- USD/CHF remains in the hands of the bears as it tests below 15-min wedge support.

- Bears look for a re-run of the day’s lows on a break of recently made 15 min support structure.

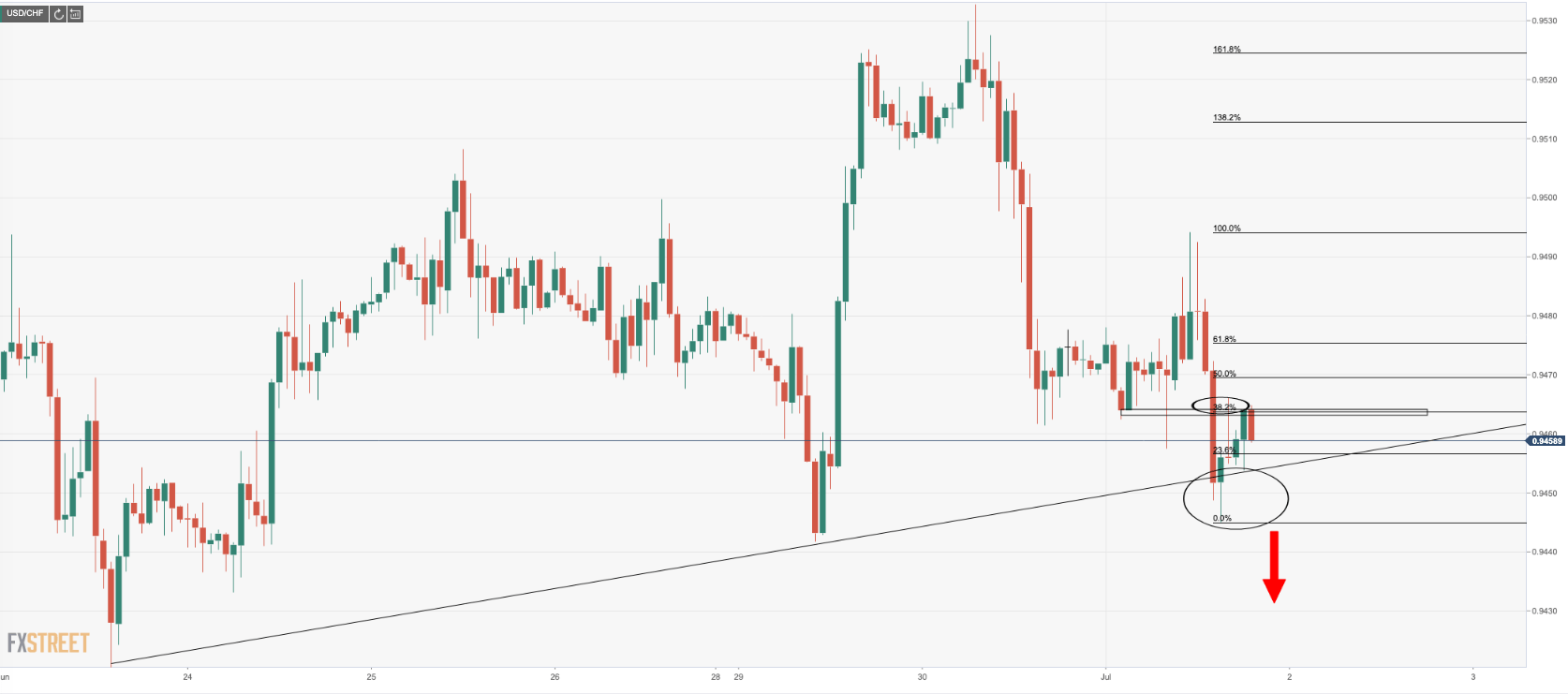

The price of USD/CHF has been in a choppy phase since the drop from the 0.9530s.

Initially, the price fell to the 0.9460s and only gave a sell scenario once pulling back to the 0.9490s after a drawn-out sideways period.

The price eventually sold off to break below the impulse support at the 0.9460s and made a low of 0.9449.

However, while the hourly trend line support was broken, bulls stepped back in and took the price back above it for a 38.2% Fibonacci retracement.

Hourly chart

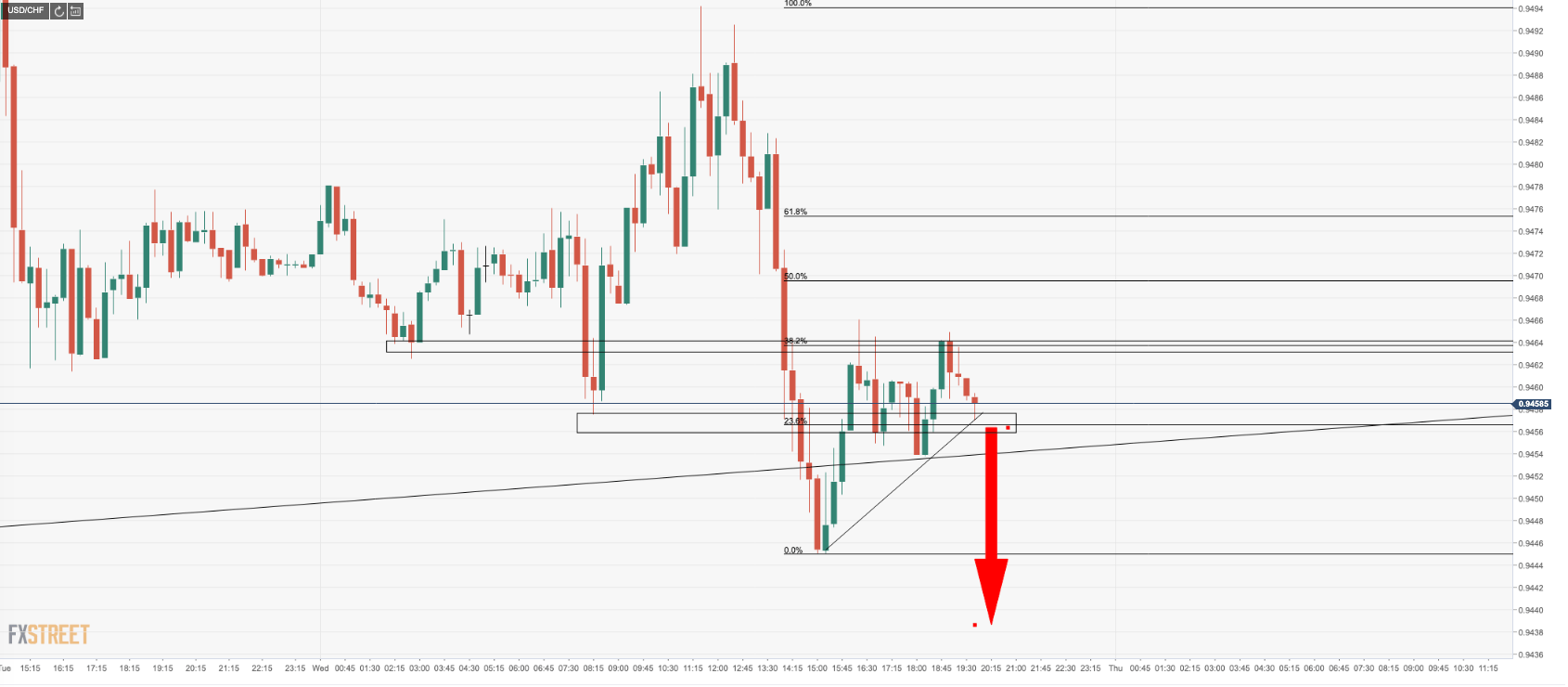

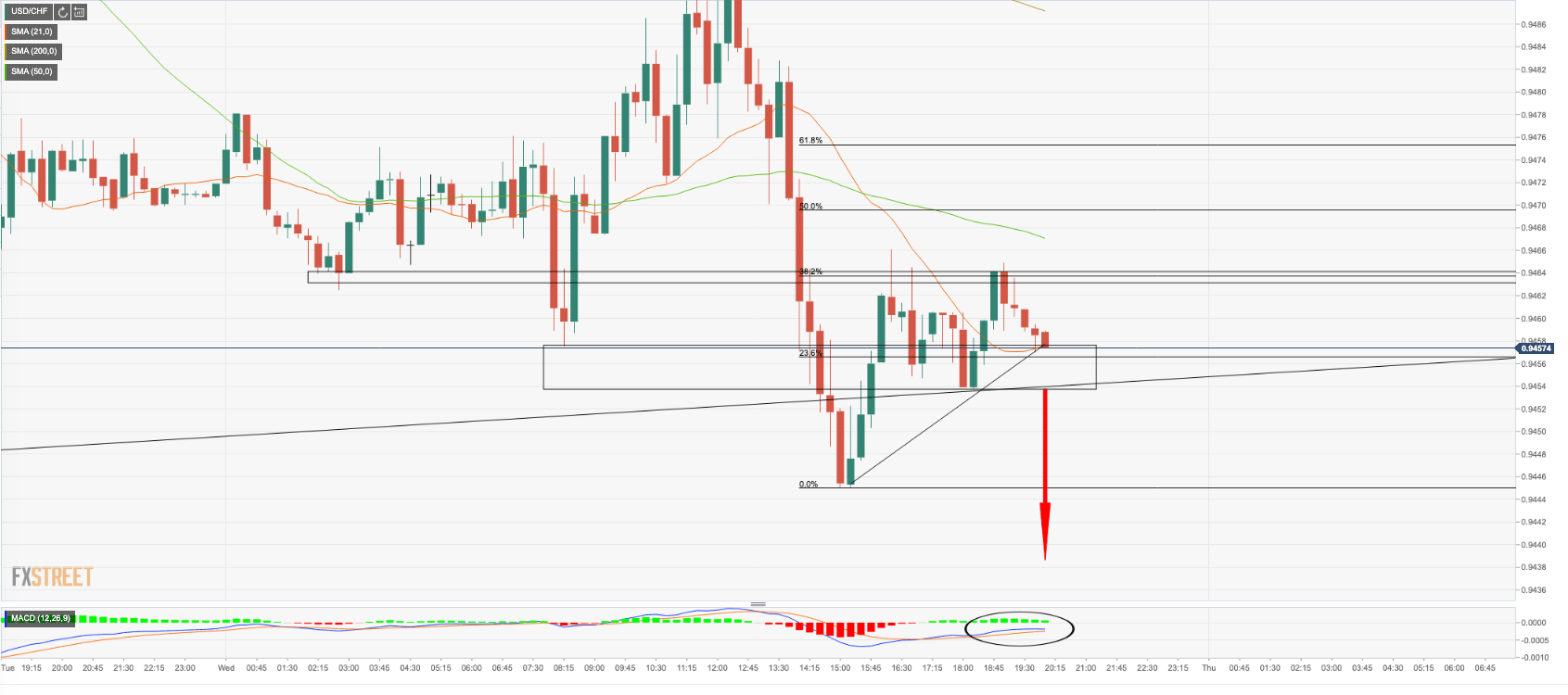

This now gives rise to a further bearish set-up considering the rising wedge formation on the 15 min chart.

15-Min charts

On a break of the wedge’s support, bears will target a break of the prior support and a re0run of the day’s lows and beyond.

MACD remains bearish which could imply a full-on a breakout below the rising trendline support.