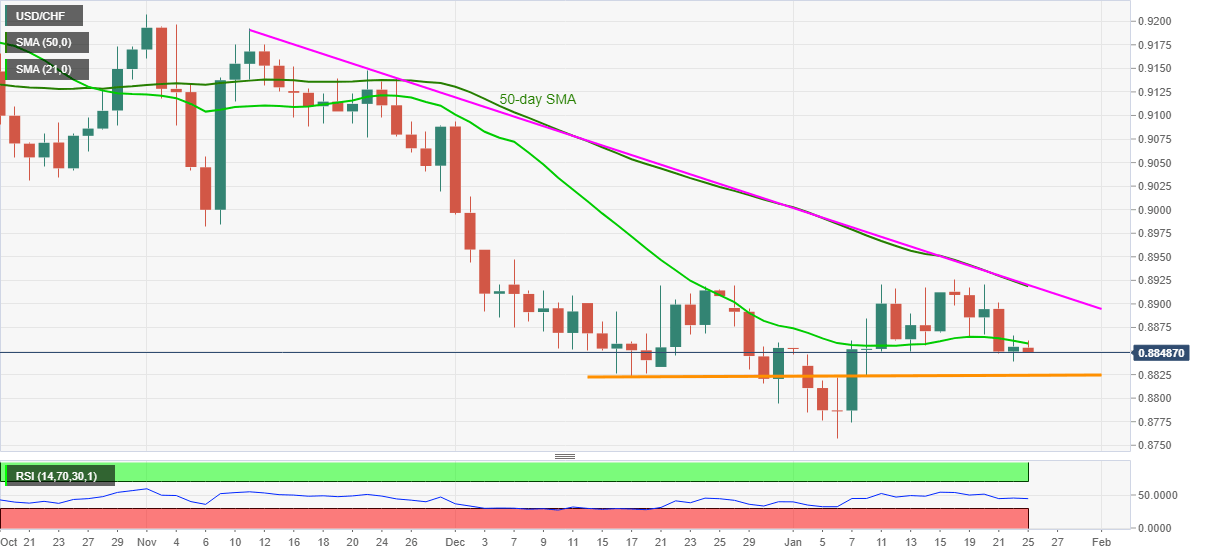

- USD/CHF wavers around intraday low after stepping back from short-term key early in Asia.

- Five-week-old horizontal support lures bears, confluence of 50-day SMA and falling trend line from November be the key resistance.

USD/CHF seesaws around 0.8850 ahead of Monday’s European session. The pair bounced off a two-week low on Friday before stepping back from 0.8866. The failure to cross 21-day SMA weighs on the quote so far on Monday as RSI also refrains from adverse signals.

As a result, USD/CHF sellers stay hopeful to visit the sub-0.8800 area during the further downside. Though, multiple supports around 0.8825 can offer an intermediate halt.

It’s worth mentioning that the quote’s weakness past-0.8800 will eye for the monthly low near 0.8755 while any more declines may not hesitate to challenge January 2015 lows.

Alternatively, an upside clearance of 21-day SMA, at 0.8858 now, will direct short-term USD/CHF buyers toward the 0.8900 round-figure.

Though any further upside will be tamed by a convergence of 50-day SMA and a downward sloping trend line from November 11, near 0.8920.

USD/CHF daily chart

Trend: Bearish