibonacci retracement.

- 200-day EMA, 61.8% Fibonacci challenge buyers amid bullish MACD.

USD/CHF registers 0.21% gains while taking the bids around 0.9805 during the early Monday. The pair recently reversed from 21/50-day EMA and 38.2% Fibonacci retracement of October 2019 to January 2020 declines. Also supporting the pullback are bullish signals from MACD.

That said, the pair now aims to confront 50% Fibonacci retracement level of 0.9820 whereas a 200-day EMA level of 0.9845 becomes the tough nut to crack for buyers afterward.

Should there be a sustained run-up beyond 0.9845, 61.8% Fibonacci retracement level of 0.9870 and 0.9900 will be on the bulls’ radars.

Alternatively, the pair’s daily closing below 0.9770/75 support confluence can divert sellers towards 0.9750/45 ahead of highlighting a 23.6% Fibonacci retracement level of 0.9710.

USD/CHF daily chart

Trend: Pullback expected