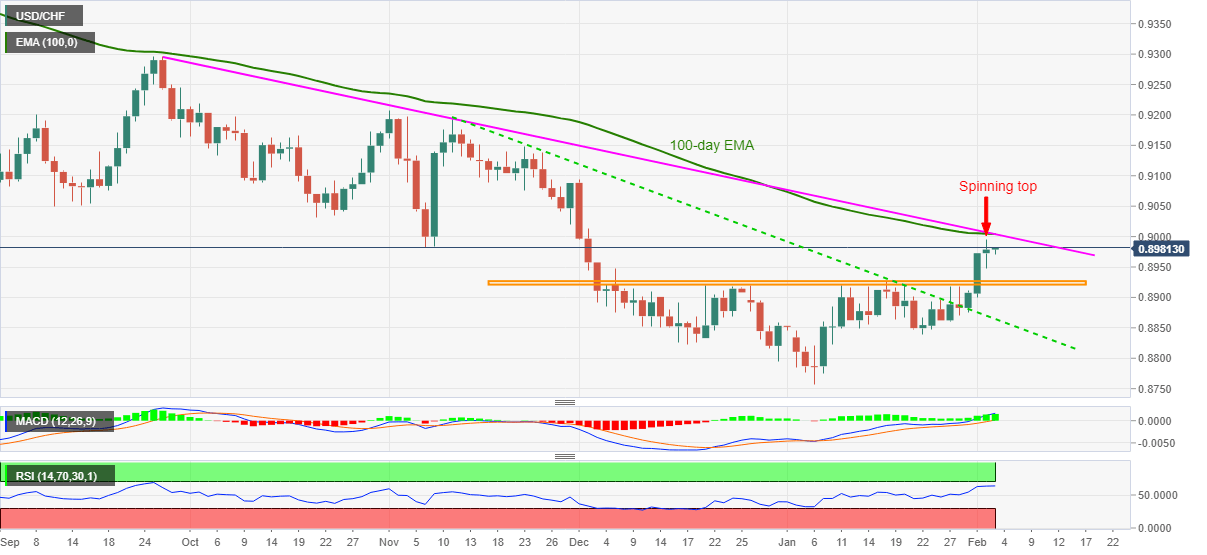

- USD/CHF buyers attack intraday top, near the highest in two months.

- Tuesday’s spinning top candle, overbought RSI test upside ahead of 100-day EMA, four-month low resistance line.

- Sellers need to wait for rejection of the inverse head-and-shoulders.

USD/CHF rises to 0.8981 during the pre-European session trading on Wednesday. In doing so, the quote stays positive around the December highs but the previous day’s play suggesting traders’ dilemma and higher levels of the RSI ahead of the key resistance confluence challenge the quote further upside.

However, the USD/CHF sellers are less likely to get convinced until witnessing a clear downside break of a two-month-old horizontal area, part of a bullish chart pattern, near 0.8920.

Also acting as the support is the previous resistance line stretched from November 11, at 0.8864 now.

Meanwhile, a confluence of 100-day EMA and a downward sloping trend line from late September around 0.9000 becomes the key resistance to crack for USD/CHF buyers.

Following that, an upward trajectory towards the November 2020 peak surrounding 0.9200 can’t be ruled out.

USD/CHF daily chart

Trend: Pullback expected