- USD/CHF struggles to extend recent recoveries from 0.9392.

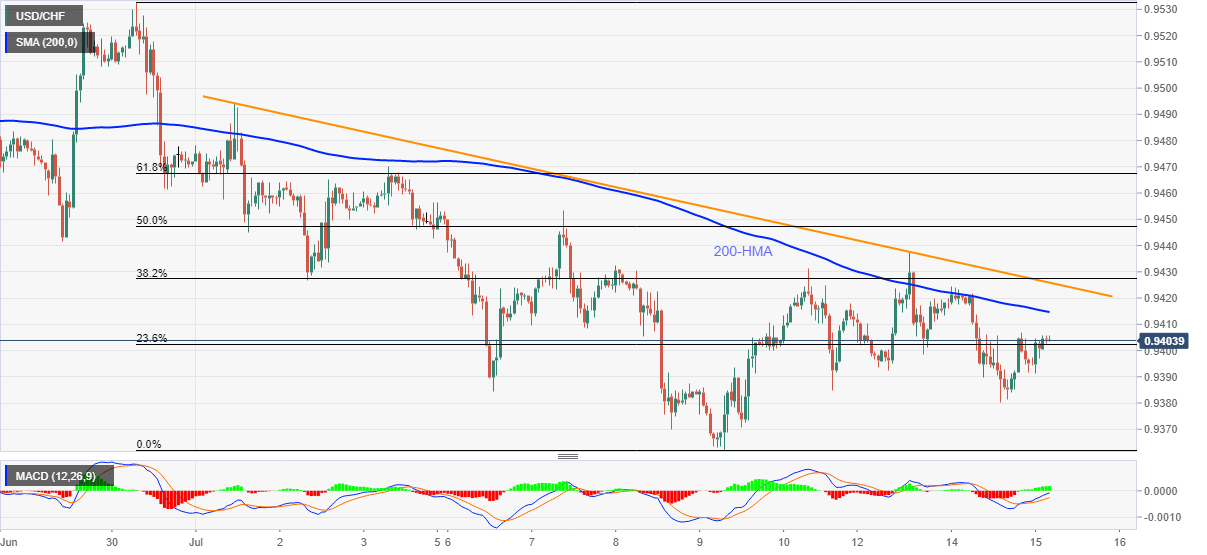

- 200-HMA restricts the pair’s moves since last two weeks, short-term falling trend line adds to the upside barriers.

- Multiple supports below 0.9400 question bears amid bullish MACD.

USD/CHF seesaws in a choppy range between 0.9400 and 0.9405, currently at 0.9403, during the pre-European session on Wednesday. The pair paused the previous three-day rise on Tuesday but turned down the bears afterward. Even so, key short-term resistances stand tall to challenge pullback moves.

Considering the bullish MACD signal, the pair may portray another attempt to cross the 200-HMA level of 0.9415. Though its failure to bounce back from the same, as it has been so far during July, could push the buyers towards confronting a descending trend line from July 01, presently around 0.9425.

If at all the USD/CHF prices manage to cross 0.9425 resistance line, 0.9450 might offer an intermediate halt during the rise to refresh the monthly top of 0.9494 with 0.9500 threshold.

Should the pair stays below 200-HMA, 0.9385 and 0.9370 will become immediate support ahead of the Thursday low of 0.9362. It should also be noted that 0.9322/18 area comprising multiple lows marked during the early March can act as additional support for the pair below 0.9400 and before 0.9300 round-figure.

USD/CHF hourly chart

Trend: Bearish