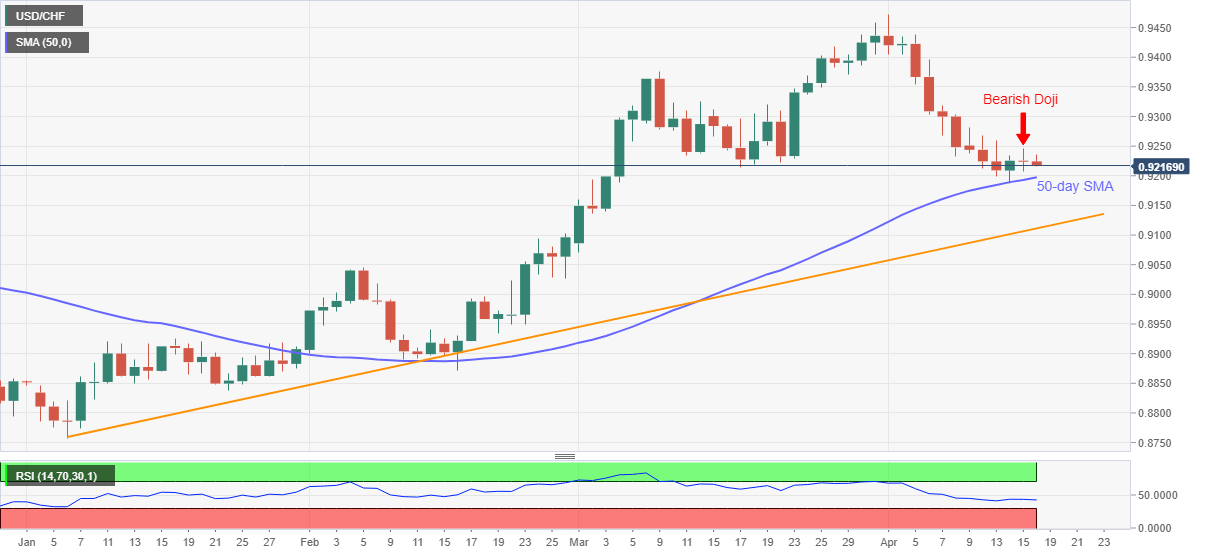

- USD/CHF remains depressed near the intraday low, justifies the previous day’s bearish candlestick formation.

- 50-day SMA, ascending trend line from early January lure sellers.

- 0.9320-25 area to guard recovery moves if bulls reject Doji.

USD/CHF stays offered around 0.9215, down 0.09% intraday, ahead of Friday’s European session.

The quote portrayed a bearish Doji candlestick on the daily chart the previous day while negating the pair’s bounce off 50-day SMA.

Given the downbeat RSI conditions join bearish candlestick formation, USD/CHF is likely to revisit the key SMA support near the 0.9200 threshold.

However, any further downside will direct sellers towards a 4.5-month-old support line near 0.9110.

On the flip side, corrective pullback needs to reprint the weekly high near 0.9270 to defy the bearish signals.

Following that, the 0.9300 round figure and an area including multiple tops marked since early March around 0.9320-25 will be the key to watch.

USD/CHF daily chart

Trend: Further weakness expected