- USD/CHF extends the previous day’s recovery.

- A sustained break of the short-term descending trend line, bullish MACD favor further upside.

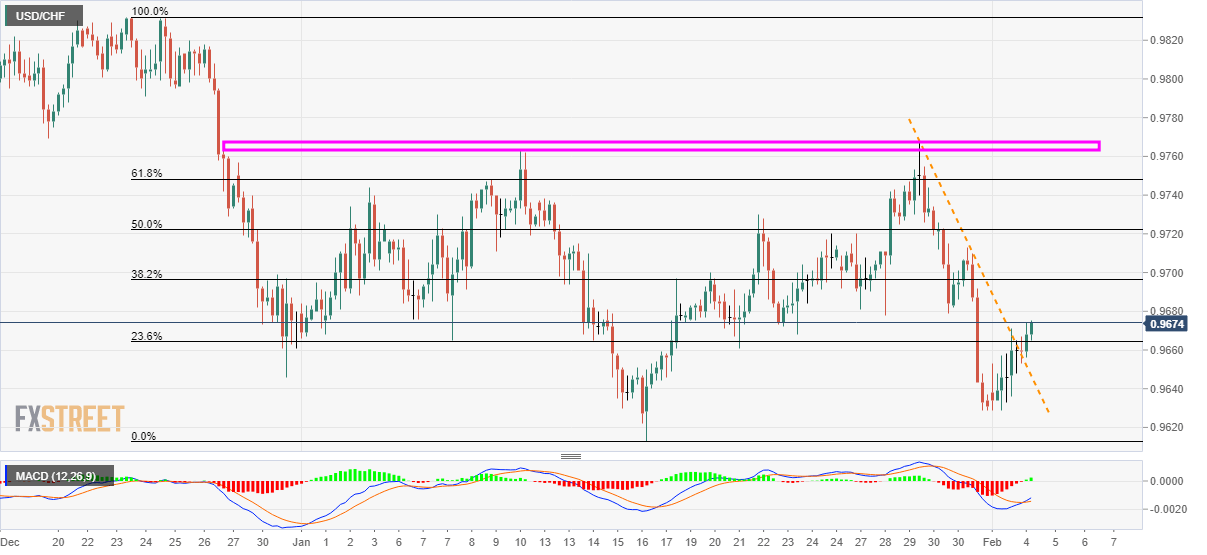

- A five-week-old horizontal resistance remains as the tough upside barrier.

USD/CHF holds on to recovery gains with 0.10% upside to 0.9672 ahead of the European session on Tuesday. The pair recently crossed a four-day-old falling trend line while also clearing 23.6% Fibonacci retracement of its December 24, 2019, to January 16, 2020 fall.

With this, prices are likely to extend the latest pullback towards 38.2% Fibonacci retracement level around 0.9700 whereas 50% and 61.8% Fibonacci retracements around 0.9720 and 0.9750 could please the bulls afterward.

However, a horizontal resistance from December 27 near 0.9768/63 will keep the upside beyond 0.9750 in check.

Meanwhile, 0.9630 holds the key to the pair’s drop towards the yearly bottom of 0.9613 and 0.9600 round-figure.

USD/CHF four-hour chart

Trend: Recovery expected