- The Swiss National Bank raised rates by 75bps.

- SNB policymakers flagged more rates in the coming months to tame inflation.

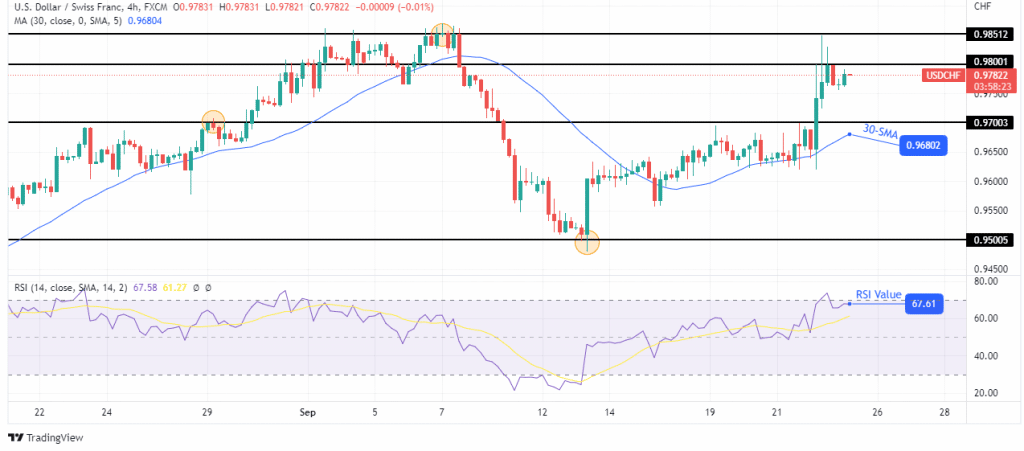

- Bulls are eyeing September 7 highs in the charts.

Today’s USD/CHF price analysis is bullish. The Swiss franc fell after the country’s central bank increased interest rates by 75 basis points when some had predicted a full percentage point change.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

The Swiss National Bank (SNB) increased its policy interest rate by 0.75 percentage points, ending the nation’s seven-and-a-half-year negative rate experiment that provoked opposition from the financial sector and concerns about asset bubbles.

“It cannot be ruled out that further increases in the SNB policy rate will be necessary to ensure price stability over the medium term,” SNB Chairman Thomas Jordan told a news conference.

Jordan added that the SNB would continue to undertake forex interventions, buying foreign currencies to prevent the Swiss franc from appreciating “excessively” or selling them to support the currency.

The SNB’s decision to raise rates came in response to higher prices in Switzerland and hawkish measures by other central banks attempting to contain resurgent inflation brought on by skyrocketing energy prices, tight labor markets, and supply chain bottlenecks.

“The language by the SNB and an inflation forecast that remains below 2% in 2024 makes it quite unlikely that the SNB is planning for another 75 bp rate hike in December again,” Junius said.

USD/CHF key events today

The S&P Global will release composite PMI data for the United States, giving markets insight into business activity and the economy’s performance. There will also be speeches from Fed chair Powell and SNB Chairman Thomas Jordan. These speeches will contain clues on future monetary policy.

USD/CHF technical price analysis: Bulls to take out September 7 highs

The 4-hour chart shows the price trading far above the 30-SMA and the RSI above 50. Bulls are very strong, and they are in control of the market. Buyers took over when sellers weakened at the 0.9500 key support level. A strong push from this level saw the price break above the 30-SMA and eventually above the 0.9700 resistance level.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

From there, bulls have only paused at 0.9800 after briefly touching 0.9851. However, the uptrend might continue soon, and if it does, the price will likely break above 0.9851, taking out the September 7 highs.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.